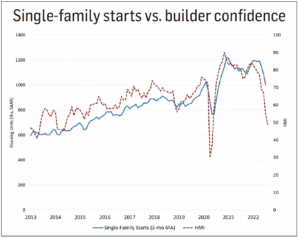

Of all the closely watched markets affected by rising inflation, perhaps none has been more impacted than housing in 2022. New home construction activity—a perennial leading indicator of the overall health of the U.S. economy—had already begun to soften heading into 2022 before rapidly rising interest rates amid elevated construction costs further dampened builders’ spirits throughout the remainder of the year.

Of all the closely watched markets affected by rising inflation, perhaps none has been more impacted than housing in 2022. New home construction activity—a perennial leading indicator of the overall health of the U.S. economy—had already begun to soften heading into 2022 before rapidly rising interest rates amid elevated construction costs further dampened builders’ spirits throughout the remainder of the year.

In fact, according to surveys conducted by the National Association of Home Builders (NAHB), builder confidence declined virtually every month over the course of 2022. By December of last year, the bellwether index reflecting builder confidence had fallen to 31. (Note: An index of 50 or above suggests more builders view conditions as “good” rather than “poor.”) Excluding April 2020, when the pandemic hit the U.S., that was the lowest confidence reading since mid-2012.

“In this high inflation, high mortgage rate environment, builders are struggling to keep housing affordable for home buyers,” said Jerry Konter, NAHB chairman, late last year. Most attempts by builders to bolster sales (i.e., providing mortgage rate buy-downs, paying points for buyers and offering price reductions) proved ineffective, he noted. “With construction costs up more than 30% since inflation began to take off at the beginning of [2022], there is little room for builders to cut prices.”

Conditions such as this, as well as other challenges builders faced over the course of 2022, contributed heavily to the housing market’s disappointing performance last year. According to the U.S. Census Bureau, housing starts totaled 1.55 million units in 2022, a 3% decline from the 1.6 million total in 2021. Single-family starts in 2022 totaled 1.01 million, down 10.6% from the previous year. On the plus side, starts in the multi-family category, which includes for-rent apartment buildings and condos, were up 15.1% in 2022 compared to the previous year—exceeding a 500,000-unit annual pace for the first time since the Great Recession in 2008-09.

Total permits for 2022 were 1.65 million units, a 5% decline from the 1.74 million unit total from 2021. Single-family permits in 2022 totaled 972,000, down 12.9% from the previous year. Meanwhile, multi-family permits in 2022 were up 9% compared to the previous year.

NAHB’s Konter, himself a home builder and developer based in Savannah, Ga., said it was no surprise that single-family starts in the U.S. in 2022 ran at their lowest level since May 2020 in light of falling builder sentiment over the course of the year. For the better part of last year, he noted that many builders remained “fixated on rising building material costs and supply chain bottlenecks with electrical transformers in particular being in short supply.”

Builders witnessed the first signs of a downturn in early 2022 as housing prices increased dramatically, in part from historically high costs for lumber and other essential building materials. By November, new single-family housing showed signs of softening. After two consecutive years of 14% growth, single-family construction fell roughly 12% to 949 million units, according to Dodge Construction Network.

Regional performance

In much the same way that residential remodeling activity ramped up significantly in the early days of the pandemic before hurtling back to earth nearly two years later, the new home construction market also cooled significantly post-pandemic. That falloff in new home construction over the course of 2022 was particularly felt in large metro outlying counties and exurban areas. However, slower activity was not just limited to regions of the country that experienced the fastest production growth over the past year.

A closer look at NAHB’s Home Building Geography Index (HBGI), released quarterly, confirms this. HBGI measures building conditions across the country and uses county-level information about single- and multi-family permits to gauge housing construction growth in various urban and rural geographies. “The single-family construction slowdown is not just limited to regions of the country that experienced the fastest production growth over the past year,” NAHB’s Konter noted in the findings of the report when it was released in the fourth quarter of last year. “Home building activity has slowed in nearly all regions and large and small metro markets as high mortgage rates, elevated inflation and stubbornly high construction costs act as a drag on consumer demand and housing affordability.”

There was one regional standout in the HBGI report, however. The South U.S. market—where the bulk of single-family construction continues to occur as a result of lower population density, more favorable jobs and overall lower housing costs—was impacted the most in 2022. “The South registered the largest production declines, even as other regions—including large metro core and suburban counties—are also displaying weakness,” said Robert Dietz, NAHB chief economist, upon release of the HBGI report at the end of 2022.

The HGBI index shows that large metro outlying counties (a.k.a. “exurban” areas) registered the largest 12-month decline in single-family production, falling from a 31.9% growth rate in the third quarter of 2021 to a minus 4.4% rate in the third quarter of 2022. Smaller metro outlying counties also saw a significant deceleration, registering a 30.6% percentage point drop during the same period. Urban core areas in both large and small metro areas also posted negative growth rates during this time frame. Rural counties, including micro counties and non-metro/micro counties, were the only counties to post a positive year-over-year growth rate.

Again, the multi-family market tells a different story. The HBGI’s sub-markets in multi-family home building showed year-over-year quarterly increases in both large and small markets as metro area economies reopened following the lifting of COVID-19 restrictions. Specifically, multi-family construction in large metro suburban counties increased from an 18% growth rate to a 27.5% rate compared to the fourth quarter of 2021 vs. 2022, and large metro core counties experienced a 7.1% increase. However, activity in large metro outlying counties decreased from a 44.1% growth rate to a 31% rate.

Other key findings from the third quarter HBGI report show building activity continued to shift away from centralized markets toward more outer, smaller areas. For example, from the first quarter of 2020 to the third quarter of 2022, the market share for single-family home building in large metro core and inner suburbs fell from 44% to 41.3%. In contrast, single-family home building in outer suburbs and exurban areas in large and medium sized metros increased from 18% to 19% during the same time frame.

Home sales activity

New home construction is just one measure of the pulse of the housing market. Looking at activity with respect to sales of existing homes also provides key perspectives on the health of the overall housing market. For example, a seasonally adjusted annual rate of 5.95 million units were sold in 2022, down 2.5% from 2021, according to Statista Research. It actually got to a point in 2022 when existing home sales declined for 10 straight months, culminating in a 6% month-over-month falloff in November. By comparison, in 2021 a total of 6.1 million housing transactions were completed—up 8.5% from 5.6 million units in 2020. Pre-pandemic, 5.34 million units were sold in 2019, which is consistent with 2018’s performance.

Of course, few analysts thought we would see a rise in the number of existing home sales in 2022 given: a) the increased costs of taking out a home mortgage amid high inflation; and b) the resulting increase in the price of existing homes in the face of lower overall inventories. “In general, people don’t want to move now because they have a 2% interest rate on their existing home, and they’ll pay 7% interest if they try to upgrade,” Brian Carson, president and CEO of AHF Products, told FCNews during an interview late last year before mortgage rates dropped down to about 6.7%. “As a result, builders are finding the need to ‘value-engineer’ some of the new homes to deal with the reality of the interest rates. So, you’re going to see more remodel business vs. sales as a result of that.”

With respect to sales of newly built, single-family homes, the U.S. market saw a bit of a bump in November last year as interest rates began to tick downward, albeit slightly. NAHB estimated that homes in this category increased 5.8% to a seasonally adjusted annual rate of 640,000 units. While it was welcomed news to the industry, it wasn’t quite enough to dramatically tip the scales.

“Declining mortgage rates during the second half of November 2022, combined with builder sales incentives, lifted the pace of new home sales for the month,” NAHB’s Konter noted at the time. “However, due to higher construction costs and ongoing supply chain issues, the median price of a newly built single-family home in November was $471,200, 9.5% higher than a year ago.”

This reinforces the impact higher construction costs have had on the market, particularly entry-level homes. “This is where we see the greatest amount of pricing out for the housing market,” NAHB’s Dietz wrote. “In November 2021, 13% of new home sales were priced below $300,000; that share has now fallen to 7%.”

In spite of that, 2022 ended on a bit of a high note as new home sales in December 2022 increased slightly. Sales of newly built, single-family homes in December increased 2.3% to a seasonally adjusted annual rate of 616,000 units. “Builder incentives and declining mortgage rates during the month of December helped push new home sales up for the month,” Konter noted.

2023 outlook

While much of the same challenges that impacted the housing market in 2022 (i.e., rising building material costs, low inventories, historically high interest rates and affordability concerns) have carried over into 2023, some industry observers are optimistic that housing will turn the corner—that is, if the Federal Reserve Bank tamps down interest rate hikes as it seeks to tame inflation.

“Modest growth should return in the latter half of 2023, where supportive demographics and continued shortages in the housing supply will support residential growth in the longer term,” predicted Sarah Martin, senior economist at Dodge Construction Network.

Other positive indicators suggest a rebound for housing this year. The firm Statista Research is forecasting existing home sales will grow 2% to 6.07 million units, putting it back on its pre-pandemic growth track. There’s also encouraging news from NAHB’s latest report, which shows total U.S. housing starts jumped 21.7% in May to an annual rate of 1.631 million units—that’s 5.7% higher than May 2022. Single-family home starts were up 18.5% last month to an annual rate of 997,000, the highest since June 2022, while home building permits grew 5.2%. NAHB estimates that the current housing market is underbuilt by 1.5 million homes—presenting a valuable opportunity providing the conditions realign favorably.

Historically, though, housing/real estate has always been a safe bet. Observers say we will weather this storm and survive the down cycle. “Housing is fine; it’s not going under,” Elliot Eisenberg, founder of Graphs & Laughs, told FCNews last month. “The housing market’s strong, equity is good. We’re not going to have these defaults that we had back in 08/09. A few, sure, but nothing meaningful enough to move the needle.”

Builder confidence is also improving but slowly. “I wouldn’t say it’s spectacular, but it’s been up six, seven months in a row off a low of the mid-30s,” he added. “Builders are saying, ‘Look, there’s nothing to buy in the existing housing market, so let’s try and fill the void and sell some houses.’ So, oddly enough, even though rates are very high, builder sentiment is improving.”