The way you look at the resilient industry in 2009 is consistent with whether you look at the glass half full or half empty. On one hand, the category was off double digits in both sales dollars and volume, between 15% and 20%, with the declines a bit worse on the commercial side. Then again, the drops were not as pronounced as what occurred with hardwood and ceramic tile, which were off more than 20% in both dollars and volume, and carpet, which came awfully close to that 20% mark. Resilient also sports the hard surface industry’s only growth subsegment: luxury vinyl tile (LVT).

The way you look at the resilient industry in 2009 is consistent with whether you look at the glass half full or half empty. On one hand, the category was off double digits in both sales dollars and volume, between 15% and 20%, with the declines a bit worse on the commercial side. Then again, the drops were not as pronounced as what occurred with hardwood and ceramic tile, which were off more than 20% in both dollars and volume, and carpet, which came awfully close to that 20% mark. Resilient also sports the hard surface industry’s only growth subsegment: luxury vinyl tile (LVT).

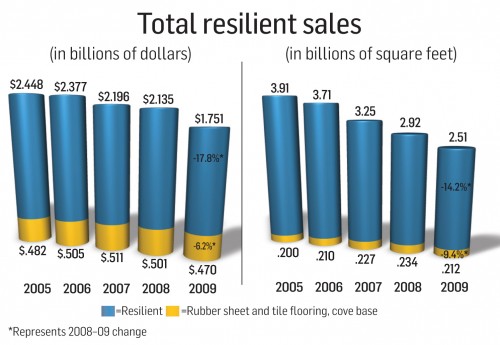

As the second largest flooring category behind carpet, overall sales of resilient sheet and tile dropped to $1.751 billion, down 17.8% from $2.135 billion in 2008 and its first dip below the $2 billion mark since the 1990s. But the category’s value proposition was again illustrated in that square footage for 2009 dropped “only” 14.2% to 2.51 billion from 2008’s 2.92 billion.

In terms of market share, resilient commands 10.8% of all flooring dollars, which is exactly on par with last year. It’s the same story on the volume side, where the category amounts to 14.9% of total industry square footage, up from 14.7% last year. So unlike most other flooring categories, resilient maintained its share of the market and even gained a bit in actual units.

“2009 was an extraordinarily challenging year due to the economic and credit climate,” said Roger Marcus, president, Congoleum. “Demand for our products fell sharply in all our markets—new construction, remodel and especially manufactured housing.”

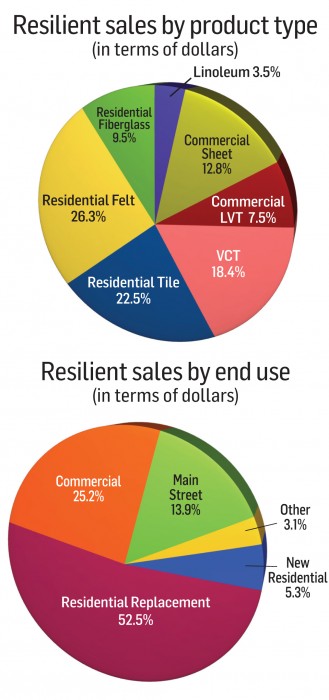

Most of the resilient sales were in the residential replacement market, attributing for 52.5% of total sales with only 5.3% in the new construction category. Its popularity in that application can partially be attributed to ease of installation. 37% of residential replacement was in sheet and 11% of residential tile was DIY, according to estimates from Armstrong World Industries.

“Vinyl continues to mature,” said Kim Holm, president of Mannington Residential. “It has always been a top-performing product and now it has the aesthetics. In a recessionary environment, vinyl continues to be the product of choice with consumers and builders because of the value it offers.”

LVT, the category’s bright spot, accounted for approximately 30% of the resilient flooring dollars. In both residential and contract applications, the durability and visual appeal of LVT has been a growing favorite among designers, specifiers and end users.

“Of all hard surfaces, resilient has been the least impacted by the economic downturn,” said David Sheehan, director of resilient/laminate at Mannington. “And, LVT is one of the main products contributing to vinyl’s success. It’s amazing how it continues to grow in what is one of the worst economies experts can remember.”

Part of LVT’s widespread appeal is its versatility in styling and installation. For example, the three installation methods in Tarkett’s Permastone add to the product’s diversity and costs a fraction of ceramic tile.

Michael Raskin, president of Metroflor, agreed LVT is taking market share from nearly every other category because it’s separating itself from the pack. For instance, he noted such qualities as more realistic looks, superior sound absorption, higher resistance to water and decreased material and labor costs as differentiators. “Today, people want value, but styling is still very important,” he explained.

“At the upper end, luxury vinyl tile and planks are excellent alternatives to the higher cost stone and ceramic tile products,” said Dean Thompson, chairman of the Resilient Floor Covering Institute (RFCI).

Commercial use also held its place at 39.1% of the pie. “Resilient flooring has a larger share as a category in the education and healthcare segments where spending has been more robust,” Thompson said. “While the demand is there, reductions in state tax revenues are likely to slow down the education segment.”

As in residential trends, LVT is a hot commodity in contract. “LVT is making its way into all major channels due to its styling flexibility and high performance,” said Zach Zehner, vice president, commercial hard surfaces, Mannington. “We are seeing the growth of demand for LVT product in projects in multiple arenas—healthcare, higher education, Main Street, military housing and multi-family.”

Centiva reported similar findings. “LVT continues to be used in all commercial market segments: retail, hospitality, corporate, and growth in the education and healthcare environments,” said Leigh Wright, senior designer. She attributed its popularity to maintenance-friendly attributes, high durability as well as realistic and sophisticated design.

Of the total 1 billion square feet in the contract sector, nearly half came from new and replacement jobs in schools and healthcare facilities, according to figures released by October Consultants.

“Products like VCT that are lower in cost than other flooring categories are helping the resilient category since many projects are value engineered and VCT comes out well when this occurs,” Thompson said.