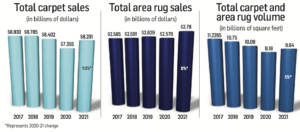

The stars were aligned for the carpet category in 2021 as a confluence of factors produced gains not likely to be duplicated in the near future. When all the numbers were tabulated for 2021, FCNews research found that overall carpet sales grew 11.5% to $8.201 billion compared with $7.355 billion carpet sales in 2020. Residential carpet sales were up an astounding 17.2%. Volume, which includes rugs, grew 5% to 9.64 billion square feet. Total area rug sales increased an estimated 8% to $2.782 billion, according to industry estimates. (Of note, a majority of rugs sold at flooring stores are fabricated from broadloom and considered carpet sales by the industry.)

The stars were aligned for the carpet category in 2021 as a confluence of factors produced gains not likely to be duplicated in the near future. When all the numbers were tabulated for 2021, FCNews research found that overall carpet sales grew 11.5% to $8.201 billion compared with $7.355 billion carpet sales in 2020. Residential carpet sales were up an astounding 17.2%. Volume, which includes rugs, grew 5% to 9.64 billion square feet. Total area rug sales increased an estimated 8% to $2.782 billion, according to industry estimates. (Of note, a majority of rugs sold at flooring stores are fabricated from broadloom and considered carpet sales by the industry.)

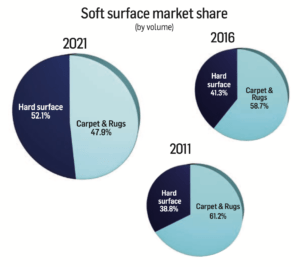

Together, carpet/rugs remain the largest category within flooring, accounting for 47.9% of the overall 20.148 billion square-foot flooring market in 2021. However, as has been the case for over a decade, soft surface’s share continues to shrink. For context, in 2020, carpet-rugs represented 48.4% of the flooring market; in 2016, the percentage was 58.7%, then 61.2% in 2011 (a decade ago) and 66.8% in 2006. In addition, the rate of soft surface decline when comparing 2016-2021 to 2006-2011 shows the gap growing 10%—from 8.4% (2006-2011) to 18.5% (2016- 2021)—when compared to hard surfaces.

Perhaps more than any other flooring segment, carpet benefited by the events triggered by the COVID-19 pandemic. The surge in business that followed the initial downturn was driven by consumers spending more time at home, which turned out to be a boon for carpet.

“People were not traveling as much as they had before COVID-19, so there was more money to spend on home renovation,” said T.M. Nuckols, president of the residential division of The Dixie Group. “Flooring received its fair share of the spend, and carpet probably received an unfair share of the spend. Carpet has become a room-by-room purchase, but in the 18 months after COVID-19 more rooms were getting carpet to create better conditions for working and going to school from home.”

Nuckols’ sentiment was echoed by other executives. “Many of the attributes that made carpet appealing to homeowners—sheltering in place, natural textures, comfort, quiet, mood-boosting color/patterns, creating work/learning zones, cleanability—are the same features and benefits that continue to drive consumer preference for the category,” said Brad Christensen, director of residential soft surface category management for Shaw Floors.

Joe Young, director of residential product development for Engineered Floors, agreed, adding: “All things home improvement benefited from limited ways to spend [disposable] income with the pandemic preventing normal travel and other social activities done outside of the household. Carpet was no different. Its comfort underfoot, sound-abatement qualities and enhanced stain protection made it a must-have for families treating the household as a school, office and social event space. In a world with constantly inflating costs, carpet became a value when compared to other flooring surfaces.”

Despite the hard surface surge, some mill executives see a lessening of the market share erosion based on what they say is carpet’s growing appeal. “Carpet’s comfort, softness underfoot, warmth and relative value compared to hard surface makes it an attractive option,” said Matt Johnson, senior director of residential carpet, Phenix.

Favorable housing trends

Always a key metric when it comes to carpet, generally positive housing data in 2021 played a role in carpet’s strong year, with total housing starts hitting 1.60 million, up 15.6% over the 1.38 million starts in 2020. Single-family starts in 2021 totaled 1.12 million, up 13.4% from the previous year. The double-digit gain for single-family starts was a continuation of the rebound and expansion of home building that took place in the wake of the pandemic, according to the National Association of Home Builders. Meanwhile, multi-family starts were up 22.1% in 2021, and entering the second quarter of 2022, multi-family had emerged as the strongest sector within residential carpet, industry executives said.

Existing home sales reached its highest level in 15 years in 2021, jumping 8.5% on the strength of low interest rates and widespread remote work.

And all that talk about strong retail activity wasn’t just hyperbole as home renovation spending grew 20% in 2021, its highest rate in four years. According to data compiled by Houzz, a larger share of homeowners (55%) tackled a home renovation project—including kitchen and bathroom remodels—in 2021 compared with previous years, this despite heightened product and material costs resulting from supply chain disruptions.

“The consumer felt good about the economy—and their income—and was ready to upgrade their home,” said Don Karlin, director of broadloom sales for Nourison. “People still want carpet where cost, softness and style are important. Carpet styling now reflects a multitude of looks, patterns and styles that allow the consumer—or her interior designer—to be creative.”

Rise in selling price

Fueled by multiple price hikes, the average selling price (ASP) for carpet increased 7% in 2021 to $0.90 per square foot ($8.10 per square yard). ASP was skewed by lower-end polyester, which is often sold into the builder and multi-family segments (in fact, 25-ounce polyester, which is at the lower end of the scale, is the most frequently purchased carpet—bought by the truckloads and used for rentals or flipping houses, observers say).

Despite the low-end activity, the average price point for carpet has risen to over $8/square yard wholesale, an increase of well over $1.00/square yard over the past two years. “That indicates a shift toward higher-priced, better goods,” TDG’s Nuckols said. “Based on this—and looking at the success of our highest-end brands—I would say the high-end segment, retailing at $35-plus/square yard (wholesale; $3.89/sq/ft.), is outperforming the market.”

Others agreed the high-middle to upper price points are seeing particularly robust activity. “We have seen the consumer paying for better product that suits her needs and willing to not sacrifice what she wants because of price point,” said Christine Zampaglione, senior director of marketing for Stanton. She noted that $11-plus/square foot at retail is “very solid and even the higher-end segment has seen steady activity.”

However, even below that price point the soft surface market flourished. “We continue to see the growth in the upper-end choices in carpeting—over $2 per square foot (wholesale),” said Chet Graham, president of Marquis Industries. “As the hard surface category continues to have pricing pressure due to freight, tariffs and record inflation, carpet provides consumers with a high-end option at value versus imported and domestic hard surfaces.”

With price hikes unabated, the average selling price of carpet grew 12.7% in Q1 2022. Executives say the price increases—now in its seventh and eight rounds in the last 18 months—are finally slowing retail traffic, forcing some consumers to push the pause button on home renovation projects. There is evidence that is already occurring as Q1 2022 carpet volume is down 7.3% over the prior year.

What’s in store for carpet?

No rational carpet executive says they expect sales to grow double digits in the near term. What they do expect to see, however, is growth to normalize (lower single digits), with gains strongest in the residential market but a healthier commercial segment as well. Even mid-single-digit growth (4%-5%) would surpass the most recent 10-year average when only one year (2013) showed an increase of more than 3% for carpet sales. In three of the six years between 2014 and 2019 overall carpet dollars decreased.

However, mills are right to point out that carpet is in a different place today than it was a decade ago and seemingly better positioned to prosper. The work-from-home trend is one reason for that optimism, given that carpet is now being considered for basements and other rooms where home offices are being set up—and not just in bedrooms.

There is also anecdotal evidence that carpet is making a comeback in builder, in part due to the installation shortage, which is more acute on the hard surface side. Of course, you would never know that by watching home improvement shows. As Nourison’s Karlin observed, “Every HGTV remodeling show seems to include the quote, ‘We’ll start by ripping out this carpet and put in LVT,’ and the consumer can watch that on TV every night. Obviously, the share of the floor that carpet once held in the home has declined in the past decade; however, I believe that decline has leveled off.”

The improved looks, patterns and styles now showing up in carpet are the result of vastly improved technology that has transformed the segment, according to executives. “What we have seen in the last five years is that carpet technology has improved significantly so we are making a better-looking carpet,” said Jamie Welborn, vice president of residential carpet product development for Mohawk. “In addition, everyday carpet is still a cost advantage over hard surfaces.”

Shaw Floors’ Christensen noted that “higher-end goods are performing well within their target demographic, and we’re also seeing increased preference for foundational styles. Pet-friendly solutions that promise high performance and high style are also winning at retail as homeowners look to protect the longevity of their investments.”

Commercial springing to life

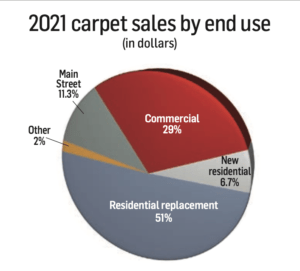

After a painful 2020 in which sales plummeted 21.7% with volume close behind at -21.4%, commercial carpet rebounded in 2021 with sales up 2.8% and volume essentially flat. FCNews estimates the commercial market at $2.99 billion for 2021 with specified contract sales at $2.250 billion and Main Street at $749 million.

[Note: For years, a large percentage of mills considered level-loop polypropylene a Main Street product, mostly installed in rental space/tenant improvement and low-end apartments and basements. Today, much of this business has been lost to low-end polyester cut piles. These cut-pile sales are reported as residential, not Main Street. As well, some mills break out Main Street from their specified business, for example, identifying smaller K-8 to K-12 schools as Main Street.]

Typically, the commercial segment lags residential in rebounding from a catastrophic event such as the novel coronavirus pandemic, albeit commercial stays in demand longer. This is because many commercial jobs are planned months out, and there is a pipeline that has to be built and completed. That scenario played out in 2021 and has continued into the first part of 2022 with commercial sales up 14.8% and unit volume up 4%.

“We are starting to see a more consistent return in the commercial market,” Marquis’ Graham said. “The hospitality sector is one of the bright spots. As the population returns to the new normal—with vacationing, dining and entertainment experiences—we are starting to see these businesses make investments to update their facilities.”

Some of that investment is seen in the retail, education and professional/corporate segments as well as Main Street. With respect to flooring types, carpet tile continues to grow as a percentage of soft surface commercial, accounting for more than 60% of the commercial soft surface market, according to industry estimates.

Rugs

Brisk activity took place in the rug segment from cut and bound or cut and serged broadloom. This has become the preferred way many customers are buying rugs these days as fewer retailers provide area rug racks in their showrooms. Among the key objections is having to maintain expensive inventory. In terms of size, retailers are ordering custom rugs in a variety of shapes and sizes.