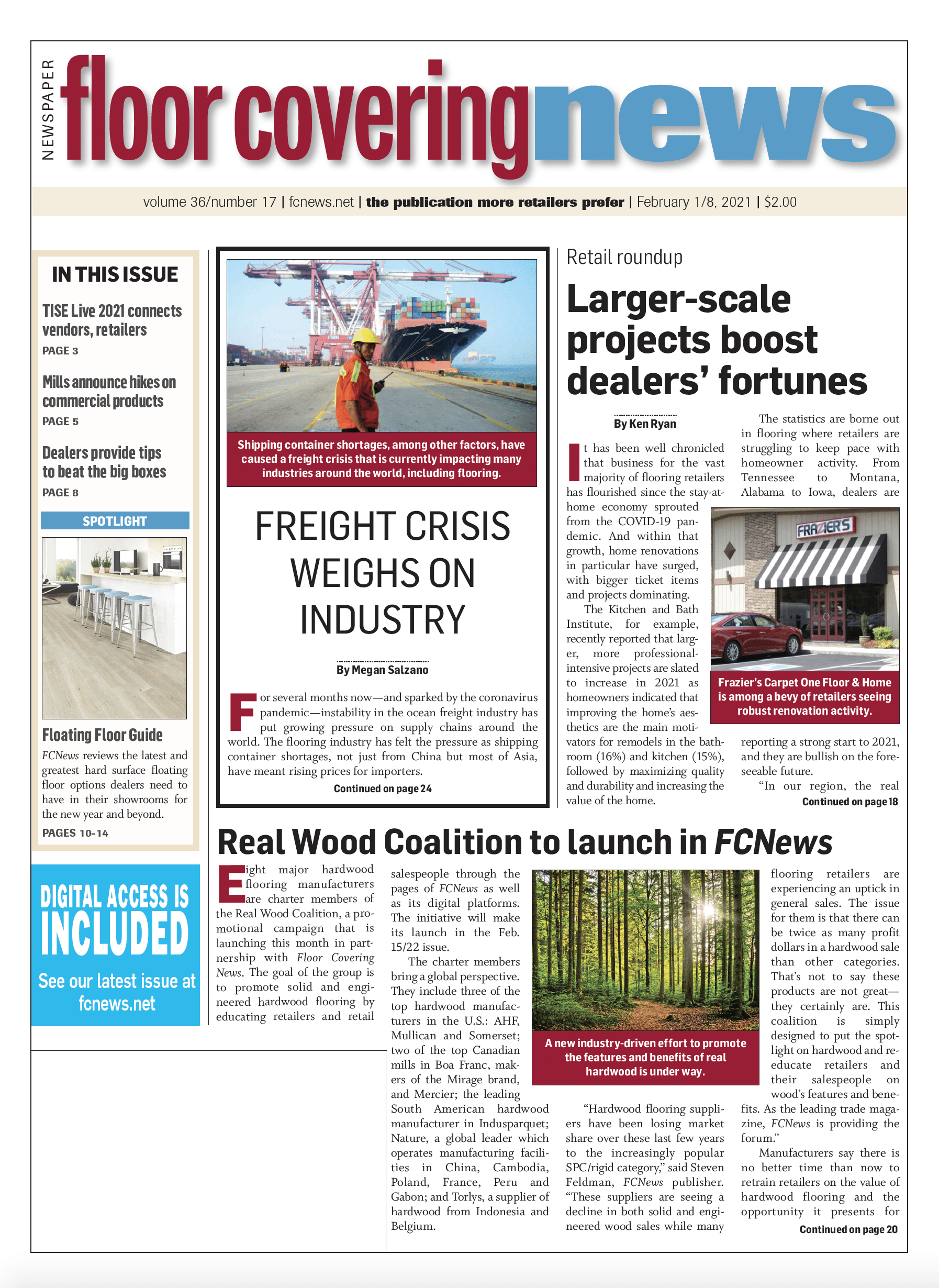

By Megan Salzano For several months now—and sparked by the coronavirus pandemic—instability in the ocean freight industry has put growing pressure on supply chains around the world. The flooring industry has felt the pressure as shipping container shortages, not just from China but most of Asia, have caused an ongoing freight crisis and rising prices for importers and their customers.

Flooring suppliers told FCNews they have seen as much as 400% increases in shipping container prices over the last six months. Add to that several other factors, including rising raw material prices, a depreciation of the U.S. dollar vs. the Chinese Yuan, domestic trucking shortages and increased consumer demand for flooring, and the industry has what suppliers and distributors call an unprecedented crisis.

“The current inability to ship material via ocean freight has created supply disruptions that have not been seen in the 21st century,” explained Richard Quinlan, vice president of sales, Wellmade. “Increased consumer demand, reductions in available shipping vessels, shortages of shipping containers and delays at ports have all combined to create crisis in which the ability to load and ship products within normal expectations no longer exists.”

Suppliers agree the price hikes began about six months ago when the typical cost for a container was about $1,200. Now, suppliers say they are paying anywhere between $6K to $9K. “On particular routes, we are paying 300% to 400% more than what we were paying several months ago,” said Rup Shah, president, MSI, which supplies both natural tile and luxury vinyl products. “While we are accustomed to fluctuating costs for ocean freight based on supply/demand, we have never seen anything even close to what we are experiencing right now. Typically, these periods of congestion only last 30-60 days. Unfortunately, this situation has been going on since early October, and progressively worsened. We appear to be in a sustained period of turmoil with no relief in sight.”

Shah also noted that it’s not just the costs of the containers that are causing issues, but a cascading effect of other related factors. “Despite paying these rates, availability of bookings is limited, containers are being delayed at transshipment ports and U.S. ports are heavily congested.”

Other suppliers agreed that price hikes are not the only challenge. Rotem Eylor, founder and CEO of Republic Floor, noted a domino effect that has caused an unheard-of bidding war. “Today, when it comes to ocean freight, whichever company bids the highest price gets the container,” he explained. “There are so many containers that didn’t ship for 10-14 days because they gave priority to those that were paying more. If the highest price I can pay is $6K but a company like Walmart is willing to pay $7K, Walmart is taking the spot. So, it’s not only a problem of price but of priority and inventory.”

For Republic, foresight has been able to mitigate some of the challenges. “Republic made a contract [just before the crisis hit] directly with some of the shipping lines. It’s a yearly agreement to give them ‘X’ amount of containers a year and we get priority. It didn’t lock us in price, but it locked us in priority.”

For most suppliers, the exponential rising costs and subsequent challenges have caused a need to raise their own prices. On both the residential and commercial sides of the business, flooring suppliers have raised prices anywhere between 4% and 10% on products like hardwood and resilient flooring. Some companies have even announced multiple price increases in the last several months due to ongoing turmoil in the supply chain.

Some suppliers have noted that they’ve absorbed at least some of the costs themselves and are working to mitigate ongoing challenges. “We have absorbed much of this for some time; however, we did have to announce a small increase to our shipping surcharge, effective March 1,” said Noah Fulton, vice president of business strategy, Karndean Designflooring. “We will continue to leverage strong inventory levels across our three U.S. distribution centers, and work within our own supply chain to ride out the current situation and mitigate the impact on our customers. Fortunately, we have strong logistics partners to assist us in these situations.”

Some suppliers also noted a silver lining: consumers aren’t always privy to the rising costs of flooring as it’s often purchased years apart. “The industry thought the tariffs were going to cause sales to slow down and businesses to die out, but nothing happened—business went up,” Republic’s Eylor said. “If I were to be the only one in the market raising prices, that would be a problem. But it’s raining all over. And not just the U.S., but across the world. It’s frustrating, and not only for retailers but for us as well. They understand. It’s something that everybody has to deal with. And at the end of the day, consumers pay what they have to pay.”

Distributors weighs in

Flooring manufacturers are not the only link in the supply chain struggling to deal with the crisis. Distributors across the country have also noted hardship. “We are seeing delays of three to four weeks on all of our shipments because of the impact of these unusual circumstances,” said Jeff. Hamar, executive chairman, Galleher, LLC, Sante Fe Springs, Calif.

Allen Gage, president, Tri-West Ltd., Santa Fe Springs, Calif., said the company has received price increases from many of its suppliers, which take time and money to implement. In addition, delays aren’t always met with updated lead times. “Not only are the shipments being delayed, but in many cases we can’t get answers as to when they will arrive,” he told FCNews. “Of course, not having accurate dates for our customers creates havoc for them and us.”

Distributors remain hopeful, however, and many have put strategies in place to help ease the burden. “In response, we’re doing our best to communicate with customers and vendors regarding revised lead times as well as any options that might exist to improve service,” said Scott Rozmus, CEO, FlorStar Sales, Romeoville, Ill. “Honestly, it’s a tough situation right now. Fortunately, we are blessed with supplier relationships that provide access to global sourcing options, so we oftentimes have options we can offer a client.”

Anne Funsten, president, B.R. Funsten, Manteca, Calif., said her company has developed contingency plans, both internally and externally. “We made a purposeful decision two years ago to explore new countries of origin, factories and shipping lanes to increase our flexibility as a company,” she explained. “These efforts are reducing our overall exposure as we navigate through these times.”

For Jeff Striegel, president, Elias Wilf, Owings Mills, Md., solutions lie within. “Since it appears nothing can impede the continued growth and activity within LVT, the real solution lies with increasing the manufacturing of the category within the USA,” he said.

Galleher’s Hamar said he is hopeful the industry will begin to see improvement by the second quarter of this year. “While not anticipating the current shipping conundrum, we did anticipate that high inventory levels would be a competitive advantage in 2021,” he added. “We never slowed down our purchasing activities last spring and summer and therefore are in a better position to handle the current situation. If it’s any comfort, the problem is impacting virtually every business vertical and industry that depends on the global movement of product.”