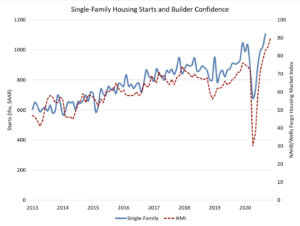

Washington, D.C.—The latest NAHB/Wells Fargo Housing Market Index (HMI) said builder confidence in the market for newly built single-family homes rose one point to 83 in April.

Washington, D.C.—The latest NAHB/Wells Fargo Housing Market Index (HMI) said builder confidence in the market for newly built single-family homes rose one point to 83 in April.

According to the NAHB HMI, strong buyer demand pushed builder confidence up in April even as builders continued to grapple with rising lumber prices and supply chain issues. The NAHB added that consumers faced higher home prices due to a lack of inventory, yet demand still increased.

“Despite strong buyer traffic, builders continue to face challenges to add much needed housing supply to the market,” said Chuck Fowke, NAHB chairman. “The supply chain for residential construction is tight, particularly regarding the cost and availability of lumber, appliances and other building materials. Though builders are seeking to keep home prices affordable in a market in need of more inventory, policymakers must find ways to increase the supply of building materials as the economy runs hot in 2021.”

Robert Dietz, NAHB chief economist, added, “While mortgage interest rates have trended higher since February and home prices continue to outstrip inflation, housing demand appears to be unwavering for now as buyer traffic reached its highest level since November. NAHB’s forecast is for ongoing growth in single-family construction in 2021, albeit at a lower growth rate than realized in 2020.”

Derived from a monthly survey NAHB has been conducting for 35 years, the NAHB/Wells Fargo HMI is designed to gauge builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component in the NAHB HMI survey are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good rather than poor.

According to the HMI index, current sales conditions increased one point to 88 and the gauge charting traffic of prospective buyers posted a three-point gain to 75. The component that measured sales expectations in the six months after that fell two points to 81.

Looking at the three-month moving averages of regional HMI scores, the Northeast rose six points to 86 and the South moved up one point to 83. The West held steady at 90 and the Midwest fell two points to 78, according to the NAHB.