As the U.S. gradually returns to pre-pandemic levels of activity, businesses are embracing their role as catalysts for economic revival. They revitalized Main Streets, revived tourism and reignited the entrepreneurial spirit that defines the nation. The rebound not only restored livelihoods, but also symbolized that unwavering spirit.

“We’re seeing positive momentum across all product categories since getting out of COVID-19,” said Robb Myer, vice president, Aladdin Commercial, observed. “We saw a little bit of a slowdown earlier this year, but I think the market was cautious considering the economy and rising interest rates.”

Coming off a year where many companies reopened or resumed normal business hours, the commercial flooring industry is poised to capitalize on this momentum. “Most of the market for commercial flooring is healthy and our members expect to have a growth year in 2023,” said Mark Bischoff, president and CEO, Starnet Commercial Flooring. “Starnet members continue to report strong backlogs, and warehouses are bursting the walls with products that need to be installed.”

As the industry nears the halfway point of 2023, commercial flooring sales are tracking to sustain moderate growth, industry watchers say, with some end use segments faring better than others. Specified contract is on pace to maintain a 70% market share of the estimated $6.6 billion-plus commercial flooring business, while Main Street applications account for the remainder, according to preliminary Floor Covering News research. Volume is projected to split between both markets.

Growth, however, is an unknown amid historically high inflation and economic uncertainty during the first two quarters. The reasons are well documented. “The cost of energy, building materials, natural gas, etc., has been gradually rising due to the rapid economic recovery following the COVID-19 pandemic,” said Rocamador Rubio, director, Trade Commission of Spain.

Meanwhile, higher lending rates and increased construction costs are reportedly impacting some new commercial projects in certain regions. In May, the National Association of Home Builders (NAHB) predicts multi-family building starts to decline by more than 10% annually from 2023 to 2024. (Many consider multi-family residential a subset of commercial.) These and other economic indicators are fueling concerns that commercial flooring projects may be canceled or delayed in the second half of the year.

“Interest rates are increasing the overall investment required for commercial projects,” said Greg Mather, president of Crossville. “While to this point this has not had a major negative influence, further rate increases will very likely slow work.”

Hard surfaces outpace carpet

As the most mature flooring category, carpet is the most vulnerable to uncertain economic conditions. Soft surfaces are trending to post a modest gain—coming off a year with approximately $3 billion-plus in commercial sales—but continues to lose market share to hard surfaces. Carpet tile leads the way with roughly 60% share of commercial carpet sales, a figure that continues growing as suppliers expand their offering of sustainable products featuring sophisticated designs and low-carbon footprints.

Broadloom sales are expected to remain flat to slightly up this year, depending largely on market needs in hospitality and retail environments. “Carpet tile leads in usage within both the Main Street and specified commercial arenas,” said Glenn King, vice president of sales, Southeast region, Stanton Carpet. “However, in the Main Street market, broadloom and glue-down LVT have a strong foothold, specifically in property/tenant management where budget allowances and tenant turnover take precedent.”

Hard surfaces is on pace to post a single-digit sales increase over 2022 commercial sales of $3.6 billion, FCNews preliminary data reveals, although the growth rate is significantly higher for all forms of LVT in commercial spaces. Many floors make up the category—from vinyl sheet and floor tile to ceramic, hardwood, laminates and polished concrete—and market share and growth rates vary by sector and region. “LVT is still growing in the major commercial sectors, with maybe the exception of mass retail,” said Brian Carson, president and CEO of AHF Products, which continues to broaden its commercial product offerings. “You’re seeing growth of LVT, in particular, in education and healthcare.”

Macro issues impact consumption

The five major commercial sectors are facing macro issues that stand to affect flooring sales growth and product specs. Case in point: corporate/office flooring sales shrunk significantly between 2020 and 2022 due largely to the high number of employees working remotely. These trends carried over to the first quarter. “The corporate real estate market faces a tough road ahead because the long-term trend has gone so far away from owner-occupied commercial office property,” Starnet’s Bischoff noted. “The commercial office market will remain difficult as long as interest rates remain high and as investors, developers and operators struggle to make the math work.”

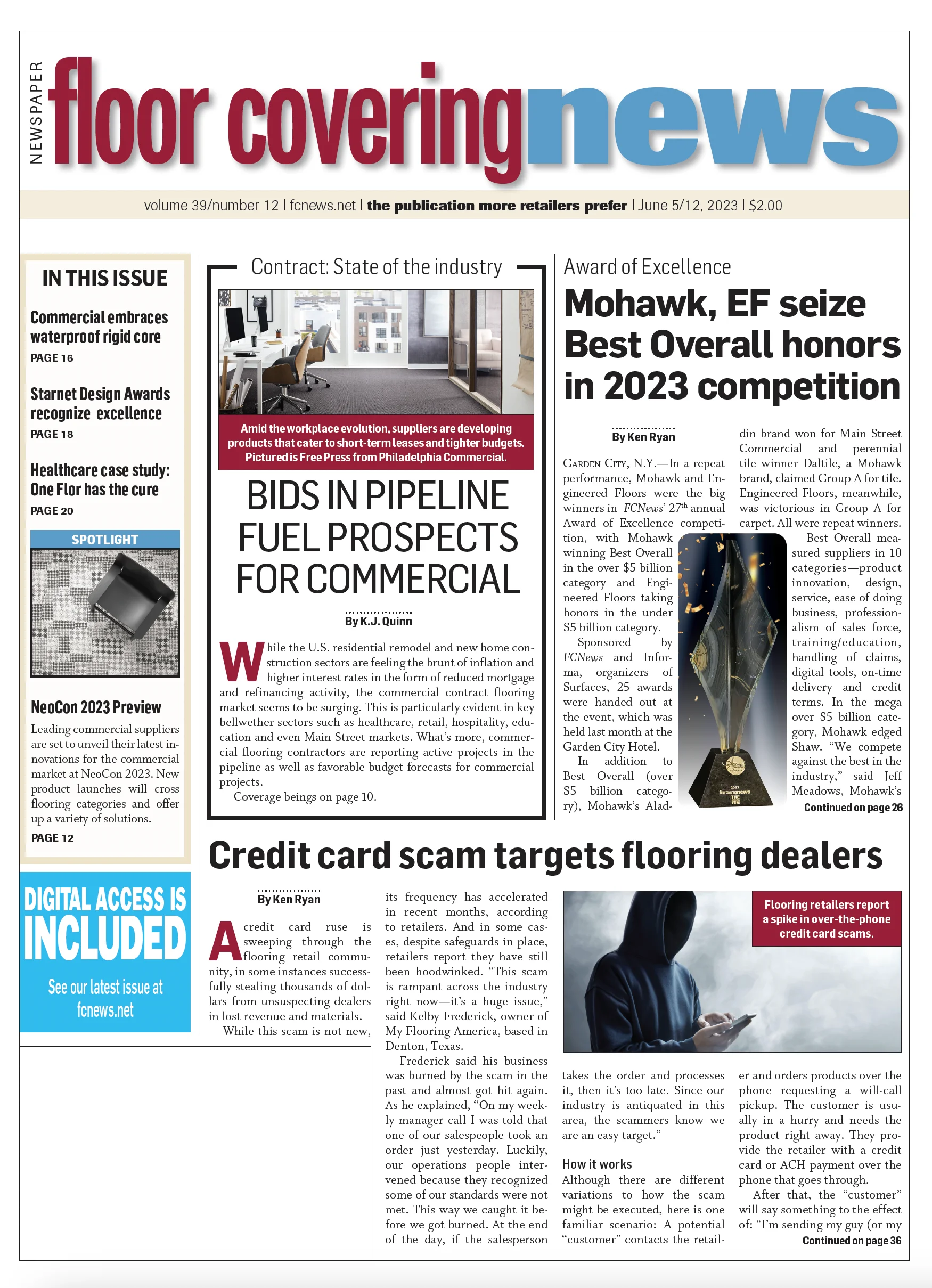

Nonetheless, industry members are not turning their backs on the corporate/offices segment, which represented about 40% of commercial flooring sales last year. The hope is that this segment will rebound as businesses recruit more talent to meet ever-changing workforce needs. However, they are mindful that commercial spaces are undergoing a transformation. From open floor plans to eco-friendly materials, investments are being made to design spaces that promote collaboration, flexibility and well-being.

“We are attributing the sustained and elevated demand in the corporate office segment to the fact that companies are renovating their workspaces for a post-COVID-19 environment and are looking to update their spaces with a focus on attracting top talent,” said Jim McKeon, vice president of sales – Americas, Interface.

Overall, the focus is on creating functional, aesthetically pleasing and technologically advanced floors that align with evolving demands. The most popular options are carpet tile, LVT and engineered hardwood. “Carpet tile dominates due to design, flexibility, ease of installation and sustainability,” said Jeff Galloway, vice president of product management, Mohawk Group. “Broadloom is used in executive offices and/or conference rooms.”

Porcelain tile and polished concrete are preferred for certain areas where fashion and functionality are required. The latter is reportedly gaining popularity for its sleek and modern aesthetic, durability and low maintenance. “With polished concrete continuing to take market share, it is a business commercial contractors should consider if they are not already in it,” said Geoff Gordon, executive director, Fuse Alliance.

Retail market

As consumers are eager to return to a semblance of normalcy, businesses are quick to seize this opportunity. The retail sector is experiencing a resurgence. April retail sales rose 0.4% from the previous month to $686.1 billion in April, a 1.6% spike over April 2022, the U.S. Census Bureau reports.

Flooring choices run the gamut—ceramic, wood and carpet are often specified in high-end retail spaces, while resilient and VCT are commonly found in other public areas. “Mass retail uses a lot of broadloom due to price, but carpet tile is growing,” Mohawk’s Galloway noted. “Specialty retail uses carpet tile and broadloom equally to meet specific design aesthetic requirements.”

LVT is reportedly gaining more coverage in retail spaces while rubber flooring is commonly used in high-traffic areas like shopping malls, gyms and fitness centers. “When you get into retail and education, you see more resilient tile being used, like VCT,” AHF Products’ Carson stated.

A segment renown for staying on top of interior design trends, flooring selections are reportedly being influenced by a blend of modern and vintage aesthetics, sustainable and eco-friendly materials, versatility and uniqueness. Sustainable floors, such as reclaimed wood and recycled materials, align with the focus on environmentally conscious design. “We continue to invest in products that are beneficial to both occupants of a space and our planet,” said Daniel Collins, vice president, commercial soft surface, Shaw Contract. “This includes new hybrid products.”

Versatile flooring solutions that can adapt to various commercial spaces are favored, observers say, allowing for easy modifications as establishments evolve. In addition, custom designs and patterns are popular, allowing retailers to differentiate themselves and create memorable experiences for their customers. “We’re seeing highly designed and affordably priced products that offer a curated solution, which means we’re making it simple for RSAs to show products in whatever medium they choose,” Aladdin’s Myer explained. “They can have a conversation with the end user about hard and soft surfaces and how it coordinates together.”

Education evolves

From classroom renovations to brand-new school builds, educational settings are transforming to create blended, flexible spaces that allow students to take the lead in their learning.

“You want the ‘wow’ factor when someone walks into a school, office or medical space, because the design has a certain look to it,” Aladdin’s Myer said. “You can do that with higher design products that meet performance needs.”

Education represents about 14% of the commercial market but is in growth mode, as commercial flooring sales are projected to increase as high as 10%, according to preliminary Floor Covering News research. K-12 retains the biggest piece of the pie, representing approximately 75% of sales, with the rest from higher education. Both spaces require flooring materials that can withstand heavy foot traffic and frequent cleaning while ensuring a safe environment for students and staff.

Most applications require hard surfaces, observers say, accounting for more than half of flooring sold to K-12 spaces. Education is a bedrock segment for ceramic, linoleum and rubber, where they are specified for their functionality and suitability for customization. Resilient and rubber flooring are popular in schools, universities and daycare centers due to their resilience, low maintenance and ability to withstand the demands of active students.

“The education market is on the rise, particularly in public school environments where there is high demand for carpet due to its comfortable underfoot feel and enhanced acoustic properties in classrooms,” said Quentin Quathamer, director of Main Street Commercial, Philadelphia Commercial. “Carpet tile typically dominates in this setting due to its ease of replacement and maintenance.”

Healthcare remains strong

One of the fastest growing commercial segments is healthcare, led by new construction and renovation work involving clinics, assisted-living communities and urgent care centers. Facilities are embracing new ways to think about patient experience. Shifts in design are going from sterile and uninviting to more homey, comfortable designs.

“Healthcare tends to have a lot of commercial sheet vinyl,” said Yon Hinkle, vice president, product management—resilient at AHF Products. “You have VCT, vinyl tiles and rubber going into healthcare as well.”

The healthcare segment accounted for about one-third of commercial flooring sales last year, according to preliminary Floor Covering News research. Vinyl flooring is scoring points in healthcare facilities due to its inherent characteristics such as durability, antimicrobial properties, moisture resistance, ease of maintenance and ability to withstand heavy foot traffic. Sheet vinyl, VCT, LVT and rubber are among the leading options, depending on end use. Natural materials such as ceramic are considered healthy choices.

One advancement in ceramic that is favorable for healthcare settings is the ability to produce a higher slip resistance value when wet. “It’s easy to clean in both environments (residential and commercial) and it responds to both environments in an optimized way,” Trade Commission of Spain’s Rubio observed.

Carpet tiles are commonly used in healthcare settings such as patient rooms, waiting areas and offices. They provide comfort, noise reduction and a welcoming atmosphere, while their modular design allows for easy replacement of damaged or stained tiles in high-traffic areas. “Carpet tile dominates except where cost is the driving factor,” Mohawk’s Galloway noted.

Hospitality opens up

One segment that is rapidly recovering from the toll of the pandemic is hospitality. Restaurants, travel and tourism, lodging and recreation are seeing their businesses return to pre-COVID-19 levels. “We continue to see significant growth in hospitality as people begin to travel again and hospitality projects resume after the pandemic put a pause on renovations,” Shaw Contract’s Collins said.

A variety of soft and hard surfaces are utilized in hospitality spaces, with specification depending largely on end use. Among the most popular floors are flexible LVT, broadloom and ceramic. An estimated 25% of commercial carpet is sold into hospitality spaces, the majority of which is broadloom.

(For more on the state of the commercial market, look for the upcoming FCNews Statistical Issue due out later this month.)