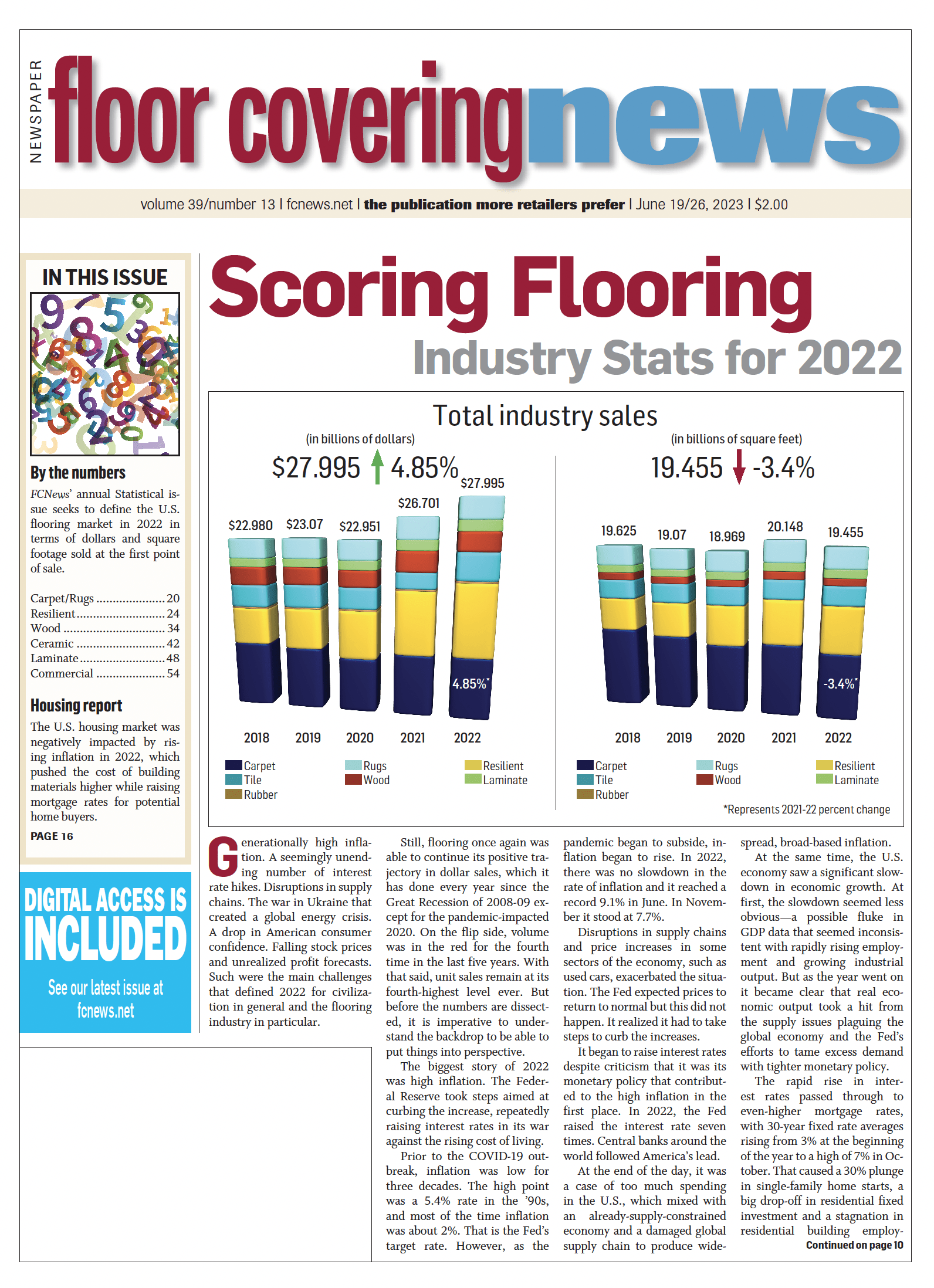

The momentum that the U.S. laminate flooring category generated in late 2020 and throughout 2021 continued to positively impact segment sales in 2022. Floor Covering News research shows the U.S. laminate flooring market generated approximately $1.382 billion in sales last year at the first point of sale—an uptick of 6% over the year prior. In terms of volume, the category grew at a slightly slower rate (4.5%), reaching roughly 1.098 billion square feet. The disparity in growth rates, industry observers say, can be attributed to slightly higher costs related to production/shipping, as well as more of an emphasis on better quality goods—those in the 10mm to 12mm range versus activity at the opening price point associated with 7mm products.

The momentum that the U.S. laminate flooring category generated in late 2020 and throughout 2021 continued to positively impact segment sales in 2022. Floor Covering News research shows the U.S. laminate flooring market generated approximately $1.382 billion in sales last year at the first point of sale—an uptick of 6% over the year prior. In terms of volume, the category grew at a slightly slower rate (4.5%), reaching roughly 1.098 billion square feet. The disparity in growth rates, industry observers say, can be attributed to slightly higher costs related to production/shipping, as well as more of an emphasis on better quality goods—those in the 10mm to 12mm range versus activity at the opening price point associated with 7mm products.

Much like 2021, the laminate category in 2022 benefited from the surge created when access to alternative products such as WPC and SPC—much of which is still largely imported—was curtailed due to shipping challenges. Although many of those shipping delays have largely returned to normal in the past six to 10 months (Forced Labor Act issues notwithstanding), the residual bump the laminate flooring segment saw in the immediate aftermath of those challenges spilled over from 2021 and into the first half of 2022.

“Sales in 2022 were definitely up over 2021, although the market saw a significant reduction in the fourth quarter last year,” said Derek Welbourn, CEO of Inhaus. “Our estimates show the U.S. laminate market was up about 5% in 2022.”

But the growth wasn’t all organic; some of it had to do with increased costs that were passed on through the channels. As Welbourn explained: “Prices rose greatly as a result of higher container costs, inflation and raw material input costs. We estimate the increases exceeded 30%. It was a major spike that’s starting to subside now.”

Looking at the big picture, laminate maintained its share of the overall market. In 2022, the category accounted for 4.9% of sales—in keeping with the percentage from 2021. But in terms of volume, laminate represented 5.6% of the overall market—up slightly from 5.2% in 2021. By comparison, resilient grew its share of overall market sales to 34% (up from 31.6% in 2021), while hardwood’s share of sales slipped from 10% in 2021 to 8.6% last year. Tile, meanwhile, saw its share of total industry sales rise from 11.5% in 2021 to 12.5% last year. Carpet’s share slipped slightly from 30.7% in 2021 to 29.4% in 2022.

Channel dynamics

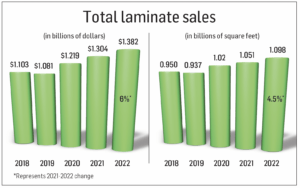

Although flooring sales at the nation’s largest home center were off slightly in 2022, that didn’t put much of a damper on the big boxes’ dominance of laminate flooring sales. Floor Covering News research shows the largest, full-service home centers (Home Depot, Lowe’s and Menards) collectively accounted for more than 62% of laminate sales last year, representing market shares of 33%, 21.5% and 8%, respectively. Home Depot’s overall flooring sales were relatively flat, with Lowe’s up about 2%. Although a fraction of the size of its larger competitors, Menards, with 350 locations across 15 states, saw its laminate sales market share rise slightly to 8%, up from 6% in 2021.

But that doesn’t mean the specialty retail sector didn’t hold its own. In fact, Floor Covering News research showed the portion of the pie attributed to specialty flooring retailers grew slightly from roughly 13.4% in 2021 to about 15% last year. This is supported by anecdotal information that showed more independent flooring retailers went with laminate (especially domestically produced flooring) as a bona fide option in 2022 when faced with supply chain issues surrounding some imported resilient flooring products.

Another key channel for laminate flooring in 2022 included design centers and flooring-specific home improvement centers. This segment, which includes the Floor & Decors and IKEAs of the world, accounted for approximately 16% of laminate sales last year, up slightly from 14% in 2021. Rounding out the list of key channels for laminate flooring are mass merchants, warehouse clubs and discount outlets, which, according to Floor Covering News research, collectively accounted for 6.5% of sales—up from 4.6% in 2021.

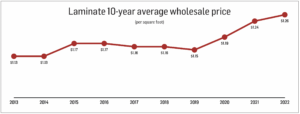

The vast majority of laminate flooring sales moves through the home center/big box channel. It’s no accident that most laminate products sold within this particular channel are geared toward the opening price point of laminate and generally reside in the 7mm realm. At the same time, the category saw the average wholesale price tick up a bit from $1.24 per square foot in 2021 to $1.26 last year. Note: In 2012, the average square foot price for laminate (wholesale) was $1.04.

“I think there’s positive movement everywhere,” said David Moore, senior product director, wood and laminate, Mohawk. “Residential remodel jobs at specialty retail is probably the best performer, just based on what we’re seeing. But we’re also seeing a strong builder business and home center sales.”

Inhaus’ Welbourn estimated the market did even better last year than most estimate. “We believe that specialty retail’s share was more likely 20% by volume and correspondingly higher in terms of sales,” he told Floor Covering News.

Driving that activity, industry observers say, are strides made at the manufacturing level. “Modern manufacturing techniques have greatly improved the aesthetics of laminate flooring, allowing it to closely mimic the appearance of natural materials like hardwood, stone or tile,” said Randy McKellar, marketing manager, Lions Floor. “Its durability and wear resistance make it ideal for high-traffic areas, while its affordability appeals to budget-conscious consumers. The ease of installation, low maintenance requirements, and advancements in moisture resistance have further contributed to its appeal. These qualities have led to the renewed popularity of laminate flooring among homeowners and commercial spaces alike.”

Peter Barretto, president and CEO of Torlys, agreed. “We’re seeing all levels of laminates doing better as waterproof features dominate the headlines. On the higher-end side, the wide/longer/pressed bevels with deeper EIR visuals are all getting exponentially better.”

Specifically, Barretto said he sees robust laminate activity in the ever-important multi-family sector. “We have been seeing both the low- and high-rise builders migrating over to laminates as well as property management/apartment buildings. It’s a ‘push-pull’ scenario given the consistent high performance of laminates and challenges with certain low-price SPC.”

Import picture

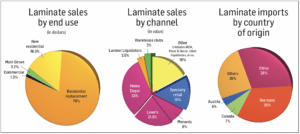

The market shift that we saw in 2021 relative to lower shipments from China continued in 2022. Floor Covering News research shows China’s share of U.S. laminate sales fell markedly from an estimated 38% in 2021 to about 28% last year. This is due primarily to not only ongoing issues surrounding duties and tariffs, but also because more Chinese flooring manufacturers have pivoted to production of SPC and other resilient flooring products.

“We definitely saw less volume coming from China, while regions such as Southeast Asia—especially Vietnam—increased their laminate production,” Inhaus’ Welbourn stated.

Indeed, this shift presented opportunities for countries in Southeast Asia to fill the void—in much the same way they are doing on the hardwood flooring side of the business. Ditto for Germany, which doubled down on its efforts to service the U.S. market, resulting in a 35% share of laminate imports to the U.S.—a slight increase over its 32% market share in 2021. In that same vein, it is estimated that laminate flooring imports from Canada increased significantly—up from a paltry 2% market share in 2021 to nearly 7% last year.

“Imports from China fell in 2022 vs. 2021, and they were replaced by material from Europe and the U.S.,” said John Hammel, senior director of hardwood and laminate, Mannington. “I estimate that U.S./Canada supply accounts for most of the material sold in the U.S., with Europe being the largest for imports.”

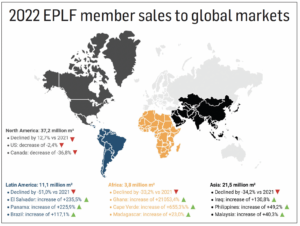

Looking at the big picture, the U.S. market remains an important sector for European producers of laminate flooring. According to data provided by EPLF, total shipments of laminate flooring to North America was nearly 400 million square feet. Although that translates into a 12.7% reduction in European laminate exports to the U.S. (and a whopping 36.8% decrease in European laminate exports to Canada compared to 2021), the total volume exported to North America exceeds shipments by EPLF member companies to Asia, Latin America and Africa combined.

End-use consumption

The key end-use sector for laminate flooring in the U.S. has been—and remains—the residential replacement market. Accounting for nearly 80% of laminate flooring sales, this segment represents the bastion of laminate flooring consumption due to its low cost, ease of installation and consistent supply. The new home construction market, by comparison, accounted for approximately 16.5% of laminate sales. Although new home construction in the U.S. market experienced a bit of a setback in 2022, it remains a desired market for laminate flooring producers. Contract commercial and Main Street commercial applications round out end-use consumption, representing 1.3% and 3.2%, respectively.

“Although residential replacement accounts for about 80% of the laminate market, we’re seeing some home builders make the switch to laminate away from products containing PVC due to some quality issues,” Inhaus’ Welbourn stated.

Other major suppliers are also seeing laminate gain share among consumer segments. “No matter where I travel around the country, I continue to hear about the migration back to laminate,” said Ted Rocha, executive vice president, SLCC Flooring. “I credit the fact that laminates have caught up to the resilient category with the waterproof/water-resistant story. Also, the visuals have become so sophisticated and realistic.”

Share of hard surface

While laminate has certainly remained a respectable category—consistently generating more than $1 billion sales at the first point of distribution for at least the past 15 years—it has struggled to transcend beyond its high-water mark of $1.384 billion back in 2006. Moreover, the category’s share of the overall flooring market in terms of sales seems to have plateaued at 4.5%-5%. Last year, laminates accounted for 4.9% of total sales and 5.6% of overall volume.

That disparity is even more evident when looking at laminates’ market share with respect to hard surfaces. In 2022, the laminate flooring category accounted for roughly 8.1% of total hard surface sales and nearly 10.3% of total hard surface volume. Ten years ago, laminate accounted for approximately 10.2% of hard surface sales and just over 15% of volume. And 15 years ago, laminate represented 15.6% of hard surfaces sales. Point being—while sales of laminate flooring have remained consistent, much faster growth rates in other hard surface categories (namely resilient) have kept laminates’ overall growth at bay.

While it’s true that laminate flooring enjoyed a sustained surge when importers were having difficulty obtaining steady shipments of LVT and SPC, some of that hyperactivity surrounding laminates has come back down to earth now that those shipping issues have subsided. “That’s one of the things that helped laminates during the downturn—there was plenty of domestic production and availability, so it did not get caught up in the container issues at the ports or COVID-19 shutdowns in China,” said Jeff Striegel, president of Elias Wilf.

Another aspect that played into laminates’ favor in 2022 was the level of improvement the category witnessed with respect to water resistance. This on top of its already well-known attributes in the durability department. But with the head start that competitive categories such as waterproof SPC and WPC gained on laminate over the past, say, 10 years, it wasn’t enough to move the needle.

“Although the laminate category is still evolving, at the end of the day, it still represents only about 4% to 5% of the business,” Striegel explained. “It’s a wonderful category; it offers great performance, the most realistic visuals, exceptional scratch resistance—all the attributes you would want in a product. I think most people would agree it offers the most authenticity in terms of looking like wood. But the growth we’re seeing in other categories like LVT just isn’t there. It ain’t LVT and that’s where the RSA’s love affair is.”