For the second year running tile flooring experienced sales growth after its 2020 decline, which had been the category’s first decrease in several years. Tile flooring was up mid-double digits in dollars in 2022 compared to 2021’s high single-digit increase. However, while dollar sales were up, much of that came from price increases and inflationary pressures. Volume experienced a slight decrease overall.

For the second year running tile flooring experienced sales growth after its 2020 decline, which had been the category’s first decrease in several years. Tile flooring was up mid-double digits in dollars in 2022 compared to 2021’s high single-digit increase. However, while dollar sales were up, much of that came from price increases and inflationary pressures. Volume experienced a slight decrease overall.

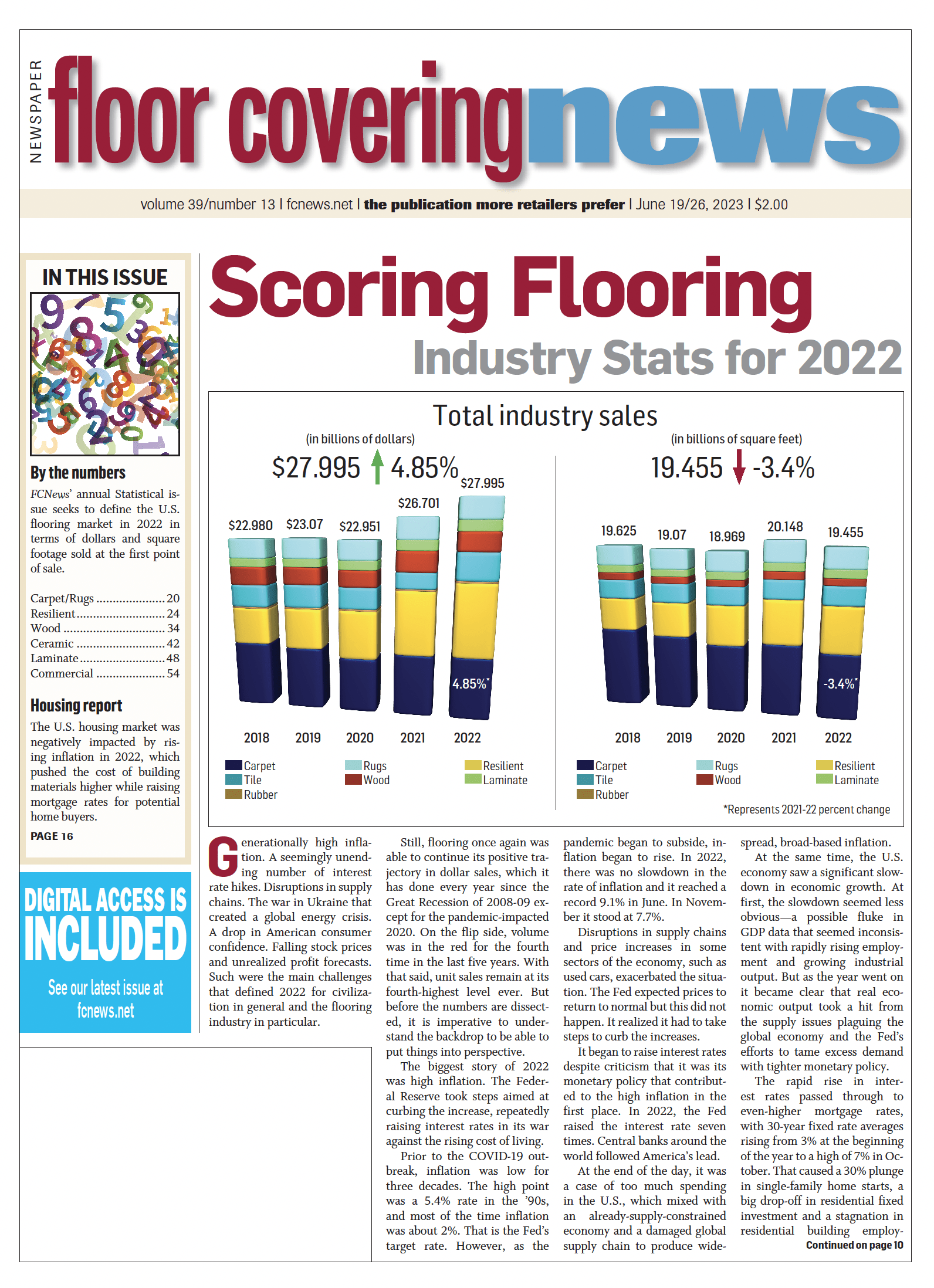

Floor Covering News research shows tile flooring experienced a 14% increase in dollar sales in 2022 to $3.507 billion versus $3.077 billion in 2021. That is a sizeable 23% increase from 2020’s $2.844 billion when the category experienced its first decline since 2009 amid the Great Recession.

Flooring volume didn’t quite make it into the black in 2022, registering a 1% decrease to 2.453 billion square feet from last year’s 2.477 billion square feet. While it is a slight decrease from the previous year it is still more than 2020’s 2.403 billion square feet.

That $3.507 billion is a record high for the category and 2.442 billion square feet is the third- highest volume total since 2006 when housing sales were at unprecedented levels.

Putting things into perspective, in 2012 as the industry was recovering from the Great Recession, tile flooring clocked in at $1.623 billion in sales and 1.45 billion square feet. So, in the last decade the category has increased by 54% in value and 41% in volume.

The discrepancy between dollar sales and volume was more significant than in years past and ceramic suppliers agreed it had much to do with price increases and inflation. As the heaviest hard surface category, it makes sense that freight hikes would impact ceramic more so than other hard surface solutions. “Due to the large increases in freight rates and the Ukraine crisis, which affected raw material and natural gas costs, we saw large increases in the overall cost of ceramic tile,” Raj Shah, president of MSI, told Floor Covering News.

It’s hard to pinpoint a percent increase across the board that could have been passed down at the first point of sale from dealers/distributors. However, the average selling price increased in 2022 from $1.24 to about $1.43, which buoyed dollar sales while volume remained relatively flat. That’s the first price increase of note for nearly a decade—price has hovered around $1.20/square foot since 2014.

The tile flooring category continued to hold strong as the third-largest sector in flooring, representing 12.5% of total industry dollars ($27.995 billion in 2022). That’s a substantial increase over 2021 when it grabbed 11.5% share, considering the proliferation of the resilient category and its rigid core colossus.

While ceramic’s share of total flooring sales increased in 2022, its share of hard surface dollars decreased to 2020 levels after 2021’s double-digit gain. In 2022, the category represented 21% of hard surface sales—which includes the ever-growing resilient category, as well as wood and laminate. That is down slightly from 21.8% in 2020 and more significantly off from 24.86% in 2019.

The tile industry faced its challenges in 2022 but, suppliers agree, tile managed gains in spite of headwinds. Some even touted the category’s resiliency despite lower expectations. “We all know of the supply chain disruptions and labor shortages, so all things considered, we expected 2022 to be a little worse than it was,” said Eric Astrachan, executive director of the Tile Council of North America (TCNA). “By value, consumption was, in fact, up to the highest number in history for the ceramic tile market.”

Emser Tile’s Rich Rose, vice president of sales support and special projects, agreed, also noting the category’s resiliency amid challenges. “In 2022, the demand for tile remained steady despite ongoing challenges in the global supply chain and fluctuations with the housing market. Despite these challenges, the tile industry managed to meet the demand, albeit with some delays and logistical hurdles.”

Home trends spurred by the pandemic also continue to be a boon for the tile flooring category. Emser’s Rose noted the demand for new and amplified spaces that continues to dominate, for example. “In addition to a strong desire for residential outdoor living improvements, home improvement and renovations are also trending. Consumers have enjoyed their living areas and have also used them extensively over the last several years with pandemic restrictions altering daily routines. As such, remodels, renovations and home improvements continue to drive growth.”

Imports vs. domestic

After a 15-year high in 2021, imports saw a decrease in 2022. The 2.18 billion square feet of tile imported last year represented a 2.3% decline from 2021, according to TCNA. However, it still managed to gain nearly 10% over 2020’s 1.97 billion square feet.

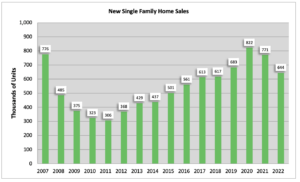

Spain, which in 2020 supplanted China as the largest exporter of ceramic tile to the U.S. by volume, maintained this position despite its exports falling 12.8% by volume vs. the previous year. Spanish imports in 2022 held a 19.8% share of total U.S. imports by volume, down from a 22.2% share in 2021, according to statistics supplied by the U.S. Department of Commerce.

Italy was the second-largest exporter to the U.S. in 2022 by volume, although Italian ceramic tile exports declined 2.9% from 2021, according to the TCNA. Italian tile comprised 17.3% of the U.S. import market last year, down slightly from 17.4% in 2021. Mexico was the third-largest exporter to the U.S. in 2022 with a 16.6% share of total U.S. imports. Tile imports from Mexico were up 1% by volume vs. 2021.

With a 13% share of 2022 imports, India became the fourth- largest exporter to the U.S., up from sixth position the previous year and its all-time highest position. Turkey rounded out the list of top five exporters to the U.S. with a 12.3% share in 2022, down from 13.5% in 2021.

On a dollar basis (CIF + duty), Italy was the largest exporter to the U.S., comprising 30.2% of 2022 U.S. imports, followed by Spain with a 26.8% share and Mexico with a 9.1% share.

On the domestic side, U.S. manufacturers shipped 889.2 million square feet of ceramic tile domestically in 2022, a 1% increase from the preceding year. U.S. shipments’ share of total U.S. consumption was 28.9% by volume in 2022, up slightly from 28.3% the prior year. Domestically produced tiles’ share of total consumption was much higher than the shares of any individual country exporting to the U.S., with the next highest shares of total consumption belonging to Spain (14.1%), Italy (12.3%) and Mexico (11.8%).

On the domestic side, U.S. manufacturers shipped 889.2 million square feet of ceramic tile domestically in 2022, a 1% increase from the preceding year. U.S. shipments’ share of total U.S. consumption was 28.9% by volume in 2022, up slightly from 28.3% the prior year. Domestically produced tiles’ share of total consumption was much higher than the shares of any individual country exporting to the U.S., with the next highest shares of total consumption belonging to Spain (14.1%), Italy (12.3%) and Mexico (11.8%).

U.S. FOB factory sales of domestic shipments in 2022 were $1.48 billion, an 8.6% increase from 2021, according to the TCNA. U.S. shipments were 33.4% of total 2022 U.S. tile consumption by value, down from 35.2% in 2021. This decrease in domestic market share by value was due in large part to the rising freight costs for imports, which helped push 2022 U.S. imports’ value up 17.5% from the previous year, according to the TCNA.

Interestingly, U.S. ceramic tile exports in 2022 grew 33.6% from the previous year and reached the highest total on record at 50.8 million square feet, according to the TCNA. The countries receiving the lion’s share of these exports by volume were Canada (70.5%) and Mexico (19%). U.S. exports by value in 2022 were $52.6 million, up 30.1% from 2021.

Commercial vs. residential

Unlike the last few years, the residential and commercial tile flooring markets both did well in 2022. Commercial tile held onto its market share and represented about 34% of overall tile dollars, or $1.2 billion of the total $3.507 billion in 2022, according to FCNews research. Overall, ceramic’s share of the total commercial market increased to 16.3% in 2022 vs. 14.2% in 2021 and 14.8% in 2020, Floor Covering News research found. In the last two years alone, tile’s portion of the commercial market saw a 15% increase.

Suppliers agreed commercial sales helped buoy the tile flooring category as a whole as the residential side of the business began to slow during the latter part of the year while commercial continued to embrace pent-up demand for new projects. “[We saw] disproportionate growth in commercial vs. residential—with commercial having higher price points,” MSI’s Shah noted. “Numerous projects had been planned during the time of lower interest rates. In addition, there was a backlog of projects due to the pandemic. Both contributed to the growth.”

There were several commercial segments that supported those sales in 2022. “Hospitality and healthcare were the strongest,” Whitney Welch, vice president of commercial sales, Dal-Tile, told Floor Covering News. “Education was steady. Retail was the slowest. Even though office was busy, it was based on remodel and tenant finish out with companies trying to recruit and retain employees; the fact that firms have also downsized and offer flexible working schedules also meant office looked different than in past years. Multi-family remains steady and consistent. Hospitality is definitely one of the strongest commercial markets with everyone traveling again. K-12 has been busy, especially in states that are seeing a rapid population growth. Healthcare is also busy, which includes senior living.”

Tom Enright, vice president of commercial at Emser Tile, noted the success of the company’s commercial contractor partners as a true indicator of commercial’s growth last year. “Our commercial contractors reported record revenues as well as solid, if not record, backlogs entering 2023,” he said. “Larger projects comprised an outsized share of the commercial market.”

The residential side of the business represents a consistent 66% of the ceramic tile market. In 2022, it saw a 6.7% increase in sales to $2.307 billion of the total $3.507 total ceramic market. While that’s less than 2021’s 11% increase, it continues to show the strength of the residential tile market despite strong headwinds.

The residential side of the business represents a consistent 66% of the ceramic tile market. In 2022, it saw a 6.7% increase in sales to $2.307 billion of the total $3.507 total ceramic market. While that’s less than 2021’s 11% increase, it continues to show the strength of the residential tile market despite strong headwinds.

Dan Butterfield, vice president, residential sales, Dal-Tile, noted several economic and trend-based factors that contributed to tile’s performance last year. “Strong builder segment sales, need for durable goods in for-rent properties, growth in North American-made mosaics and growing interest in strong sustainability stories were key factors that influenced residential tile growth in 2022.”

Housing remains a steady meter against which to gauge the health of the residential ceramic tile market in the U.S., and numerous factors within the housing market impacted the category in 2022.

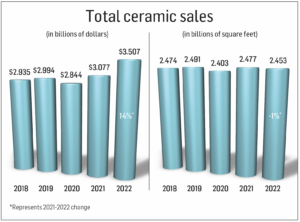

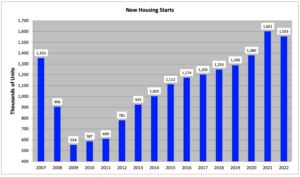

Total new home starts declined for the first time since the beginning of the Great Recession. The 1.56 million units started in 2022 were a 2.9% decrease from the preceding year, according to the U.S. Census Bureau. Hindered by rising mortgage rates and record-high average sales prices, new single-family home sales fell for the second year in a row. The 644,000 units sold in 2022 represented a 16.4% decline from the previous year. Multi-family starts in 2022 were up 14.5% compared to the previous year and exceeded a 500,000 annual pace for the first time since the Great Recession.

While the housing market was tumultuous in 2022, it nevertheless proved a boon to tile. “From a unit sales volume perspective, the housing market helped drive significant Y-O-Y growth,” Daltile’s Butterfield explained. “However, with the acceleration of ‘everything included’ packaged housing, ASPs decreased with large reductions in consumer selected design showroom material upgrades. Dollar sales grew substantially but it took a significant lift in lower-tiered units to do so.”

Emser’s Rose added that market conditions signaled a slowdown in home sales as interest rates rose and the affordability gap widened. “As a result, residential improvements and repairs were above historical averages as remodeling remained (and remains) in the spotlight.”

Looking ahead

Ceramic tile remains one of only two truly aspirational product categories in the industry—hardwood being the other—which remains a boon to its continued survival against the likes of rigid core/resilient. In order to continue moving forward, the tile industry will have to embrace the category’s most impressive—and sellable—attributes. That means looking to its cleanability, versatility, sustainability and design prowess, which give it a major leg up against its competition.

Suppliers agree, several traits inherent to tile already help the category thrive—even during hardship. “Timeless designs, high durability, low care and maintenance and being completely free of VOCs represent a few of the many benefits provided by this category,” Dal-Tile’s Butterfield noted.

Emser’s Rose pointed to tile’s ongoing evolution as another advantage. “Over the years, ceramic tile has experienced a significant evolution in both application and design possibilities and has moved beyond traditional use to, for example, statement walls and outdoor living spaces. The advancements in technology and design have expanded the potential of tile, allowing it to replicate various materials and offer a wide range of options for customization.”

Andrea Serri, communication and editorial activities coordinator at Confindustria Ceramica (Ceramics of Italy), noted sustainability as one of tile’s most valuable assets moving forward. “As the correlation between chemical off-gassing and health issues is becoming more apparent, homeowners will continue to gravitate toward sourcing long-term surfacing materials—like ceramic and porcelain—that are truly non-toxic and better for indoor air quality. As compared to other choices like vinyl plank flooring, tile is made of natural raw materials and therefore does not contain PVC, phthalates and vinyl chloride or emit harmful volatile organic compounds. This makes them one of the most sustainable and healthy surfacing choices for homeowners on the market.”

While ceramic continued its sales growth trajectory—albeit via price increases—there are persisent challenges it will need to contend with moving forward. That includes installation labor shortages, high interest rates and raw materials and freight costs. However, as the residential side of the business tackles these challenges head on, some suppliers are looking to the commercial segment in 2023 and beyond as a bright spot.

“Commercial is doing well and we believe it will continue to have a strong year in 2023, 2024 and beyond,” Dal-Tile’s Welch stated.