March 4/11, 2019: Volume 34, Issue 20

By Ken Ryan

As the industry knows all too well, the replacement cycle for carpet is many years earlier than that of hard surfaces, which translates to more transactions—and higher margins—for specialty dealers. Conversely, a customer who buys a rigid vinyl floor today may not need another floor for a generation. For the long-term health of the specialty flooring channel, dealers agree, carpet needs to remain vibrant and viable.

As the industry knows all too well, the replacement cycle for carpet is many years earlier than that of hard surfaces, which translates to more transactions—and higher margins—for specialty dealers. Conversely, a customer who buys a rigid vinyl floor today may not need another floor for a generation. For the long-term health of the specialty flooring channel, dealers agree, carpet needs to remain vibrant and viable.

Carpet, too, is not just another product in a dealer’s showroom, industry observers say. For some, carpet was the first product sold—the product that launched their business. Today, even as hard surfaces continue to grow—with the LVT segment taking share from carpet—retailers remain resolute in keeping carpet top of mind as a mainstay business that they can’t live without.

“Carpet is the most profitable part of our business, and it is the product we have the least amount of problems with as far as installation is concerned,” said Paul Johnson, president of Johnson Carpet One, Tulsa, Okla.

However, dealers are not in this fight alone. Industry executives believe it is incumbent upon manufacturers to bring true innovation to this category to excite consumers. “We have to give the consumer a better story and solution,” said Tom Lape, president of Mohawk residential. “We have to excite those in the trade and make it exciting and fun for consumers to buy carpet.”

To that end, mills are getting smarter with their investments—focusing more on capability and process efficiencies than on capacity, such as advanced tufting machines that can do more with texture and color. This gives dealers much more to work with in their conversations with customers.

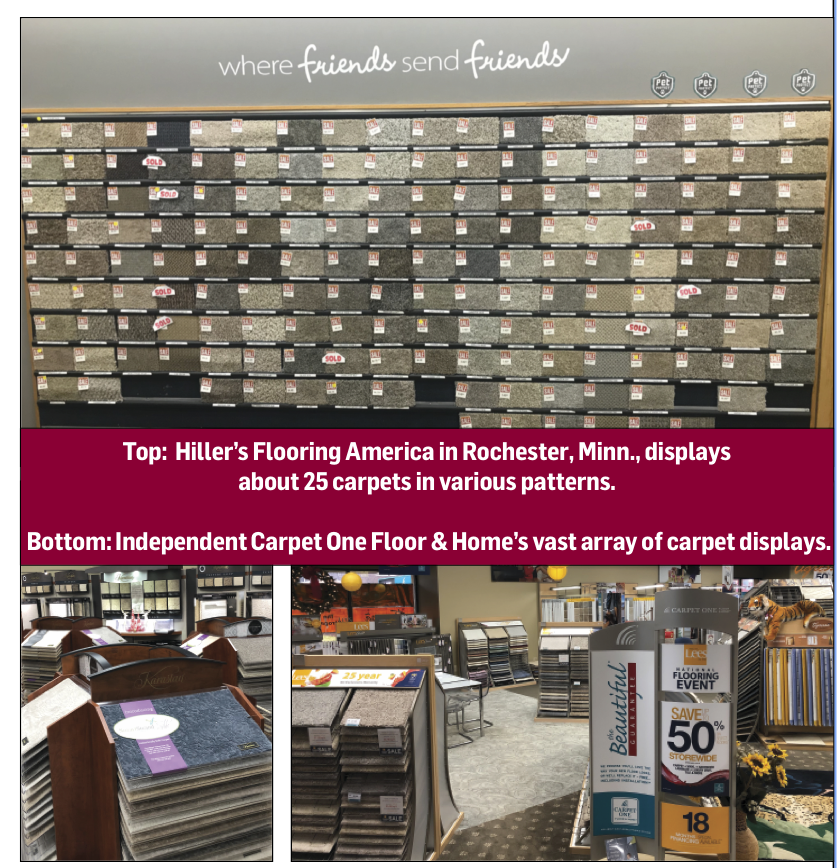

Hiller’s Flooring America in Rochester, Minn., displays about 25 carpets on its showroom floors, spanning many different patterns and textures. “It’s much easier to sell when you can see it, feel it and imagine it in your own home,” said Rob Elder, co-owner. “We do a large amount of business in commercial, and we are caught up in the LVP/LVT gold rush as well. But when you get right down to it, carpet is still our industry’s bread and butter.”

Carpet has typically fared better in colder climates such as Minnesota. However, it has its place in California as well as the Southwest, dealers say. Anthony Maye, vice president of sales, Yates Flooring Center, for example, said the market in west Texas has historically been strong, and that has continued even as carpet has gone through market changes. “We see that carpet has transitioned to a complementary category to the hard surface types,” he told FCNews. “The middle weights and class of carpets have moved down, but multi-family base grades have moved up and our higher-end carpet from specialty mills has greatly increased. The trend is: consumers want less carpet, but better carpet.”

To meet that need, Yates is expanding its selection of higher-end carpets, patterns, softs and wools and creating a showroom to showcase that selection and tap that market. “The mills are doing a great job of helping to disclaim the ‘carpet-holds-dirt’ mentality of the consumer with easier-to-clean, pet-friendly and hypoallergenic innovations,” he added.

There are few people who are bigger advocates of carpet than Cathy Buchanan, owner of Independent Carpet One Floor & Home in Westland, Mich. Buchanan touts the importance of soft surfaces any chance she gets. “As a Carpet One retailer, our name says it all. So, no, we couldn’t survive without it nor would I want to. There is a place for carpet and there always will be, especially in the colder climates of our country. There is nothing better than the warmth and cozy atmosphere carpet emits. The ambiance and sound absorption is a necessity with a house full of kids. Carpet is also safer on steps and much more conducive to bedrooms.”

There is some talk in the industry that the dominance of hard surfaces over carpet may slow and carpet share may start to reverse the recent trend. One explanation is new home builds. Newer homes tend to have higher ceilings than previous iterations, thereby causing noise reverberation against a hard surface backdrop. The noise issue is also impacting some commercial environments, including corporate office spaces. While area rugs can help, carpets act much better as sound absorbers, executives say.

Carpet One’s Buchanan said the threat against carpet is nothing new. She recalled a time in the 1990s when hardwood was the go-to floor and led to a resurgence in hard surfaces. “All of a sudden carpet came back into the limelight because every home was loud, hard and cold. I think this will happen again.”

Buchanan said the introduction of Mohawk’s SmartStrand was brilliant because it answered concerns about stains and pets. “My staff is very confident selling this yarn system and other similar [systems]. I wouldn’t count carpet out. It’s easier to install and offers much better margins.”

Hiller’s Elder added that installation is also easier and smoother with carpet than all other hard surface options. “If I can make more money, have fewer callbacks and make my end user happy, why wouldn’t I push carpet? Tack on the fantastic warranties that carpet manufacturers and yarn companies offer, and I think you have a winner.”