Call it the “year of the comeback.” That’s how some industry observers might describe the commercial flooring industry in 2022, which continued to emerge from the wreckage of a global pandemic to experience a vibrant rebirth. As businesses reopened, construction and renovation projects activities increased, breathing new life into building interiors.

Call it the “year of the comeback.” That’s how some industry observers might describe the commercial flooring industry in 2022, which continued to emerge from the wreckage of a global pandemic to experience a vibrant rebirth. As businesses reopened, construction and renovation projects activities increased, breathing new life into building interiors.

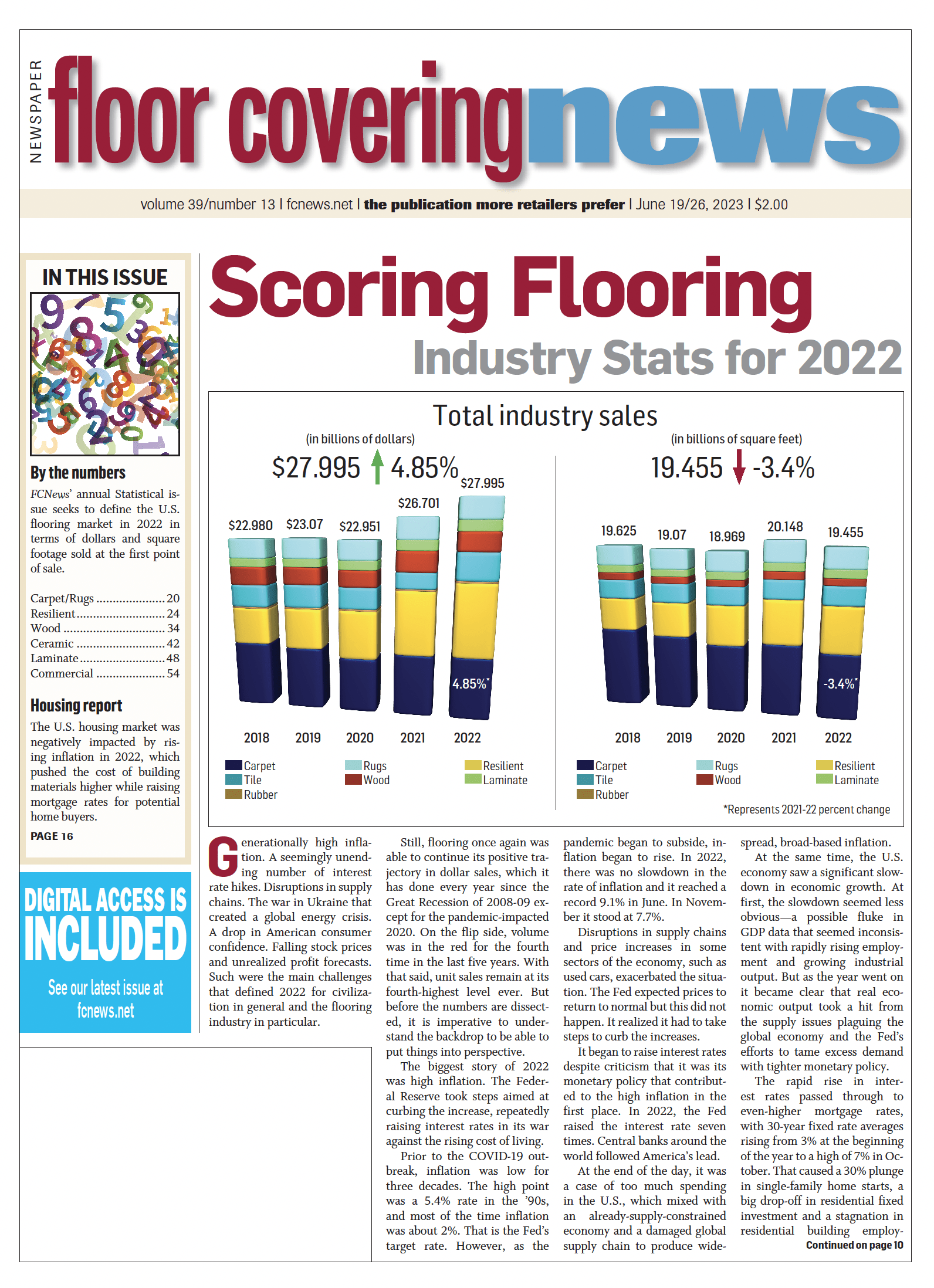

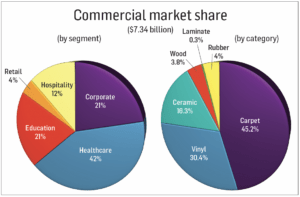

Commercial flooring rebounded as sales increased 13.1% from roughly $6.5 billion in 2021 to $7.34 billion in 2022, Floor Covering News research shows. This growth built on momentum witnessed by the industry at the end of 2021 as business conditions improved. The lion’s share of sales (approximately 70%) was generated from specified contract while the remainder came from Main Street commercial applications, research shows. Overall, commercial represents approximately 26.2% of total U.S. flooring sales, according to Floor Covering News research.

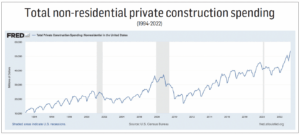

The turnaround was fueled, in part, by a resilient U.S. economy and lower unemployment rate. GDP rose nearly 10% last year, which also had a positive impact on non-residential construction. Commercial and multi-family construction made impressive gains largely driven by pent-up demand for apartments and condos, Dodge Construction Network reported.

Credit commercial flooring dealers and contractors for their creativity in refining their businesses to adapt to the new normal, industry members say. Some expanded into growing and recovering business segments, such as healthcare, education and hospitality, in a move to expand their client portfolio and mitigate the impact of economic fluctuations in any single sector. Others diversified their product and service offerings to cater to a wider customer base, which included more A&D community members working remotely more often.

Collaboration and strategic partnerships played a pivotal role in the recovery. Property owners and facility managers formed alliances with contractors, architects and designers to secure large-scale projects and gain a competitive edge. These partnerships, observers said, allowed them to access new leads, share resources and provide comprehensive solutions to clients.

“[Businesses] want to have a welcoming and warm feeling in their office settings, a sense of calm in their healthcare and hospitality environments with overall durability, so they realize a true return on their investment,” said Glenn King, vice president of sales, Southeast region, Stanton Carpet.

By delivering exceptional quality, timely installations and post-sale support, property owners and facility managers forged closer ties with clients and generated repeat business. “What we found through research and influencers is anyone involved in the whole process of selecting flooring is looking for a highly designed product at an affordable price,” said Robb Myer, vice president, Aladdin Commercial.

Market conditions, however, did not completely recover across the board, slowing down progress in some end-use segments. For example, port congestion and escalating freight costs caused disruptions and challenges in the supply chain and manufacturing operations. “Inflation has impacted nearly every aspect of the ceramic industry,” Rocamador Rubio, director, Trade Commission of Spain, observed. “The cost of energy, building materials, natural gas, etc., have been gradually rising due to the rapid economic recovery following the COVID-19 pandemic.” To ensure its guarantee of supply, Spain has been working to diversify resource sourcing.

Hard vs. soft surfaces

The tale of the tape remained largely the same in 2022 as hard surfaces outpaced carpet, growing its share of the pie from $3.5 billion in 2021 to $4.022 billion in sales last year—that’s a rise of 14.7%, according to Floor Covering News research. An estimated 60% of sales is from specified contract while volume is virtually split with Main Street applications. “The shift to resilient and alternative flooring surfaces continues to take some share away from traditional carpet,” said Daniel Collins, vice president, commercial soft surface, Shaw Contract.

Resilient, which includes sheet vinyl, LVT, rigid core, linoleum and VCT, accounted for roughly 55% of commercial hard surface sales—and more than 30% of total commercial flooring sales, including soft goods. In much the same way that it has dominated in residential, resilient flooring remains the fastest growing flooring category in commercial, Floor Covering News research confirms.

Ceramic tile, rubber flooring and hardwood round out the top five hard surfaces specified for commercial, accounting for 30%, 7.3% and 6.9% of hard surfaces sold in commercial, respectively, according to Floor Covering News research. More importantly, ceramic maintains almost twice as much share in category sales, with the majority coming from education (50%) and retail (20%). “Ceramic is long lasting and requires minimal maintenance versus other flooring options,” Greg Mather, Crossville president, noted. “We have a strong proposition and need to be focused on educating the design community.”

One unconventional but longtime product reportedly gaining coverage in public spaces is polished concrete. Proponents say the floor is environmentally friendly, sports a sleek, modern look and offers durability and low-maintenance qualities ideal for high-traffic areas like retail stores, offices, warehouses and industrial facilities. “With polished concrete continuing to take market share, it is a business that commercial contractors should consider—if they are not already in it,” said Geoff Gordon, executive director of Fuse Alliance, the commercial contractor network spanning more than 160 members operating more than 240 locations.

Carpet posted modest growth as sales increased from $3 billion in commercial sales in 2021 to $3.32 billion last year—in line with pre-pandemic levels. Moreover, the category represents 45.2% of commercial sales, only slightly down from 2021’s numbers, according to Floor Covering News research. An estimated two-thirds of this revenue came from specified work and the rest from Main Street. Typically, the commercial segment lags behind residential in rebounding from a catastrophic event such as the pandemic, albeit commercial stays in demand longer, observers said.

Carpet tile maintained solid growth across most market segments and represents 60% share of soft surface sales, with the majority coming from specified business, according to Floor Covering News data. Broadloom accounts for the remainder but maintains strongholds in hospitality and certain Main Street applications. “Carpet tile sales continue to dominate while broadloom sales remain steady or slightly higher, based on the specific needs of the hospitality and retail sectors,” said Quentin Quathamer, director of Main Street Commercial, Philadelphia Commercial.

End-use segment activity

The major commercial end-use sectors—including healthcare, corporate, education, hospitality and retail—faced their share of issues impacting growth rates and flooring choices. Some saw business spikes from re-openings and a return to normal working hours. Meanwhile, corporate/offices, tied for the second-largest sector, was hard hit during the pandemic largely due to layoffs, construction slowdowns and work-from-home policies. Activity in this sector was off slightly last year, dipping from 30% of sales in 2021 to 21% in 2022, according to Floor Covering News research. “The disruption of the pandemic and the struggle for end users to adopt consistent back-to-work plans that minimize hybrid time away from the office has been a very difficult challenge for our members,” said Mark Bischoff, president and CEO of Starnet, the largest network of commercial flooring contractors with 170 members operating nearly 400 locations. “The market for new construction in offices remained subdued, except for large project work.”

Carpet tile and resilient are among the prominent floors specified while hardwood, porcelain tile and polished concrete are preferred for areas where fashion and functionality are required. Versatility and modularity are important considerations, as office layouts change frequently, requiring adaptable solutions that can be easily modified or replaced. “Carpet tile dominates due to design, flexibility, ease of installation and sustainability,” said Jeff Galloway, vice president of product management, Mohawk Group. “Broadloom is used in executive offices and/or conference rooms and lower-budget tenant improvement.”

Floor design was also impacted by growing awareness of environmental issues, fueling demand for sustainable materials like recycled or renewable flooring options, according to published reports.

Following is a closer look at some of the major end-use markets:

Healthcare

Healthy flooring choices are a staple of medical facilities, one of the fastest growing commercial segments. During the pandemic, healthcare continued its dominance as the largest commercial sector, increasing its share of the market from 39% in 2021 to 42% in 2022, Floor Covering News research found. “We viewed healthcare as the strongest segment followed by education and, surprisingly, retail,” Crossville’s Mather said.

Resilient has historically been the most popular flooring option in healthcare settings mainly due to its ease of maintenance. For example, sheet vinyl’s antimicrobial properties contribute to a clean and hygienic environment, making it essential for areas such as emergency, operating and treatment rooms. An increasing amount of LVT is also finding its way into non-critical areas such as corridors, waiting rooms and patient rooms.

“The education and healthcare segments tend to use more hard surface products than soft surface products,” Mohawk’s Galloway observed.

Carpet tile is commonly used in patient rooms, waiting areas and offices, where it is valued for providing comfort underfoot, noise-reduction qualities and modular design allowing for easy replacement. Broadloom is reportedly gaining popularity in non-patient areas because of its warmth and welcoming nature. Meanwhile, natural materials such as ceramic and linoleum are eco-friendly, premium products installed throughout facilities such as hospitals, clinics, assisted living communities and urgent care centers.

Education

Education and healthcare share several desired traits in flooring, such as safety, durability and low maintenance. The education sector accounted for about 21% of the commercial market in 2022, up slightly from 18% in 2021. K-12 in particular is the dominant end-use market with approximately 75% share of sales activity in education flooring specifications while the rest comes from higher education, according to Floor Covering News research.

There is a diversified amount of soft and hard surfaces specified, especially at college campuses, which operate multiple facilities. Most applications require hard surfaces, which represent more than half of flooring sold to K-12 spaces. “Broadloom is still used in K-12, but carpet tile is growing rapidly,” Mohawk’s Galloway noted. “Higher education uses carpet tile in public spaces; carpet tile and broadloom are both used in dorms.”

Education is the second-largest commercial segment for carpet, accounting for nearly one-third of sales, Floor Covering News research found. “Local schools, specifically private primary/secondary schools and higher education, use carpet and carpet tile to offer warmth, noise reduction and use in damp climate environments,” Stanton’s King observed. “They reduce slip-and-fall concerns.”

Several major trends are influencing flooring choices at academic institutions. Sustainability, for instance, is fueling an emphasis on incorporating elements of nature into a space. Flooring materials made from recycled content, renewable resources or low-emission products are in demand as schools seek to reduce their ecological footprint. “We are investing in products that benefit both the occupants and the environment, such as our new ReWorx hybrid flooring made from recycled bottles,” Philadelphia Commercial’s Quathamer said.

Technology integration is increasing, leading to flooring specs that accommodate advanced audio-visual systems, wiring and connectivity. Flexibility is crucial as spaces are used for various purposes, necessitating modular and adaptable options. “Carpet remains in high demand due to its comfort underfoot and enhanced acoustical properties in classrooms,” Shaw’s Collins pointed out.

Hospitality

This sector saw a dramatic post-pandemic recovery in 2022 as leisure travel increased and as more people got more comfortable taking vacations and dining out. Research shows U.S. hotel revenues jumped 44% over 2021 with room-rate growth dominating the gains, according to a report from Cushman and Wakefield, a global real estate services firm. In that same vein, the unemployment rate for leisure and hospitality workers dropped from 6.7% in December 2021 to 5.4% one year later, the Census Bureau reported.

“The hospitality sector is experiencing significant growth as travel resumes and hospitality projects recommence after the pause in renovations caused by the pandemic,” Philadelphia Commercial’s Quathamer told Floor Covering News.

Hospitality, which represented approximately 12% of the commercial market in 2022, consists primarily of the arts, entertainment, recreation, accommodation and food services sectors. Hard surfaces like LVT, hardwood, ceramic and natural stone are frequently used in high-traffic areas such as lobbies, restaurants and bars, offering durability and upscale aesthetics.

“Guest rooms, which have seen an uptick in LVT use due to a perceived ease of care and maintenance, are using rugs to soften a room and offer comfort underfoot, specifically in areas around the bed,” Stanton’s King explained.

However, broadloom is still the dominant floor covering due to cost and aesthetic requirements, experts like Mohawk’s Galloway noted, adding that broadloom is still losing share to carpet tile as well as LVT.

Retail

Retail, which represented about 4% of commercial sales in 2022, has been slow to recover post-pandemic but has improved incrementally. While this sector didn’t break any records last year, flooring demand still grew as businesses welcomed back customers in greater numbers. The turnaround that began in the tail end of 2021 carried over to 2022 as retail sales grew 6.5%, the Commerce Department reported. As stores reopened, special attention was paid to renovating spaces to attract and retain customers.

“Most customers, when they walk into a retail store, want that color, design and pattern impact,” Aladdin’s Myer noted. “You can do that with higher design products that meet performance needs.”

Flooring specs are wide ranging, often depending on budget, aesthetic and functionality needs. For instance, sustainable products such as reclaimed wood or recycled materials align with the focus on environmentally conscious design. LVT, ceramic, laminates and carpet are often found in high-end stores. “Specialty retail uses carpet tile and broadloom equally to meet specific design aesthetic requirements,” Mohawk’s Galloway said.

Resilient flooring continued to be specified in other public areas due to its functionality, color choices and acoustical properties. And let’s not forget about stained concrete in certain applications. “One of the biggest competitors for vinyl flooring is concrete floors, which you are seeing more of nowadays,” said Brian Carson, president and CEO, AHF Products. “Concrete is a bigger disruptor in mass retail than it is in some other categories.”

Ongoing challenges

Despite the rebound across the major end-use segments, by no means is the commercial market fully recovered from the damage caused by the pandemic, industry watchers say. Adapting to challenging circumstances requires careful, strategic planning, cost optimization measures and a focus on operational efficiency to navigate a challenging business environment.

“Sectors such as hospitality and travel may take longer to fully recover while industries like healthcare and technology may continue to thrive,” Philadelphia Commercial’s Quathamer noted. “Additionally, the rise of remote work and hybrid models may influence the demand for office carpeting and flexible workspace solutions.”

Shaw Contract’s Collins said he continues to see opportunities in hospitality, senior living and education settings but the industry remains “challenged in corporate offices in both carpet tile and broadloom due to a slow return to office after the COVID-19 pandemic and the prevalence of hybrid work policies.”

Starnet’s Bischoff attested to the challenges in the office space. “Since the A&D community has not fully returned to the office, our members continue to be frustrated by the lack of access they have to A&D decision makers,” he explained. “They need this access for educational opportunities on product and service solutions that would resolve many details early in planning.”

And let’s not overlook the impact the continuing decline in the labor pool has on the commercial market. “Labor continues to be our biggest challenge, specifically in sheet vinyl and ceramic tile,” Fuse Alliance’s Gordon reported. “In addition, not enough labor in other trades is slowing down projects prior to flooring contractors coming onto the job.”