Minneapolis—A series of distributor acquisitions, culminating with last year’s purchases of Blakely Products and All Tile and Carpet Cushions & Supplies (All Tile CCS), has resulted in the creation of what will now be known as All Surfaces. The brand formerly operated as Crown Products, an acquisition corporation that between 2017 and 2022 was combining local and regional flooring and supplies distribution businesses across the U.S. In addition to Blakely and All Tile CCS, the group also includes Walcro, Cartwright Distributing and Tri-State Wholesale Flooring. Combined, All Surfaces now accounts for close to half a billion dollars in sales, making it the second-largest flooring and supplies distributor in the country.

Minneapolis—A series of distributor acquisitions, culminating with last year’s purchases of Blakely Products and All Tile and Carpet Cushions & Supplies (All Tile CCS), has resulted in the creation of what will now be known as All Surfaces. The brand formerly operated as Crown Products, an acquisition corporation that between 2017 and 2022 was combining local and regional flooring and supplies distribution businesses across the U.S. In addition to Blakely and All Tile CCS, the group also includes Walcro, Cartwright Distributing and Tri-State Wholesale Flooring. Combined, All Surfaces now accounts for close to half a billion dollars in sales, making it the second-largest flooring and supplies distributor in the country.

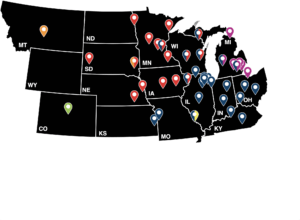

All Surfaces, headquartered in Minneapolis, boasts almost 500 employees, 50 distribution locations across 16 states with a fleet of 100 trucks connecting all locations to its major distribution centers located in Wood Dale, Ill.; Denver; Warren, Mich.; Sioux Falls, S.D.; and Bloomington, Minn.

The benefits of its combined entity are endless, both for the individual brands that retain their regional identities and legacies and, more importantly, it allows its customers, the flooring retailers and contractors, to take advantage of All Surfaces’ scale and experience. “All Surfaces is the power behind these brands,” said Bob Weiss, the former CEO of All Tile CCS who now is a strategic advisor for All Surfaces.

According to John DeYoung, All Surfaces’ CEO, all brands that are part of All Surfaces are “storied brands that our customers have come to know and trust, in some cases for over 70 years. Behind the scenes through integration, we’re able to really turbocharge each brand’s abilities to service our customers and provide a great experience. Each company now has access to company-wide expertise they didn’t have before such as IT, purchasing, logistics, finance, marketing and more. There are also benefits for our employees with improved career opportunities as well as health and retirement benefits.”

The capital behind All Surfaces is ShoreView Industries, a private equity firm based in Minnesota with 20-plus years of experience and more than $1 billion in committed capital. ShoreView partners with family and entrepreneur-owned companies across many sectors, including building products, facilitating business development and funding growth initiatives. “Their strength is working with companies our size,” DeYoung, noted, adding, “they are great partners and patient, strategic thinkers. Over the next five years, we have a lot of work ahead of us, working hard integrating our businesses and making All Surfaces bigger and better.”

The leadership team at All Surfaces says it believes in a proven strategy popular across the broader building materials industry of customers looking for their suppliers to be easy to do business with by providing simplicity and efficiency through one-stop shopping. All Tile, a flooring company started in 1947, early on recognized the benefits for their customers of combining supplies with flooring and acquired Carpet Cushion & Supplies in 2014. The leadership team at All Surfaces says, as the name implies, they are a company where their customers can get everything they need for their flooring projects.

“We are a one-stop-shopping flooring and supplies distribution company in the upper Midwest,” DeYoung said, “certainly between Denver and Detroit and north of the Mason-Dixon line. We are always looking for opportunities to grow. We look for well-run companies that are excellent at what they do, that can teach the rest of us something, have a bit of a secret sauce and make the sum of the parts greater than the individual pieces. That’s what we’ve put together and that’s what All Surfaces has become.”

Each brand shares similar cultures. “We all approach business the same way and value the same things,” DeYoung said. “And doing acquisitions for such a long time, I have found that’s the most critical aspect. A lot of people will get enamored with P&Ls or geographies or product lines, and they completely skip over the cultures of the business. I firmly believe that the strength of our company is that each company’s cultures and values are very similar.”

Weiss concurred, adding: “The people running our company have deep roots in the building materials distribution businesses. Keith Anderson, formerly of Congoleum, joined the team right before the All Tile CCS acquisition. He’s the chief commercial officer with sales, marketing and merchandising reporting to him. Add in the collective knowledge and expertise of the leadership team and employees of the five distributors and that’s what drives All Surfaces.”

Anderson added: “We’re all learning from each other. It’s rare to be able to look under the hood of your competitor and really know how that engine works. We’re able to do that with all these brands.”

At the same time, DeYoung noted the integration work the All Surfaces team has in front of them. “It’s about taking each local, entrepreneurial brand and integrating them into a cohesive unit that works together without watering down what made them individually successful.”

At the end of the day, All Surfaces is all about providing value through scale. “The reality of the world is that it’s very difficult to be a local business and compete on a national or global basis,” Weiss explained. “As a regional company that maybe is doing $30, $40 million, you can’t have best-in-class technologies. By creating All Surfaces, we are able to spread that cost over a much larger number. And that’s what All Surfaces is doing. It’s allowing us to compete effectively and be a better partner for our customers and suppliers.”