By Reginald Tucker

Amid the lingering impacts of COVID-19, strained oil prices and staggering unemployment, there are some encouraging silver linings. That’s according to statistics and analysis provided by ITR Economics, an economic research firm known for its uncannily accurate predictions and timely forecasts.

In its most recent webinar titled “Recovery and Eventual Growth vs. Depression,” the tag-team twin-brother tandem of Brian Beaulieu, CEO and chief economist of ITR Economics, and Alan Beaulieu, the firm’s president, delved into both recent and forward-looking data to discern where we are going and what the near-term indications are for the economy. Following are excerpts of that presentation.

Leading indicators looking up

ITR Economics typically bases its forecasts on a list of a dozen key leading economic indicators that reflect everything from single-family housing starts and total U.S. exports to manufacturing industry capacity utilization and purchasing indices, among others. Just last month, many of these indicators were in the “red.” However, as of late July, eight of the 12 telltale economic indicators have flipped green (see table).

ITR Economics typically bases its forecasts on a list of a dozen key leading economic indicators that reflect everything from single-family housing starts and total U.S. exports to manufacturing industry capacity utilization and purchasing indices, among others. Just last month, many of these indicators were in the “red.” However, as of late July, eight of the 12 telltale economic indicators have flipped green (see table).

“This is very exciting news,” said Alan Beaulieu, citing the freight and real estate recovery indices in particular. “Anything over five positive indicators fills us with confidence.”

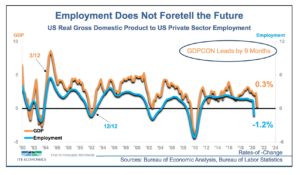

Another metric that’s providing encouraging signs is gross domestic product (GDP) in relation to employment (see table). Historically, employment lags behind GDP, which is forecast to rebound. While anyone would be hard pressed to find anything encouraging at all in the current unemployment numbers, the way GDP is expected to trend means employment is not too far behind.

As Brian Beaulieu explained: “GDP leads employment by nine months, so when you try to forecast the future by saying employment today is at minus 1.2%, that’s not helping you forecast the future. When you’re looking at the unemployment numbers in the Wall Street Journal, it doesn’t necessarily mean the economy is going to be tanking as we go into the future. You forecast the future by looking at leading indicators and what really drives GDP. That enables you to forecast employment, which is a lagging indicator behind GDP.”

As Brian Beaulieu explained: “GDP leads employment by nine months, so when you try to forecast the future by saying employment today is at minus 1.2%, that’s not helping you forecast the future. When you’re looking at the unemployment numbers in the Wall Street Journal, it doesn’t necessarily mean the economy is going to be tanking as we go into the future. You forecast the future by looking at leading indicators and what really drives GDP. That enables you to forecast employment, which is a lagging indicator behind GDP.”

ITR Economics’ optimism surrounding the unemployment forecast is primarily due to the nature of the cause of the current downturn. “We’re recovering from a natural disaster, not from a systemic economic failure,” Brian explained. “And when we look at it this way, that helps prove the case because the economy wants to get going. It’s just a matter of the government taking the shackles off and letting it happen.”

The upside, he said, is the economy is not fundamentally broken. The downturn was “self-inflicted” out of an abundance of caution to protect the population. “We’re maintaining our position that this is a natural disaster that has had economic consequences,” Brian added. “This is fundamentally different than that Great Recession, which was purely a gross imbalance within the economy.”

ITR Economics is so encouraged by the trends it is seeing that the firm said it is rethinking its 2019 predictions that a recession was imminent in the next four years. “We have found more evidence to lead us to think that we were correct in taking the 2023 recession off the table,” Brian said. “The evidence is mounting that once we start this rebound, there is going to be this halo effect that will carry us through 2022 and 2023. Yes, we’re in a nasty, two-quarter decline, but we’re sticking with—based on everything that we’re seeing— our analysis that GDPs low is 2Q 20, and we start climbing our way out of this hole from that point on.”

Positive movement in retail sales trends

The measured reopening of retail establishments around the country, combined with an acceleration in e-commerce activity, is giving retail a much-needed shot in the arm. Many ITR clients report that while May was not stellar by any means, it was certainly better than April. Likewise, clients report June was a “pretty good month,” Alan said. (See June retail sales.)

The measured reopening of retail establishments around the country, combined with an acceleration in e-commerce activity, is giving retail a much-needed shot in the arm. Many ITR clients report that while May was not stellar by any means, it was certainly better than April. Likewise, clients report June was a “pretty good month,” Alan said. (See June retail sales.)

The COVID-19 pandemic has also accelerated a trend that has already become evident in recent years—the move to greater online purchasing. “Brick and mortar is clearly losing ground to e-commerce, and that’s clearly been accelerated because of the coronavirus,” Alan said. “This pandemic has forced a lot of people into the e-commerce space necessarily. It’s not a new phenomenon; it’s just an acceleration of what was going on before.”

And that’s a key business takeaway. “A lot of businesses have been slow to adopt,” Alan said. “They’ve been kind of pushed into going into it, dragging their feet, not wanting to spend the money, not wanting to do it. This is no longer an option going forward in business; you have to do this unless you’re just phasing your business out and riding into the end.”

Consumer expenditures on recreation

In gauging economic trends, ITR Economics also uses sales of motorcycles, boats and ATVs as a barometer. As consumers spend less money on international vacation travel, they are looking for ways to enjoy more of their time off closer to home. And that’s reflected in the kinds of purchases they are making.

“You’re seeing it in rising sales of motorcycles, boats and ATVs,” Brian said. “Retail sales have bounced back rather nicely because consumers have had the wherewithal to do that. We’re home more, so we’re going to looking for more ways to entertain ourselves locally.”

That won’t likely include participation in professional sports, however. With a handful of pro sports resuming activity (i.e., hockey, basketball, baseball and, potentially, football), there won’t be any fans in the stadium to consume tickets, cold beers, hot dogs and pretzels. More importantly, the lack of stadium personnel as well as other jobs supporting those venues negatively impacts local economies and ancillary businesses.

“The world’s appetite for sports right now has changed, and this is an industry that’s essentially ruined for the rest of this year,” Brian said. “I can’t envision a world where we’re anxious to sit side-by-side in stadiums, whether it’s a collegiate game, or an indoor high school game or a professional sporting event. We’re going to need to recover from this psychologically more than physically before we go back to being on trend.”

Despite the harsh health realities people are dealing with during the pandemic, ITR Economics said it won’t necessarily put a drag on spending or the economy as a whole. “We’ve seen a nice recovery from the calamity of the Great Recession, and we don’t see that stopping,” Brian said. “When you look at interest rates, inventories and how people want to buy, they actually have the means to buy what they want. True, credit conditions have tightened up a little bit, but people’s financial status is relatively healthy. This is a trend that we can count on to continue.”