Generationally high inflation. A seemingly unending number of interest rate hikes. Disruptions in supply chains. The war in Ukraine that created a global energy crisis. A drop in American consumer confidence. Falling stock prices and unrealized profit forecasts. Such were the main challenges that defined 2022 for civilization in general and the flooring industry in particular.

Generationally high inflation. A seemingly unending number of interest rate hikes. Disruptions in supply chains. The war in Ukraine that created a global energy crisis. A drop in American consumer confidence. Falling stock prices and unrealized profit forecasts. Such were the main challenges that defined 2022 for civilization in general and the flooring industry in particular.

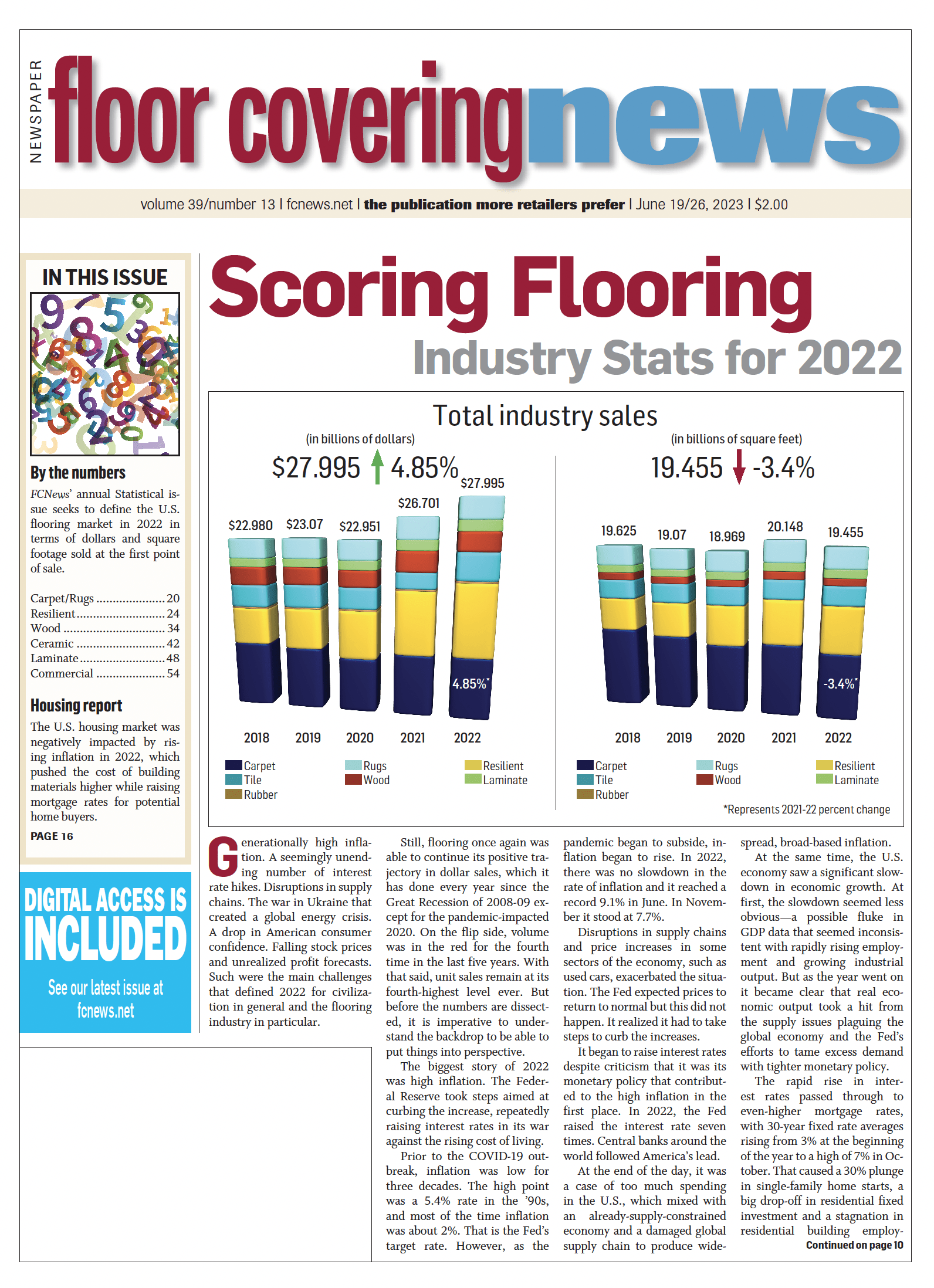

Still, flooring once again was able to continue its positive trajectory in dollar sales, which it has done every year since the Great Recession of 2008-09 except for the pandemic-impacted 2020. On the flip side, volume was in the red for the fourth time in the last five years. With that said, unit sales remain at its fourth-highest level ever. But before the numbers are dissected, it is imperative to understand the backdrop to be able to put things into perspective.

The biggest story of 2022 was high inflation. The Federal Reserve took steps aimed at curbing the increase, repeatedly raising interest rates in its war against the rising cost of living. Prior to the COVID-19 outbreak, inflation was low for three decades. The high point was a 5.4% rate in the ’90s, and most of the time inflation was about 2%. That is the Fed’s target rate. However, as the pandemic began to subside, inflation began to rise. In 2022, there was no slowdown in the rate of inflation and it reached a record 9.1% in June. In November it stood at 7.7%.

Disruptions in supply chains and price increases in some sectors of the economy, such as used cars, exacerbated the situation. The Fed expected prices to return to normal but this did not happen. It realized it had to take steps to curb the increases.

It began to raise interest rates despite criticism that it was its monetary policy that contributed to the high inflation in the first place. In 2022, the Fed raised the interest rate seven times. Central banks around the world followed America’s lead.

At the end of the day, it was a case of too much spending in the U.S., which mixed with an already-supply-constrained economy and a damaged global supply chain to produce widespread, broad-based inflation.

At the same time, the U.S. economy saw a significant slowdown in economic growth. At first, the slowdown seemed less obvious—a possible fluke in GDP data that seemed inconsistent with rapidly rising employment and growing industrial output. But as the year went on it became clear that real economic output took a hit from the supply issues plaguing the global economy and the Fed’s efforts to tame excess demand with tighter monetary policy.

The rapid rise in interest rates passed through to even-higher mortgage rates, with 30-year fixed rate averages rising from 3% at the beginning of the year to a high of 7% in October. That caused a 30% plunge in single-family home starts, a big drop-off in residential fixed investment and a stagnation in residential building employment.

The rapid rise in interest rates passed through to even-higher mortgage rates, with 30-year fixed rate averages rising from 3% at the beginning of the year to a high of 7% in October. That caused a 30% plunge in single-family home starts, a big drop-off in residential fixed investment and a stagnation in residential building employment.

Housing is arguably the sector by which interest rate hikes have the clearest effects on both demand and supply, so it is obviously a key component of Fed-driven shifts in the business cycle.

In addition, the price of natural gas soared to a record high, and as a result the price of electricity also increased. High energy prices have contributed to high inflation, forcing factories to reduce output or stop operations altogether.

The Russian invasion of Ukraine led many countries to end dependence on Russian gas completely. Russia is the largest exporter of fossil fuels in the world. At the same time, OPEC decided to cut oil output by 2 million barrels per day, which immediately led to a spike in fuel prices. That was the largest pullback by OPEC members since the COVID-19 outbreak.

The supply chain situation, though it arguably improved throughout the year, remains historically bad. American factories reported that material, labor and transportation constraints prevented them from operating at full capacity. Transoceanic freight travel times finally started to decline as the year wore on, prices returned to normal and overall supplier delivery times only started improving in the fourth quarter.

Against that backdrop, each segment of the flooring industry seemed to have its own story. Take carpet, for example. The category was up less than 1% in dollars but down 9.1% in volume. Commercial saved the day or it would have been a lot worse. Commercial, which accounts for about 40% of all carpet sold, was up 11.2% in dollars but down 1.2% in volume, illustrating the inflation that plagued the global economy in 2022. Speaking of which, no product was victimized by inflation more than ceramic tile, which was up 14% in dollars but down 1% in volume. The average selling price hovered around $1.20 for nearly a decade, but last year saw its ASP leap to $1.43. This category experienced more price hikes than any other due in large part to freight increases. Ceramic is more import-driven than other hard surface categories and is the heaviest of all flooring products on a square-foot basis. So it stands to reason that it would be most impacted by increases in freight costs.

Against that backdrop, each segment of the flooring industry seemed to have its own story. Take carpet, for example. The category was up less than 1% in dollars but down 9.1% in volume. Commercial saved the day or it would have been a lot worse. Commercial, which accounts for about 40% of all carpet sold, was up 11.2% in dollars but down 1.2% in volume, illustrating the inflation that plagued the global economy in 2022. Speaking of which, no product was victimized by inflation more than ceramic tile, which was up 14% in dollars but down 1% in volume. The average selling price hovered around $1.20 for nearly a decade, but last year saw its ASP leap to $1.43. This category experienced more price hikes than any other due in large part to freight increases. Ceramic is more import-driven than other hard surface categories and is the heaviest of all flooring products on a square-foot basis. So it stands to reason that it would be most impacted by increases in freight costs.

The category that suffered the most in 2022 was hardwood, down just under 10% in dollars and slightly more than 11% in volume. Why? Given how many consumers still had the itch for renovating their homes yet were feeling the pinch in their pocketbooks, they found themselves opting for more budget-friendly options like rigid core or laminate. The latter continued on the comeback trail, growing about 6% in dollars and 4.5% in volume, capitalizing on ample domestic availability and much improved features and benefits. Since 2012, laminate has grown 24.6% in dollars and 5.6% in volume. This reflects a move toward better goods—away from the 7mm and 8mm products—and a greater focus from specialty retailers.

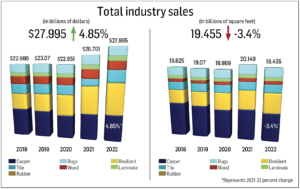

As has been the case for seemingly the last decade, resilient, specifically LVT and its sub-category savior SPC, remains the industry’s shining star. In fact, when you consider all the LVT sold last year (residential and commercial, glue-down and click, SPC and WPC), the number surpassed carpet (not including area rugs) by $15 million.

LVT grew a little more than 14% in dollars and just under 7% in volume. Inflation reared its ugly head here as well, but unlike the other categories (aside from laminate), volume grew at a healthy clip although it did not approach the double-digit growth of the previous five years as business slowed in Q4.

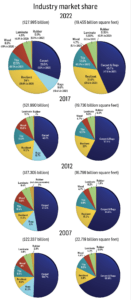

Interestingly, the flooring industry got a shot in the arm from the commercial segment. Spending on non-residential projects rebounded, with key segments such as healthcare, education, hospitality and, to a lesser extent, retail, leading the charge. Following a period where many commercial projects remained in limbo while the world grappled with a raging pandemic, commercial rebounded with a vengeance. FCNews research shows commercial flooring sales totaled $7.34 billion in 2022, an increase of 13.1% over the $6.5 billion figure reached in 2021.

Of course, much of the dollar growth the industry achieved last year was attributed to multiple rounds of price increases as suppliers tried to keep pace with rising costs. Container costs remained high before abating toward the end of the year. And freight expenses once product reached these shores were through the roof.

To further illustrate the impact of price increases, the average selling price of all flooring (wholesale) in 2022 soared to $1.44, up from $1.33 in 2021 and $1.21 in 2020. That’s a 16% increase over two years. And for those historians out there, in 2006, when more flooring was sold than any other year, the average selling price was $0.94. Back then it was about products like resilient tile and VCT.

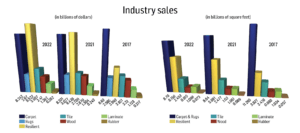

When the dust cleared and all the numbers were counted and run through the wash multiple times, total industry sales in 2022 reached a record $27.995 billion, up 4.85% from 2021’s $26.701 billion, and an enormous 21.8% gain from 2020’s $22.975 billion. To put it another way, the industry is up 73% in dollars since it started its recovery from the Great Recession in 2009. (Note: These numbers are in wholesale dollars reflecting the first point of sale. They also do not include stone flooring—nor do they account for ceramic wall tile, cove base and rubber accessories.)

When the dust cleared and all the numbers were counted and run through the wash multiple times, total industry sales in 2022 reached a record $27.995 billion, up 4.85% from 2021’s $26.701 billion, and an enormous 21.8% gain from 2020’s $22.975 billion. To put it another way, the industry is up 73% in dollars since it started its recovery from the Great Recession in 2009. (Note: These numbers are in wholesale dollars reflecting the first point of sale. They also do not include stone flooring—nor do they account for ceramic wall tile, cove base and rubber accessories.)

At no time since FCNews started tracking statistics has the industry come close to $28 billion. By comparison, until 2021 the high-water mark for the industry was in 2006 when it reached $24.715 billion.

The caveat is that much of that rise was due to repeated price increases. In illustration, some people said the price of the aforementioned darling, waterproof flooring, increased as much as 20% throughout the year. To further the point, the averaging selling price of SPC in 2020 was $1.59 (wholesale). In 2021 it was $1.85. In 2022 it was over $2. By the way, those prices are driven down by the Home Depots and Floor & Decors of the world, which buy less expensively because of their sheer volume.

A better gauge for the industry’s performance last year may lie in volume, which declined 3.4% in units. FCNews research reveals that the industry went from 20.148 billion square feet sold in 2021 to 19.455 billion square feet in 2022. This marks the fourth decline in the last five years. Only in pandemic recovery year 2021 did the industry post growth in units (6.2%).

It would have been much worse had it not been for resilient (up 4.7%) and laminate (up 4.5%). And the bulk of the growth is attributed to LVT/WPC/SPC, which posted a 6.8% increase in 2022. This category now represents 23.1% of the entire floor covering industry in terms of volume. For the record, that 19.455 billion square feet still represents the second-highest total since 2007, right before the Great Recession. The high-water mark came in 2021.

While many will not be overly excited about 2022 given the 3.4% decline in volume and the inflation-generated 4.8% rise in dollars, at least the average selling price is increasing. When we were recovering from the Great Recession in 2010, flooring sales were $16.221 billion and 16.625 billion square feet for an ASP of $0.98. As we reached the end of the decade, the industry was up 0.4% in dollars but down 2.8% in volume. So the average selling price of one square foot of flooring (wholesale) has increased $0.46 in the last 12 years. The average wholesale price of all flooring in 2022 was $1.44, up from $1.33 in 2021. In 2020 it was $1.21, the same as in 2019 and up from $1.17 in 2018 and $1.11 in 2017.

Home centers’ share

Home centers contributed their fair share to the rise in overall flooring sales as well, especially with more homeowners and renters opting to remodel their spaces versus buying new homes amid historically high mortgage rates. While flooring sales at Home Depot were relatively flat year over year (the retailer reported $9.22 billion in flooring revenues in fiscal year 2022), Lowe’s—the second-largest home center chain—reported flooring department sales of $5.044 billion last year, an increase of roughly 2% over 2021.

Meanwhile, Lumber Liquidators showed a little bit of a decline in 2022, generating $957.9 million in 2022—down 3.6% from $993.9 million in 2021.

But probably the biggest winner in the large-store format category in 2022 was probably Floor & Décor, which reported sales of $4.2645 billion in 2022, a whopping 24% increase from $3.4335 billion in 2021.

Following is an overview of the respective floor covering category performances in 2022:

Carpet

Following the anomaly that was the 2021 statistical year, when overall carpet sales grew 11.5%, a return to normalcy was expected once the pandemic-inspired rally fizzled. And that’s exactly how it played out as total carpet volume (including rugs) was down 9.1% from 2021. If not for a resurgent commercial sector, sales would have been in the red as well. Just two years after 20%-plus sales and volume losses were registered, the segment bounced back nicely as dollars grew 11.2%. Another area that showed vibrancy was multi-family, a price-sensitive channel that lends itself to value-oriented products like solution-dyed polyester. At the end of the day, commercial’s comeback resulted in overall sales growing 0.5%.

Other good news: Higher-end products continue to perform as consumers show a willingness to spend more on a product that may only appear in one room of the house.

Resilient

When the dust settled, FCNews research found the resilient category as a whole generated $9.522 billion in sales in 2022, a 13% increase over 2021’s $8.426 billion. In terms of volume, the category accounted for 6.156 billion square feet (not including rubber) at the first point of sale, a 4.7% increase over 5.881 billion square feet in 2021. The discrepancy in double-digit sales growth vs. a single-digit volume increase is attributed to the unprecedented price increases in freight and raw materials as well inflationary pressures in 2022 due to the lingering effects of the pandemic.

When taking total flooring sales into account, resilient made gains in 2022. Resilient flooring comprised 34% of total dollar sales and 31.64% of volume compared to last year’s 31.6% of sales and 29.2% in terms of volume. In 2020, that number was 28.7% of dollars and 28.8% of volume, which was up from 24.6% of dollars in 2019. Looking back nearly a decade to 2014, resilient accounted for only 12.2% of dollars and 15.1% of volume. In essence, over these last several years, resilient’s share of the market has nearly tripled in terms of dollars and doubled in terms of volume.

Ceramic tile

FCNews research shows ceramic experienced a 14% increase in dollar sales in 2022 to $3.507 billion versus $3.077 billion in 2021. That is an eye-opening 23% increase from 2020’s $2.844 billion when the category experienced its first decline since 2009 amid the Great Recession.

Ceramic flooring volume didn’t quite make it into the black in 2022, registering a slight 1% decrease to 2.453 billion square feet from last year’s 2.477 billion square feet. The discrepancy between dollar sales and volume was more significant than in years past and ceramic suppliers agreed it had everything to do with price increases. As the heaviest hard surface category, it makes sense that freight hikes, for example, would impact ceramic more so than other hard surface solutions.

Hardwood

No repeat performance for the hardwood flooring category in 2022. After achieving high double-digit growth rates in both sales and volume in 2021, the U.S. hardwood flooring category took a big step back in 2022. FCNews research shows hardwood flooring revenues fell 9.8% last year to $2.41 billion. Volume-wise, square footage sold at the first point of distribution slipped to 915 million square feet—an 11.2% drop-off. Industry observers attribute the falloff to increased competition from resilient and laminate.

Laminate

The momentum that the U.S. laminate flooring category generated in late 2020 and throughout 2021 continued to positively impact segment sales in 2022 as sales reached $1.382 billion—an uptick of 6% over the year prior. In terms of volume, the category grew at a slightly slower rate (4.5%), reaching roughly 1.098 billion square feet. The disparity in growth rates, industry observers say, can be attributed to slightly higher costs related to production/shipping as well as more of an emphasis on better quality goods.

For the full assessment of each individual category, be sure to check back to fcnews.net throughout the week or visit the full July 26 digital edition.