By Ken Ryan

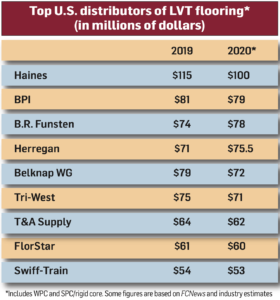

The SPC/rigid core subsegment of the LVT category continued to grow by double digits for distributors in 2020 as a percentage of overall business, and in a few cases now represents 50% or more of some businesses. This trend is expected to continue for the next year.

“Retail sales associates typically push products that they want to sell, and LVT is what they want to sell as there is an absolute love affair going on with the LVT category,” said Jeff Striegel, president of Elias Wilf, Owings Mills, Md. “If you take an RSA who believes in something and stakes his claim on it, he is going to be enthusiastic in what he sells. The RSA thinks it’s the single best product on the floor, and a couple more dimes is not going to change it.”

The caveat with this explosive category, some distributors say, is that with increased competition comes pricing pressures that ultimately lead to margins being squeezed. As Keith Slobodien, president of Apollo Distributing, Fairfield, N.J., explained, “Our industry has a history of letting price dictate the market. For as long as I can remember, every time we take a leap forward with product technology, we end up driving down the price points. Ultimately, we allow the product to become driven by price point instead of value proposition. It happened with Stainmaster carpet and laminate flooring, and it is happening now with LVT.”

The LVT segment, led by SPC/rigid core, has taken share from every other product, most notably wood. Indeed, distributors say wood is under siege from other categories. “And it’s not just wood vs. LVT; it literally is wood vs. everything else,” Striegel said. “While you still have customers who want wood, they could just as easily be sold laminate that someone is calling wood.”

However, hardwood still remains an important product for distributors. A case in point is Galleher, whose wood business represents between 65%-70% of its overall mix while LVT accounts for roughly 15% of sales.

Hardwood also continues to flourish at Manteca, Calif.-based B.R. Funsten, where higher-end brands and looks are selling briskly. Likewise, the hardwood and laminate segments at Glen Burnie, Md.-based J.J.Haines each emerged stronger after COVID- 19, according to Hoy Lanning, CEO. “The laminate business has actually grown, and the wood business is coming back,” he said.

The reality, though, is this is an LVT industry until further notice. “While hardwood and laminate aren’t going away, they have certainly taken a hit,” said Jud Hurt, president of Cincinnati- based Ohio Valley Flooring. “The LVT segment shows no signs of slowing down. However, I do think hardwood and laminate have stabilized and there is a place for high-quality hardwood and laminate in this business.”