This article was originally featured by the National Association of Home Builders.

Washington, D.C.—In the wake of the COVID-19 pandemic, certain patterns and trends have begun to emerge in the housing industry—in particular, higher demand for housing in lower-density areas. How much of these trends, though, are actually a change in demand or behavior, or just a continuation of existing trends that may have been accelerated through COVID-19?

Washington, D.C.—In the wake of the COVID-19 pandemic, certain patterns and trends have begun to emerge in the housing industry—in particular, higher demand for housing in lower-density areas. How much of these trends, though, are actually a change in demand or behavior, or just a continuation of existing trends that may have been accelerated through COVID-19?

“When we think about the conversation around suburban and urban development, it’s really thinking about the extent the trends are on the curve, or if this is really a shift,” moderator Richard Gollis observed during NAHB’s recent The Future of Urban and Suburban Housing in the Wake of COVID-19 webinar. Gollis was join by panelists from NAHB, CoStar, Zillow and Toll Brothers Apartment Living, who presented information from various segments of the industry to highlight growing trends.

According to NAHB chief economist, Robert Dietz, increased construction activity in lower-density markets was already occurring as part of the housing affordability crisis, with the COVID-19-related shift to telecommuting accelerating the trend as people have more flexibility to live outside of large metro areas. Supply can respond better in lower-density areas as well because of the lower cost to build, he said, and may affect the size and design of single-family homes and types of multi-family projects being built in these areas as well.

The same can be said for demand for multi-family rentals, according to John Affleck, vice president of market analytics at CoStar. Supply and demand have geared toward the suburban markets—a trend already in progress pre-COVID-19—with suburban multi-family products comprising all the rental demand in the second quarter of 2020.

This has impacted rents, as historically expensive markets such as San Francisco, San Jose, Seattle and Boston have seen double-digit decreases in asking rents since their March peak. Meanwhile, smaller suburbs and cities such as Inland Empire, Calif. (a bedroom community of Los Angeles), Norfolk and Richmond, Va., and Memphis, Tenn., have seen rents increase between 3.6% to 5.3%.

Not every suburb is the same, though, noted Charles Elliott, president of Toll Brothers Apartment Living—both in terms of performance as well as mindset. “The meaning of suburbs is very relative to people,” he stated, providing Toll Brothers’ success in the urban core of New Jersey, which can be considered a suburb of New York City, as an example.

Elliott predicted the urban and walkable suburban markets will come back strong because of rising interest among Gen Z, and also noted increased interest in second homes as a result of the increased flexibility of working from home.

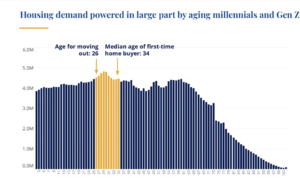

Gen Z and millennials are key drivers in the real estate market, observed Svenja Gudell, chief economist for Zillow Group, as many millennials are reaching or have reached 34—the median age of first-time home buyers. Those with the means to buy are facing an increasingly competitive market, however; although interested home buyers have been active, sellers have been apprehensive to put their properties on the market, leading to tight inventory and quick sales. Low interest rates are helping buyers, she added, but they aren’t going to make up for the extremely high prices.

Other trends to watch include the size of single-family homes, which had been on a decline, but is likely to increase as people look to expand their available space. Flexible design will play a key role in that as well. Higher unemployment rates among younger age groups is also likely to have a lasting impact on the rental market, with an increased number of young adults moving back in with their parents as a result.