Flooring retailers are on heightened alert as a familiar credit scam continues to proliferate, swindling dealers out of an estimated hundreds of thousands of dollars in lost revenue and materials within the past two years. In fact, some dealers have been ripped off multiple times.

For small business owners, fraud is an ever-present risk that seems to increase every day. According to a recent report from the Association of Certified Fraud Examiners (ACFE), companies lose roughly 5% of their revenue to fraud each year. What’s more, small businesses tend to be especially hard hit because they can’t afford the same level of internal controls and fraud prevention technology that larger companies enjoy.

To exacerbate matters, floor covering is an attractive target because flooring materials are expensive, are in high demand and are commonly transported by the truckload—a mode of transportation commonly used by scammers.

A prime example

Floor Covering News contacted more than a dozen retailers about their knowledge of the scam. Most said they were aware of its existence and have either been a victim or an attempt was made. In fact, some retailers acknowledge being hit multiple times, losing thousands of dollars in the process. A case in point is Scott Perron, proprietor of Floors 4 Pros in Sarasota, Fla., who twice lost tens of thousands of dollars under different scenarios.

As Perron recounted, in the first violation a credit card order came over the phone for some stock material. “He gave us name, billing information, credit card number and told us their installers would be picking up the material. We wrote an order, sent it for DocuSign to the email address provided and—once authorized—we processed the sale and the credit card was accepted. The next day two men showed up with a truck and trailer to pick up the materials. Approximately seven to 10 days later we were notified that this was a fraudulent order. We summoned the detectives from our county, and that investigation is still ongoing. However, there has been no progress.”

The second instance, which occurred about three weeks later, was more brazen as the pick-up driver came into the store and spent the better part of one hour shopping for materials. “Once again, he gave us all the information, including a driver’s license from the state of Georgia that matched the name and description, then provided a credit card with the same name. At that time my warehouse staff was a little hesitant due to the prior issue, so I contacted my payment processor and the customer service rep said that everything sounded legitimate.”

Perron’s team loaded the materials into a U-Haul truck—which, he said, is not uncommon as people need to rent these vehicles to handle the weight of these items. “As a precaution, we took pictures of the loading process, license plate and truck number. The perpetrator left and, once again, we were notified about five days later that the credit card he provided belonged to an elderly lady in the local market and that he had systematically emptied her bank account of over $20,000 during that weekend.”

Perron turned the video images of the suspect over to detectives along with the background information he provided. Several weeks later, a detective visited Perron’s business and showed him mugshots. “We positively identified Jamie Hobdy as the person who stole from us—only to be informed by the detective that his body was recovered from a pond in the Tampa area.”

According to police reports, Hobdy was shot and killed during a drug deal in St. Petersburg, Fla. At the time he was slain, Hobdy was still driving the same U-Haul truck used in the flooring heist.

Perron said he no longer accepts drivers’ licenses that are not valid in the state of Florida or debit cards drawn on any online banks. Additionally, he requires two forms of identification. “Unfortunately, this is not a foolproof method—and because of the stupidity within the laws, the burden of proof always lies on the store owner as the processors—and the banks—have little or no liability in these matters.”

Adding safeguards

Dan Mandel, owner of Sterling Carpet & Flooring in Anaheim, Calif., can empathize with Perron’s situation as he, too, has been left holding the bag after being victimized. His business has been hit multiple times in the last year, losing more than $20,000. “We have learned over the course of many of the frauds that nothing is being done from a law enforcement aspect to go after these people.”

Mandel implemented some stringent policies since fourth quarter of last year. “We have software now where if someone wants to pay for material-only via our online pay links they must go through a dual check with the credit card company and the bank for the transaction to process. Also, if they are paying over the phone, they must present photo ID either when they pick up material or must come in and run a credit card rather than taking a phone payment if they are sending a contractor to pick it up.”

The credit scams that Perron and Mandel experienced serve as a cautionary tale to other flooring dealers. When informed of the credit card scams, Independent Carpet One Floor & Home’s owner, Cathy Buchanan, sprang into action. She contacted her attorney for advice before implementing a new company policy that now requires customers to physically come to the store and run their credit card transaction whether it be deposit or balance due. “We need to see their proper ID [driver’s license],” she said. “This protects them as well as the store.”

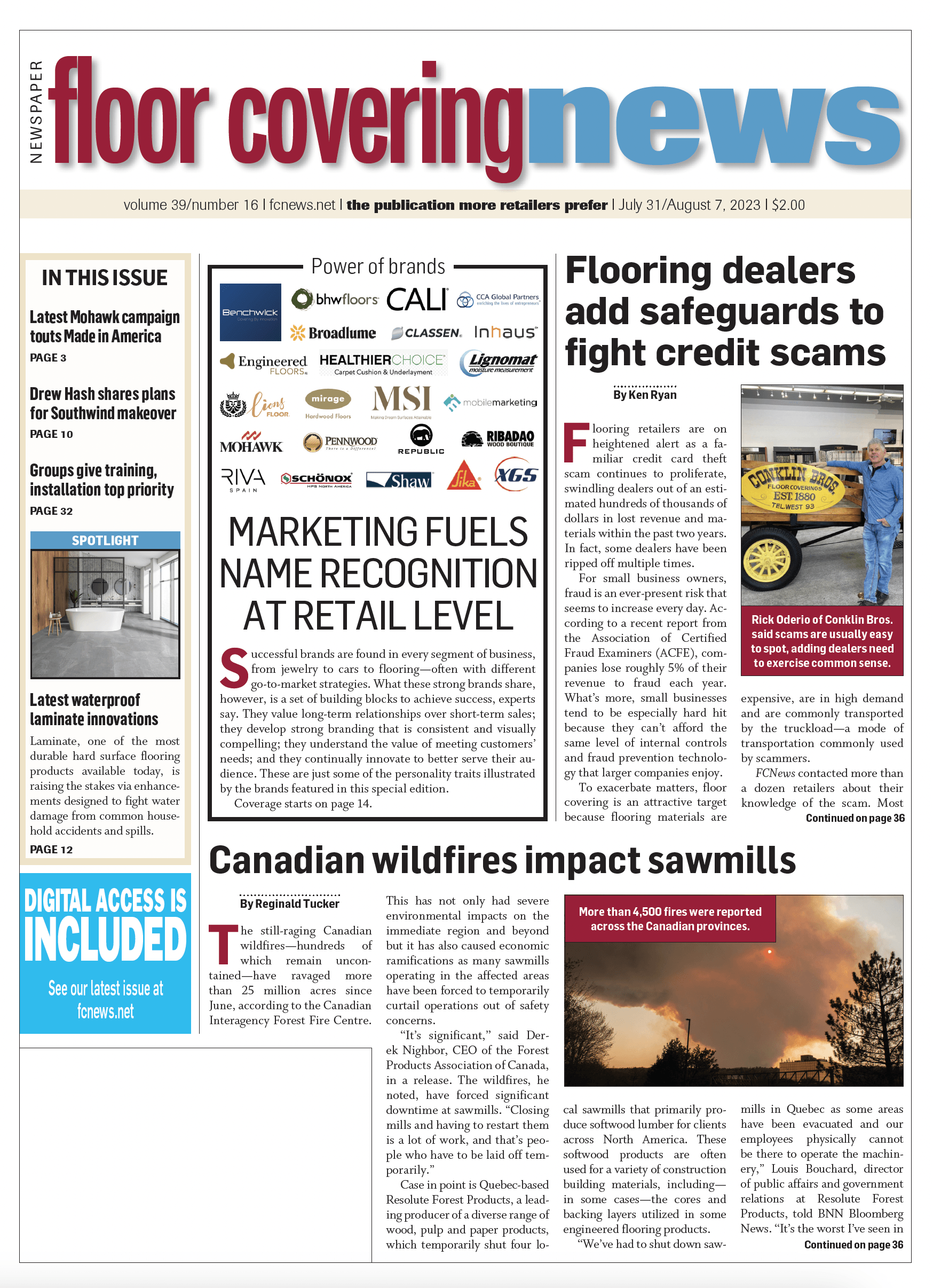

Exercising common sense—and being more than a little skeptical—no doubt benefits flooring retailers. That’s according to Rick Oderio, the long-time owner of Conklin Bros., with three locations in northern California. “These scams hit us on a regular basis,” he shared. ‘They are usually easy to spot. We do not take credit cards on cash and carry from our stock unless we know who the customer is. So far, so good.”

Some retailers, by the nature of their business, are less likely to be a target for these credit scams. As a mostly non-stocking dealer, Barefoot Flooring, Castle Hayne, N.C., does not encounter this scenario often. “We have had phone calls where it was attempted,” said John Bretzloff, president. “Usually, they are easily identifiable because they are not particular about the floor being purchased, nor the price.”

Similarly, Hadinger Flooring in Naples, Fla., said it is less prone to these types of credit scams simply because cash-and-carry business is not their forte, according to Chris Cosentino, president. While the retailer, a mamber of the National Floorcovering Alliance, has never been hit with this one, he reported someone did attempt a different scam—unsuccessfully—several years ago.

“We are a full-service store,” Cosentino explained. “If someone wants cash and carry—and is in a hurry to pick materials up right away—we ask that they come into the store with a credit card. That will usually separate serious customers from scammers.