How crazy have price increases been in the flooring industry? So crazy that earlier this year a flooring retailer placed an order with his distributor for SPC and by the time the dealer received the shipment, several months later, the product had incurred three price increases.

How crazy have price increases been in the flooring industry? So crazy that earlier this year a flooring retailer placed an order with his distributor for SPC and by the time the dealer received the shipment, several months later, the product had incurred three price increases.

Maddening as that sounds, such is the state of the flooring industry today. It is a frustrating time for retailers, especially those with multiple stores and those who do not have the ability to automate pricing. (News flash, suppliers—the vast majority of dealers don’t have the ability to automate their pricing just yet.) Therefore, the frequent price increases have added work to already busy showrooms that are bustling with business, but retailers warn that the rally could soon fizzle if prices continue to move upward.

One saving grace for flooring dealers is that most of their walk-in customers are unfamiliar with the price of flooring since it is such an infrequent purchase and, therefore, are less swayed by the increases. Still, there’s no denying that flooring retailers are at the very least inconvenienced by the uncertainty taking place in the market.

As Marjorie Benson, president of Friendly Floors, Port Charlotte, Fla., explained: “The price increases are definitely causing quite a bit of aggravation. At one point, I told the team to just take all the pricing off everything. We are being very transparent with our clients. As soon as we get finished repricing something, either the price goes up again or the freight charges increase dramatically. That is why I just pulled all pricing.”

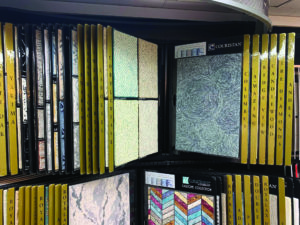

For dealers with multiple stores, like John Taylor, who owns Carpet One Floor & Home stores in Florida as well as a Pro Source, the need to remove pricing has also come into play, as it’s difficult and time consuming to constantly update pricing throughout the system. “We have had to remove much of the pricing off of our floors that were on individual samples and go more to a pricelist on a display simply because it is easier and quicker to print out,” Taylor explained. “We are hopeful that because of the retirement market here people will continue to purchase our products.”

Several dealers said they are looking into automating the pricing function, which would update prices in real time. CCA Global is encouraging its members to take on its new program, which, they say, will pay for itself over time.

Eric Langan, president/owner of Carpetland USA, with nine locations in eastern Iowa and western Illinois, agreed, adding that constant price increases also make it extremely difficult to make/protect margin. “We’ve increased our stocking inventory substantially in attempts to lock in costs on some of our best-selling SKUs,” he said.

For Mike Foulk, president of Foulk’s Flooring America, Meadville, Pa., the growing possibility of having a product increase in price during transit has affected margin and become a hurdle to overcome. “The material, shipping or both has gone up, and the customers want you to honor your quote,” he said. “It is causing a huge hit to our margin. We are offering a lower-cost item if the first choice is beyond the consumers’ budget and/or offering financing to attempt to salvage the sale.”

Adapting to the conditions

Flooring retailers have a knack for adapting to business conditions and making the best of a bad situation. That holds true for price increases; in fact, some retailers say the price hikes are not necessarily a bad thing. Some dealers have used the increases to their advantage, instructing RSAs to persuade shoppers to buy now, lest they pay more by waiting.

“My partners and I have totally switched our mindset around price increases,” said Matt Wein, sales manager for Marshall Carpet One Floor & Home and Rug Gallery, in Mayfield Heights, Ohio. “We look at them as positives and a way to drive more revenue. We adjust our prices on the floor, keep our margins the same and watch the bottom line increase. We have coached our sales team to use the increases as a selling tool to assist in closing customers quicker. Telling customers that their material costs can jump 7%-12% if they don’t buy has a strong impact on their decision to buy.”

What to expect in 2022

Consumer spending—a key driver of the U.S. economy—saw a modest increase in the fall (up 0.6% in September) even as inflation remained stuck at a 30-year high for the fourth month in a row and labor costs in the third quarter rose to their highest level in 20 years. Many executives say inflationary pressures will continue well in 2022, and some flooring observers say this will serve to slow down the red-hot flooring market.

“At this point, unless things ease up with the cost of freight and labor shortages improve, I expect more increases to come over the next few quarters,” said Jon Dauenhauer, co-owner of Carpet World in Bismarck, N.D. “I don’t see the pricing stabilizing anytime soon. We do believe, as the inflationary conditions continue to grow, that we will see some slowdown because of less disposable income. Time will tell. It is not a fun business right now, though.”