By Reginald Tucker

Despite all the havoc COVID-19 has wreaked on the world, the U.S. economy is on track for a full and robust recovery. That was the forecast Brian Beaulieu, chief economist for ITR Economics, conveyed to attendees who participated in day two of the North American Association of Floor Covering Distributors’ (NAFCD) Virtual Xperience conference.

In his keynote presentation, “Economic Guidance in an Uncertain Economy,” Beaulieu—who has presented at numerous NAFCD conferences over the years—referenced a variety of leading market indicators and business trends that support his belief that the United States will weather the storm that is the coronavirus. That is, he said, as long as governors around the country don’t resort to the crippling shutdowns that stalled an otherwise strong American economy.

“We just came through what we affectionately called the “silly season,” and we call it that because it’s the Presidential Election cycle and all sorts of nonsensical things get said and expressed by politicians of both sides of the aisle during the season,” Beaulieu told attendees. “I just want to straighten away a few things, because while it isn’t going to matter to you for 2021, it’s going to matter to your thinking and your perceptions as you think about the next eight years. I think it’s important to step back from all the noise and look at the reality.”

Following are some of the highlights from his presentation.

Foreign domestic investment in the U.S. is on the rise

“In 2019, the U.S. was the No. 1 recipient of foreign direct investment on the planet,” Beaulieu said. (See table.) “What that is telling you is that, investors are setting up new businesses or buying business assets already in the United States. We’re the No. 1 destination for investment, and along with that comes jobs. We’re the country people are betting on. So, if the world is betting on us, shouldn’t we be betting on ourselves?”

“In 2019, the U.S. was the No. 1 recipient of foreign direct investment on the planet,” Beaulieu said. (See table.) “What that is telling you is that, investors are setting up new businesses or buying business assets already in the United States. We’re the No. 1 destination for investment, and along with that comes jobs. We’re the country people are betting on. So, if the world is betting on us, shouldn’t we be betting on ourselves?”

Changing demographics favor the U.S. workforce

ITR Economics said that, beginning in 2021, China will begin losing 100 million workers every 15 years. That means they’re going to lose about 200 million workers over the course of the next 30 years. “You don’t turn demographic trends around on a dime,” Beaulieu said. “The trend represents a hollowing out of China’s ability to maintain their current economic status and their manufacturing status as well. They’re just not going to be as good as we are in terms of adapting and adopting, creating, inventing new technologies, automation, AI, etc.—that technological edge that belongs to the U.S.”

Meanwhile, the demographic trend in the U.S. is trending positive. “According to the United Nations, our population will continue to grow through the year 2100,” Beaulieu said. “We’re going to be gaining more and more consumers, while China is going to have fewer consumers.”

The U.S. economy will survive the coronavirus pandemic

The difference between the most recent economic downturn and past recessions, Beaulieu said, is the pandemic was a natural disaster—not an economic collapse. To that end, the recovery is expected to be quicker and more robust. “The economic collapse came because of the human reaction to the pandemic,” Beaulieu explained. “This means we have the ability to recover and the economy doesn’t have to heal itself. At ITR we have studied a lot of natural disasters—clearly not as big as a global pandemic. But one of the rules we have learned is that economic fundamentals will dominate. Once we are past the natural disaster—when the vaccine is ubiquitous, for example—economic fundamentals will dominate.”

What impact will a Biden presidency have on the economy?

“There’s a lot of concern about President Biden and how that might turn the economy into a recessionary environment,” Beaulieu said. “I want to ensure you that there’s no basis for that. Look back to the time when we had the president and both the Senate and the House aligned under Democrats, from Kennedy through Johnson. And then in the late ’70s there’s another period of alignment, and then in the mid-90s another period of alignment. Bottom line: When you have ‘blue on blue,’ as it’s called, or ‘red on red’ you don’t really see any change in retail sales. You’d be hard pressed to prove that anybody is going to go into a funk if it’s blue on blue or the economy is going to go into a recession or our markets are going to suffer.”

The impact of Senate races on the economy

“If the Republicans control all of Congress, the stock market does better than if the Democrats controlled all of Congress,” Beaulieu said. “When it split between the two, which is what a lot of people seem to be hoping for, a Senate driven by the Republicans and the House stays with the Democrats, we’ll see slower stock price growth, but it’s a lot closer to the Republicans dominating. What tends to do better when it’s blue on blue is housing starts. So, in our space, put aside all the other reasons why you want to go one way or the other with your party affiliation. From a purely business standpoint, driving construction—particularly residential construction—it’s not a bad thing.”

Encouraging signs fuel optimism

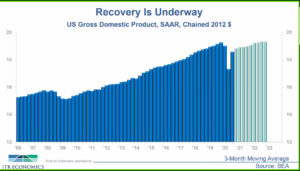

“Our dashboard of leading indicators for the U.S. economy is quite positive right now,” Beaulieu said (See chart). “This is overwhelming evidence that the economy is poised for growth and it will take a political decision to stop this growth. But left to our own devices, we are good to go. So even if they do stall us again or shut us down again, what this is telling you is that there’s this latent ability to grow that came back very quickly following the second quarter shutdown and is showing you what we are capable of doing. This economy of ours naturally will grow.”

“Our dashboard of leading indicators for the U.S. economy is quite positive right now,” Beaulieu said (See chart). “This is overwhelming evidence that the economy is poised for growth and it will take a political decision to stop this growth. But left to our own devices, we are good to go. So even if they do stall us again or shut us down again, what this is telling you is that there’s this latent ability to grow that came back very quickly following the second quarter shutdown and is showing you what we are capable of doing. This economy of ours naturally will grow.”

When do you predict the economy will return to pre-COVID-19 levels?

“By late 2022, we will have recouped all the ground that we have lost,” Beaulieu said. “The states, airline industry and tourism, etc., are not likely to come back fast. So that’s a drag and is keeping us on the slow growth path. In 2023, we’re likely to see a dip in GDP for one quarter and then the rest of the year we expect to see a rise in 2023 and likely 2024 (See chart). For people who are reluctant to believe that or buy into that, if it’s COVID-19 driven I get that. But if it’s because you’re still shellshocked at what the economy went through, I’m urging you to go back to 2009 and ask yourself, ‘What do you wish you had realized back then? What do you wish you had done sooner in order to capitalize on that rising trend that was upon us? What do you lament not doing?’ This is the time to be asking yourself those retroactive questions. Even if you’re still reticent about employing more people, go lay out the plans anyway so that as soon as you feel better about the COVID-19 situation you’ll be ready to go. I urge you to do that. It will put you ahead of the competition.”

“By late 2022, we will have recouped all the ground that we have lost,” Beaulieu said. “The states, airline industry and tourism, etc., are not likely to come back fast. So that’s a drag and is keeping us on the slow growth path. In 2023, we’re likely to see a dip in GDP for one quarter and then the rest of the year we expect to see a rise in 2023 and likely 2024 (See chart). For people who are reluctant to believe that or buy into that, if it’s COVID-19 driven I get that. But if it’s because you’re still shellshocked at what the economy went through, I’m urging you to go back to 2009 and ask yourself, ‘What do you wish you had realized back then? What do you wish you had done sooner in order to capitalize on that rising trend that was upon us? What do you lament not doing?’ This is the time to be asking yourself those retroactive questions. Even if you’re still reticent about employing more people, go lay out the plans anyway so that as soon as you feel better about the COVID-19 situation you’ll be ready to go. I urge you to do that. It will put you ahead of the competition.”

(Look for more coverage of the inaugural NAFCD conference on fcnews.net)