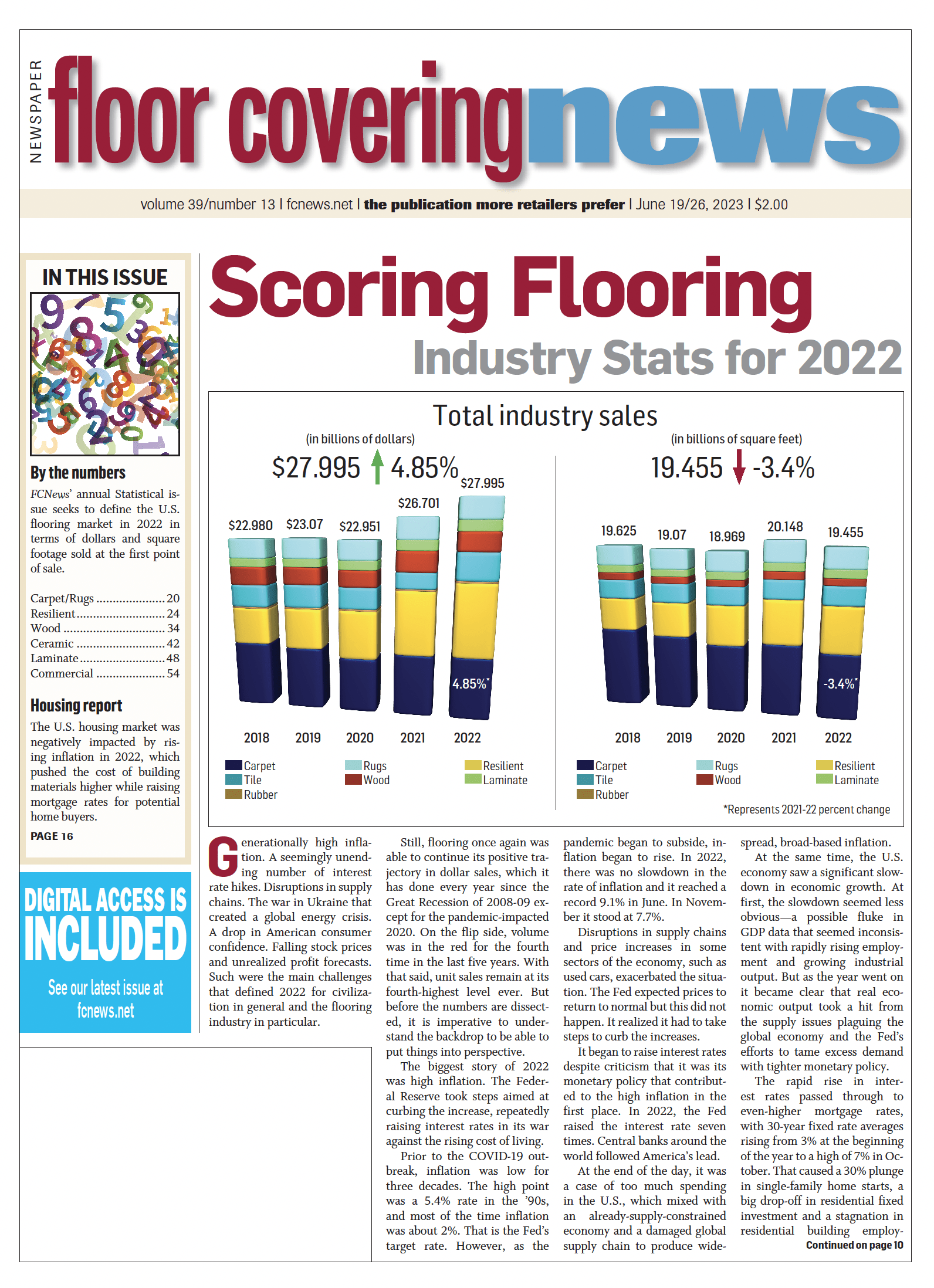

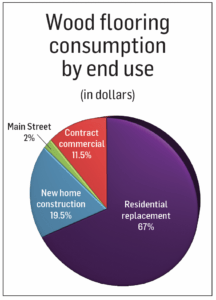

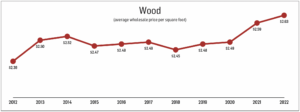

After turning in a stellar performance in 2021 with growth rates in both sales and volume landing in the high double-digits, the U.S. hardwood flooring category took a big step back in 2022. Floor Covering News research shows hardwood flooring revenues fell 9.8% last year to $2.41 billion. Volume-wise, square footage sold at the first point of distribution slipped to 915 million square feet—an 11.2% drop-off. Industry observers attribute the disparity in sales to volume activity primarily to higher material and production costs in the face of slower sales. More broadly, the decline in sales activity is the result of intense competition from the resilient and laminate categories, which grew at a much faster rate last year, as well as consumer desires for more budget-friendly flooring options in their remodeling decisions.

After turning in a stellar performance in 2021 with growth rates in both sales and volume landing in the high double-digits, the U.S. hardwood flooring category took a big step back in 2022. Floor Covering News research shows hardwood flooring revenues fell 9.8% last year to $2.41 billion. Volume-wise, square footage sold at the first point of distribution slipped to 915 million square feet—an 11.2% drop-off. Industry observers attribute the disparity in sales to volume activity primarily to higher material and production costs in the face of slower sales. More broadly, the decline in sales activity is the result of intense competition from the resilient and laminate categories, which grew at a much faster rate last year, as well as consumer desires for more budget-friendly flooring options in their remodeling decisions.

As a result of the diminished sales activity in 2022, hardwood flooring saw its total share of flooring sales fall to 8.6% in 2022—down from 10% last year. In terms of volume, hardwood flooring represented roughly 4.7% of square footage sold at the first point of distribution in 2022; the year prior, that number was 5.1%. Hardwood’s share loss is even more pronounced when looking at the category’s percentage of total hard surface flooring sold at the first point of sale. Last year, hardwood flooring accounted for 14.1% of hard goods sold, with volume representing 8.6% of all hard surface flooring products. In 2021, hardwood flooring accounted for 17% of all hard goods sold at the first point of sale, while hardwood volume accounted for 9.8% of total hard surface square footage sold.

A look back at the shape of things 10 years ago puts matters in further perspective. In 2012, hardwood accounted for 9.5% of total flooring sales and 18% of hard surface sales. Volume-wise, hardwood represented 4.1% of total flooring volume shipped at the first point of distribution and 11.6% of total hard surface square footage shipped.

While hardwood flooring industry experts also attribute the category’s lackluster performance in 2022 to a weak second half due to extenuating economic factors impacting virtually every category with the exception of carpet, the fact of the matter is competing hard surface products that are becoming more adept at mimicking real wood—namely resilient, laminate and even tile—continued to nip market share from hardwood.

“The first half of the year was doing quite well, but then the back half of the year softened up considerably,” said Brian Carson, president and CEO of AHF Products. “Coming off such a strong year in 2021, the industry was still running pretty hard and that momentum carried over into the beginning of 2022. At the same time, the single-family residential remodel segment—the largest single sector for hardwood—pulled back sharply during the latter part of the year, which also impacted hardwood sales.”

Other major wood flooring supplier executives saw sales activity shake out in much the same way, making it more of a category-wide trend as opposed to an isolated incident. “The first three quarters of 2022 showed strength while the last quarter softened quickly,” said Brad Williams, vice president of sales and marketing, Mirage.

Other major wood flooring supplier executives saw sales activity shake out in much the same way, making it more of a category-wide trend as opposed to an isolated incident. “The first three quarters of 2022 showed strength while the last quarter softened quickly,” said Brad Williams, vice president of sales and marketing, Mirage.

That sentiment was echoed by Dan Natkin, chief commercial officer, Bauwerk Group, which markets the Boen and Somerset Hardwood brands. “The year 2022 was definitely the tale of two halves; the first half of the year saw a continuation of the breakneck growth pace we saw in 2021, followed by a significant pullback in the back half of the year.”

In digesting the numbers comparing year-over-year activity in the category, hardwood flooring manufacturing executives caution that it’s important to compare apples to apples. While no one likes to see year-over-year declines by any measure, experts say it’s important to put sales and volume growth experienced in the “COVID-19 years” in the proper perspective. It was during this time frame that wood—much like other flooring segments—achieved above-average sales growth.

“The year 2021 was an anomaly for wood,” Kyle McAllister, director of hardwood and laminate, Shaw Floors, told Floor Covering News. During that period, U.S. hardwood flooring grew 21% in sales and 16% in terms of volume. “In late 2020 throughout 2021, we had a hangover from the pandemic and U.S. domestic manufacturers really benefited from it. Consumers wanted material that was readily available, and they bought that material from suppliers that had inventory. But the headwinds the industry began to face in the latter part of 2022 were pretty strong— which explains the mid-double-digit sales declines in sales and even greater declines in terms of square footage.”

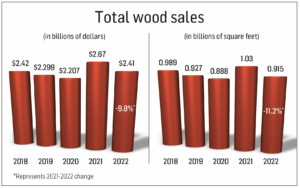

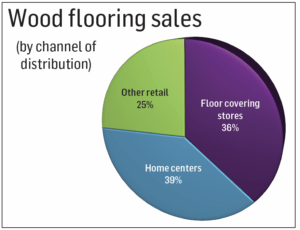

That falloff was more acutely felt on the new home construction side of the business—a segment that typically accounts for 30% of hardwood flooring sales. According to Floor Covering News research, however, that segment’s share fell to just under 20% in 2022. “Softening in the new home construction market was a big factor last year,” McAllister added. “In late 2021, we saw new home starts starting to slow down and that continued into 2022. Rising inflation caused higher interest rates, so that was a big hit. And then when you look at the overall real estate market, inventory was very tight.”

Amid higher interest rates—which often dissuade home buyers from applying for a mortgage while simultaneously keeping some sellers on the sidelines—the issue of price sensitivity also comes into play for home builders. “With many consumers feeling inflationary pressures and what’s going on in the market in general, homeowners are looking at their budgets to see if they’re able to do a remodeling project,” said David Moore, senior product director, wood and laminate, Mohawk. “And when they do, they’re often looking at a more budget-friendly option.” In this scenario, he noted, genuine hardwood—which typically retails higher than its wood-look-alike competitors—sometimes falls out of contention. “The consumer is looking at her budget and trying to stretch it as much as she possibly can,” Moore added.

That price sensitivity, experts say, also plays into the types of products home builders select for their projects when they do decide to move forward with a new build. “All this talk of budget stretching becomes exponentially more relevant when you’re talking about new home construction,” Moore added. “Builders, likewise, are looking to take cost out of the homes—that is a huge point of emphasis for them. So I think that segment really accelerated some of the decline we saw in hardwood last year.”

That price sensitivity, experts say, also plays into the types of products home builders select for their projects when they do decide to move forward with a new build. “All this talk of budget stretching becomes exponentially more relevant when you’re talking about new home construction,” Moore added. “Builders, likewise, are looking to take cost out of the homes—that is a huge point of emphasis for them. So I think that segment really accelerated some of the decline we saw in hardwood last year.”

On the flip side of that equation, the residential replacement sector took some share from the anemic new home construction market as more homeowners stayed in their existing residences as mortgage and refinancing rates continued to soar. Floor Covering News research shows the residential replacement portion of the end-use consumption pie grew from roughly 58% of category sales in 2021 to approximately 67% last year.

“Residential remodel was definitely the saving grace for hardwood last year,” said Wade Bondrowski, director of sales, USA, Mercier. “Looking at where interest rates were then—and even now—I just think people are going to hold tight for a little bit. While there was still a strong demand for housing in 2022, most people are not going to put their homes up for sale when they financed at 2.75% just to buy a new home at an interest rate that’s nearly three times that number. I still don’t see the housing market opening up.”

Evolving product mix

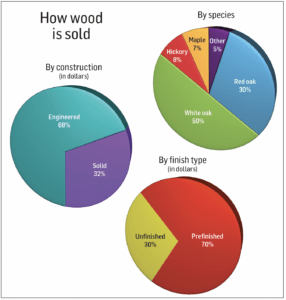

The industry-wide shift to a higher ratio of engineered hardwood products vs. solid continued in 2022 as suppliers reported that a larger percentage of their product mix trended toward wider and longer—a format that cannot easily be rendered in a solid format. Anecdotal evidence provided by several of the primary hardwood suppliers corroborates Floor Covering News research, which shows engineered accounted for almost three-quarters of all hardwood flooring products sold last year. Naturally, the bulk of those products fall in the prefinished category. Putting things in perspective, 10 years ago it was a 50/50 split between solid and engineered after decades of solid enjoying the dominant share.

“We estimate engineered hardwood continued to rise, likely by a couple percentage points, to 70% of the total wood market,” said John Hammel, senior director of hardwood and laminate, Mannington, which only plays in the engineered arena these days. Ditto for Mohawk, which shifted completely to prefinished engineered several years ago. “Though we don’t do any solid or site-finished product, I would say much of the market is predominantly engineered,” Moore stated.

Shaw Floors’ McAllister agreed. “Overall, engineered is the high-growth category. It makes hardwood available to people who live in climates where it’s not a conducive environment for solids. And then when you look at trends, you’re able to achieve different specifications in the engineered side of things that you’re unable to achieve in solids because of the sensitivity to extreme climate variations.”

While there is high-volume production activity within the engineered segment of the hardwood flooring market, most of that activity was dominated by traditional engineered products—i.e., all wood-based materials from top to bottom. This includes wear layers, cores and backing layers consisting of a variety of real wood species as well as hardwood flooring products featuring an HDF or MDF core—the contents of which comprise wood byproducts. When it comes to “hybrid” offerings, however, observers estimate that particular subsegment hasn’t gained much share over the past year. It’s not that these products—which feature a non-wood rigid core bonded to a real wood wear layer—don’t appeal to a certain customer base; it’s just that they haven’t been embraced as quickly as traditional engineered wood products. “I’ve seen more entrants in the wood/rigid core hybrid market, but not necessarily a significant increase in share,” Mannington’s Hammel shared. He estimated hybrid floors account for 4%-6% of all wood flooring sold.

While there is high-volume production activity within the engineered segment of the hardwood flooring market, most of that activity was dominated by traditional engineered products—i.e., all wood-based materials from top to bottom. This includes wear layers, cores and backing layers consisting of a variety of real wood species as well as hardwood flooring products featuring an HDF or MDF core—the contents of which comprise wood byproducts. When it comes to “hybrid” offerings, however, observers estimate that particular subsegment hasn’t gained much share over the past year. It’s not that these products—which feature a non-wood rigid core bonded to a real wood wear layer—don’t appeal to a certain customer base; it’s just that they haven’t been embraced as quickly as traditional engineered wood products. “I’ve seen more entrants in the wood/rigid core hybrid market, but not necessarily a significant increase in share,” Mannington’s Hammel shared. He estimated hybrid floors account for 4%-6% of all wood flooring sold.

Boen’s Natkin estimated hybrids’ share of the overall hardwood flooring market was even lower than that—somewhere in the low single-digit range. “While the initial hybrids achieved some success, we saw some pullback in 2022,” he told Floor Covering News. Meanwhile, Mirage Hardwood Floors’ Williams estimated hybrids (a.k.a. composite floors) accounted for roughly 3% of the market in 2022.

But other industry executives say the lackluster performance of the hybrid category in 2022 had less to do with any perceived lack of appeal among traditional hardwood flooring consumers than pure economics. “Hybrids did not take more share of the engineered market last year, and the main reason is freight,” AHF Products’ Carson explained. “Last year the industry was dealing with $22,000 freight charges in the first part of the year, and wood flooring with rigid core is so heavy vs. regular engineered. So it became a cost disadvantage compared to many traditional engineered products, especially during the first half of last year. As a result, many retailers chose to de-emphasize the product because it was so much more expensive to move.”

Still, the nascent wood/rigid core hybrids category is nothing to scoff at. Estimated at roughly 6% of the wood flooring market in 2020, followed by 5% last year, the sub-segment is expected to rebound this year to account for 6%-7% of the total hardwood flooring market. Prospects are improving especially now that many issues surrounding the astronomically high freight charges that retailers and distributors had to contend with last year have largely abated. “It’s not a sea change in terms of the growth, but it’s encouraging,” Carson stated. “In general, the locking joint of an SPC/wood hybrid is a little bit better; it locks together easier than a product that’s milled out of plywood. Don’t get me wrong—I don’t think it’s going to knock plywood construction out of the mix, but I think it’s going to outperform plywood a little bit and become a bona fide platform.”

Others also agree that hybrids have a home in the overall hardwood flooring portfolio—just not as much as anticipated. “We used to have a very large assortment of hybrids—about 60 SKUs at one point in time,” Shaw Floors’ McAllister stated. “However, last year we reduced that number significantly. We just didn’t get the performance out of it that we expected. Now, that’s not saying we believe the product’s inferior; it’s actually a great product. I think some of the challenges we’re seeing pertain to price point, especially compared to where it aligns with resilient.”

Species in high demand

Over the past several years, the industry has seen a burgeoning demand for white oak—particularly European and American white oak—due to the desirable aesthetic attributes of the species. But more recently, supply has outstripped demand, which has sent prices higher and in some cases caused suppliers to aggressively pursue alternatives. Accounting for roughly 19% of the market in 2012, demand has ballooned to the point where the species accounted for about 50% of the market in 2022.

“The species mix has remained relatively steady, with white oak still dominating the market,” Mannington’s Hammel stated.

Mercier’s Bondrowski agreed. “Years ago, I couldn’t give white oak away,” he noted. “Now that’s where the demand is—so much so that demand for white oak has exceeded our production capacity.”

It’s a particularly challenging situation for North American suppliers given the proximity of the forests where the lumber is harvested. “With U.S. and Canadian suppliers, we’re pulling yields out of the North American market where the forests can only produce 17% white oak,” Bondrowski explained.

As a result of the strong demand for white oak, several major hardwood flooring suppliers have resorted to red oak—which is plentiful at the moment—as a species option. But while it has the clarity and visual characteristics consumers demand, its slightly pinkish hue is not desired by the majority of hardwood flooring consumers, observers say. To that end, manufacturers have altered the way they treat red oak—some using proprietary techniques—in an attempt to make it resemble white oak. “We’re putting a coating on to take some of the pink out before we’ll do the colorations,” Bondrowski explained. “We’re also experimenting with ash because it doesn’t have that pink tone.”

As a result of the strong demand for white oak, several major hardwood flooring suppliers have resorted to red oak—which is plentiful at the moment—as a species option. But while it has the clarity and visual characteristics consumers demand, its slightly pinkish hue is not desired by the majority of hardwood flooring consumers, observers say. To that end, manufacturers have altered the way they treat red oak—some using proprietary techniques—in an attempt to make it resemble white oak. “We’re putting a coating on to take some of the pink out before we’ll do the colorations,” Bondrowski explained. “We’re also experimenting with ash because it doesn’t have that pink tone.”

With demand for species with cleaner visuals on the rise, manufacturers have had to get really creative during the manufacturing process. “Most large manufacturers are playing with pink blocker or red-out technology to try to emulate those white oak visuals on a more readily available species such as red oak,” Shaw Floors’ McAllister said. “By nature, North American white oak is still somewhat pink whereas European white oak is not. However, there are some hardwood species out there that are great alternatives and we’re certainly experimenting with that.”

White and red oak are not the only species that saw higher demand in 2022. “We are seeing a resurgence in other species such as hickory and maple,” Boen’s Natkin said. That jibes with research conducted by Floor Covering News, which shows hickory has grown to represent roughly 8% of the market in 2022—up from less than 5% in 2021. And five years ago hickory didn’t even command 1% of sales.

Although tropical exotic species—namely South American products like Brazilian cherry and Brazilian oak—account for less than 5% of the overall hardwood flooring market, suppliers still see strong demand in regional markets. “We laugh when retailers tell us that consumers are not looking for exotics anymore, because we then walk through many showrooms that are not showing one SKU of a South American exotic hardwood,” said Jodie Doyle, president of Indusparquet USA. “The point we are trying to drive home is that if the retailer simply dedicates a small amount of floor space to the category, they will be amazed by the reactions and ROI they will achieve from that square footage. These products are not like many others in the category; you simply cannot value engineer premium Brazilian hardwood flooring. If the retailer does not show it on the floor and the consumer is looking for those products, they are simply going to go somewhere else.”

Out of the top five SKUs sold by Indusparquet in the U.S. market last year, Brazilian cherry, Brazilian chestnut (Sucupira) and Brazilian oak (Tauari) accounted for the greatest volume. “People will tell us that Brazilian cherry and Tigerwood are not the looks that today’s shopper wants, but that just is not the case,” Doyle stressed. “While we do not think we will ever see the kind of volume produced back in the early 2000’s, we are seeing the consumer return to more of the warmer, darker tones that are characteristic of many of our exotic species. When you add in the superior durability, performance and truly unique visuals available only in South American hardwoods, those are things today’s consumer can really understand and embrace.”

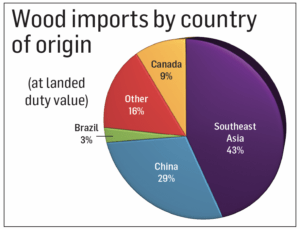

Industry observes are also gauging shifts with regard to other regions that export hardwood flooring products to the U.S. Much like other hard surface categories, hardwood flooring imported from China has also declined measurably in recent years. Floor Covering News research shows China accounted for roughly 35% of hardwood flooring inputs in 2021; that number fell to approximately 29% in 2022. To put things in perspective, hardwood flooring imports from China accounted for more than 55% of the wood flooring market 10 years ago.

Industry observes are also gauging shifts with regard to other regions that export hardwood flooring products to the U.S. Much like other hard surface categories, hardwood flooring imported from China has also declined measurably in recent years. Floor Covering News research shows China accounted for roughly 35% of hardwood flooring inputs in 2021; that number fell to approximately 29% in 2022. To put things in perspective, hardwood flooring imports from China accounted for more than 55% of the wood flooring market 10 years ago.

“Wood flooring shipments from China are going to continue to decline just because of all of the tariffs and duties and whatnot, and Southeast Asia will probably continue to grow as those companies move out of China into the other areas,” Mohawk’s Moore predicted.

Mannington’s Hammel agreed. “I expect that shipments from China declined significantly in 2022 vs. 2021, replaced by other Southeast Asian countries such as Vietnam, Cambodia, Malaysia and Indonesia.”

That’s in keeping with Floor Covering News research, which showed Southeast Asia grew its share of hardwood flooring imports to approximately 43% in 2022. Five years ago that percentage was about 35%, and in 2012 Southeast Asia represented less than 25% of hardwood flooring shipments to the U.S.