June 24/July 1, 2019: Volume 35, Issue 1

By K.J. Quinn

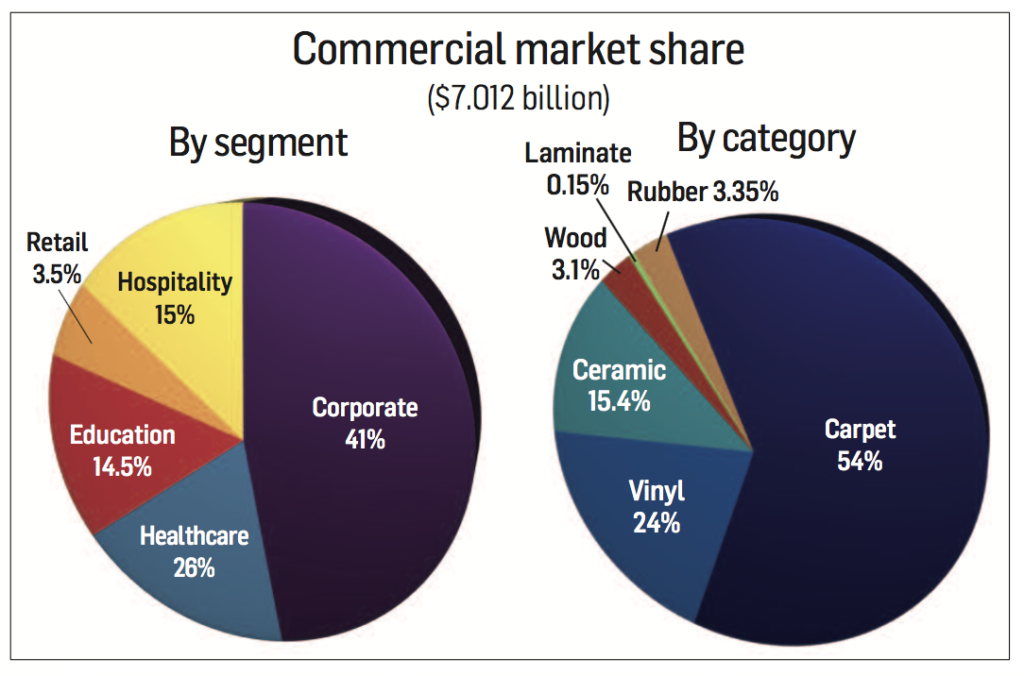

An uptick in activity in key end-use sectors—namely corporate, hospitality, healthcare and education—drove the bulk of commercial flooring specifications in 2018. FCNews research shows total specified commercial flooring sales grew to $7.012 billion in 2018, a 5.9% increase over 2017.

An uptick in activity in key end-use sectors—namely corporate, hospitality, healthcare and education—drove the bulk of commercial flooring specifications in 2018. FCNews research shows total specified commercial flooring sales grew to $7.012 billion in 2018, a 5.9% increase over 2017.

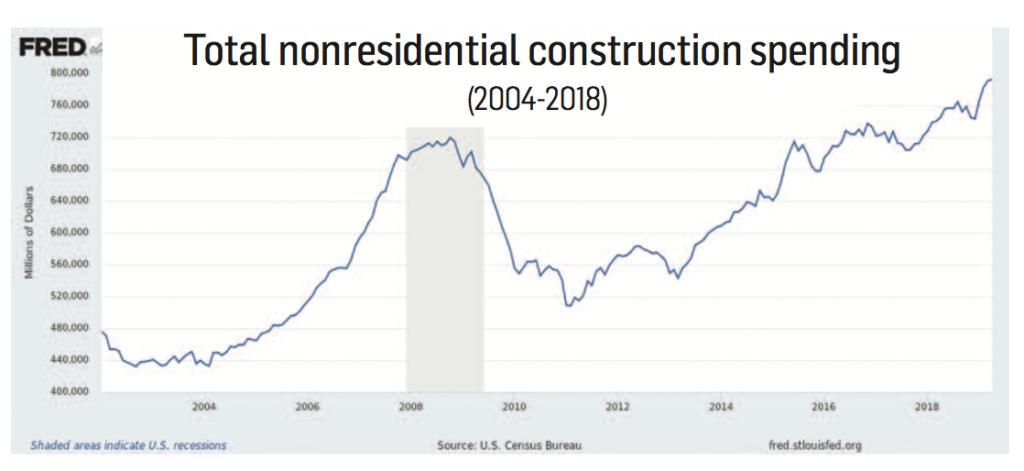

“History will view 2018 as a solid year for nonresidential construction spending in America,” said Anirban Basu, chief economist with Associated Builders and Contractors. “Both private and public segments experienced growth in construction spending last year.”

The growth of the commercial market is heavily attributed to stronger demand for hard surfaces—specifically LVT—which have entered practically every commercial sector. “Resilient flooring, particularly LVT, is growing across virtually all commercial channels, as hard surfaces are seen more and more often in spaces that used to feature carpet,” observed Deb Lechner, vice president, marketing, Armstrong Flooring. “This is true from offices to hotel rooms.”

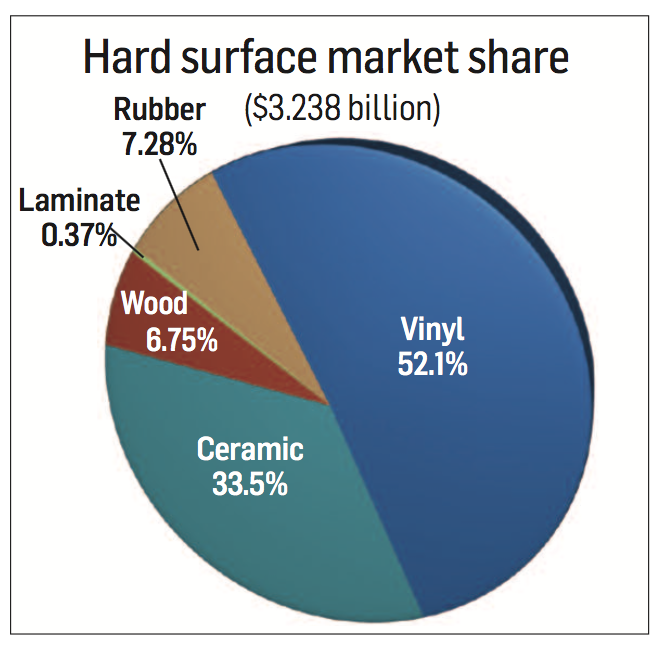

Hard surfaces’ versatility is a major factor in the commercial segment’s performance last year. FCNews statistics showed hard goods generated just over $3.2 billion in sales for 2018, a 15% increase over 2017. No surprise that resilient accounted for the bulk of that growth, representing about 52% of commercial hard surface consumption.

“We’re continuing to see an influx of competition within LVT, especially given the rapid growth of the rigid core category,” said Katherine Caringola, communications manager, Karndean Designflooring. “As a result, there appears to be higher market investment in floating floor options, especially rigid core/WPC.”

LVT is the headliner of resilient, posting double-digit sales growth and expanding its usage across all segments, the majority in specified contract. “Technological developments may also allow the floor to go into new spaces and take on other flooring categories inside the hard surface market,” said John Szilagyi, manager-market intelligence, Tarkett North America. “With the modularity of design that has accompanied LVT and new core technologies, there should be no end to the combinations that end users and A&D firms can leverage into new spaces.”

Not all hard surface categories fared as well as LVT. FCNews research found several major products such as VCT, sheet goods, hardwood and laminates experienced low- to mid-single digit declines in volume and sales last year. Rubber and linoleum sales and volume held steady, as they are positioned as healthy flooring choices, especially in healthcare and education.

One hard surface that sustained growth despite competition from LVT is ceramic tile. While statistics are hard to pin down due to fragmented distribution channels, tile sales experienced a low single-digit increase to $1.086 billion according to FCNews research. “We have seen the growth of LVT due to lower installation costs and faster installation costs,” observed Raj Shah, president, MSI. “We believe that finding ways of keeping ceramic tile’s value [proposition] is important in its long-term growth.”

Despite its high price tag, tile is positioned as the most formidable hard surface alternative to LVT. An estimated two-thirds to 70% of ceramic’s commercial sales come from specified contract and half the volume.

“The greatest impact on the ceramic commercial market is the continued development of segments that use a lot of tile in their structures, such as healthcare, hospitality and education,” said Gianni Mattioli, executive vice president, Dal-Tile.

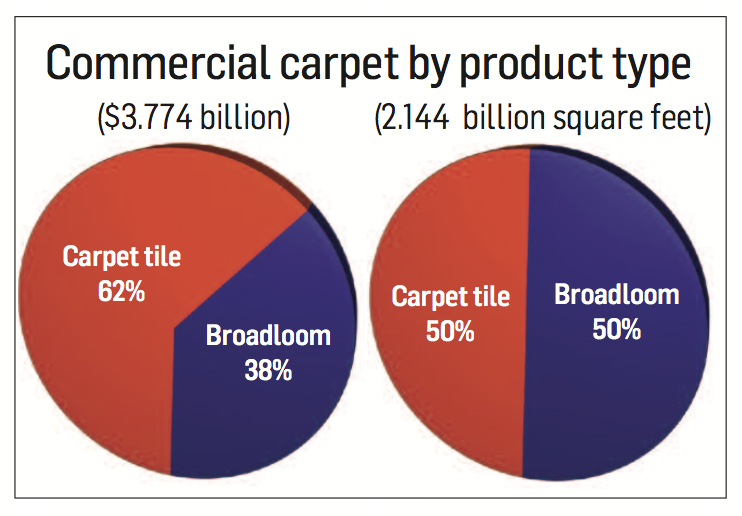

Meanwhile, soft surfaces showed a slight decrease of 0.8% from $3.805 billion in 2017 to $3.774 billion in 2018. Approximately 75% to 80% of carpet sales and 65% to 70% of volume were generated from specified contract while the remainder came from the Main Street commercial sector, research shows.

Within the segment, carpet tile boosted its position as the top soft surface, representing about half of sales and more than 60% of volume, according to FCNews research. The subcategory maintained nearly double-digit increases in both areas, while broadloom’s presence in commercial spaces continued to dwindle—even in the bedrock hospitality sector. “The main reason why people buy tile is it works in any segment,” Mike Gallman, president, Mohawk Group, explained. “People know how to use it from a design standpoint.”

Within the segment, carpet tile boosted its position as the top soft surface, representing about half of sales and more than 60% of volume, according to FCNews research. The subcategory maintained nearly double-digit increases in both areas, while broadloom’s presence in commercial spaces continued to dwindle—even in the bedrock hospitality sector. “The main reason why people buy tile is it works in any segment,” Mike Gallman, president, Mohawk Group, explained. “People know how to use it from a design standpoint.”

The largest sector remains corporate/offices, representing roughly 40% of commercial flooring sales. Although key economic indicators such as new construction, asking rents per square foot and leasing activity point in the right direction, major design trends taking hold are reportedly influencing flooring choices.

“As more employees put in more hours at work, many offices are beginning to offer unique amenities to make employees feel relaxed, comfortable and happy,” said Kerri Convery, a spokesperson for Parterre Flooring Systems. “Current trends in office design focus on improving both the functionality and aesthetics of a space, and we expect that pattern will continue.”

The workplace is among the most diverse segments in terms of flooring selections. Among the key factors impacting specs are functional and design needs of the space. Carpet tile is the most popular choice, representing close to 60% share.

“The ‘resimercial’ trend of creating offices that feel more like home lends itself to innovative uses of carpet tile, both in terms of design and texture,” said Matt Miller, president, Interface Americas. “Designers are often looking for more of a homey feel than before.”

Armstrong’s Lechner agreed, noting, “LVT and rigid core illustrate a blurring of lines between products that are considered strictly residential or commercial. These products are increasingly gaining traction in commercial environments, bringing authentic wood looks to spaces, along with the durability to maintain their beauty even under high traffic, high moisture and high impact.”

Hard surfaces such as resilient, hardwood, porcelain tile and polished concrete are preferred for areas where fashion and functionality are required. LVT is gaining ground in reception areas, workrooms, kitchens, dining areas. “We are seeing a trend toward more hospitality-like finishes, including LVT or laminate flooring, polished concrete, specialty decorative tile—all items to bring personality and warmth to the previously sterile workplace,” stated Alana Lopez, RA, NCIDQ, LEED AP, director, hospitality and workplace studio at Stantec.

Still, broadloom remains a favorite in speculative workspaces or “market-ready” offices looking for cost-effective upfront investments. “You see broadloom in high-end areas such as conference rooms,” said Jeanette Himes, Mohawk’s creative design director for workplace. “Sometimes it’s in offices adjacent to open areas where you might use tile and, of course, on stairs.”

HospitalityThe hotel/lodging sector is one of the fastest growing markets, due to economic growth that’s driving more business and leisure travel, experts say. Designers and hotel proprietors are seeking to create a higher-end environment than their guests live in at home. “Hotel design seeks to help guests feel at home,” said Kim Drautz, director of segment strategy, hospitality and senior living, Tarkett North America. “As we’ve been shifting our residential interiors to have more hard- surface flooring than carpet, the hospitality industry is following suit.”

An increasing number of major hotel chains are specifying LVT for its good looks, durability, acoustic and hygienic qualities. “LVT feels cleaner to the everyday traveler because it gives them peace of mind knowing they can clean it themselves,” said Doug Detiveaux, interior designer, associate, at Gensler’s Houston office. However, not all hotel owners are onboard with using LVT, due to its higher initial cost and potential for longer cleaning times, he added.

An increasing number of major hotel chains are specifying LVT for its good looks, durability, acoustic and hygienic qualities. “LVT feels cleaner to the everyday traveler because it gives them peace of mind knowing they can clean it themselves,” said Doug Detiveaux, interior designer, associate, at Gensler’s Houston office. However, not all hotel owners are onboard with using LVT, due to its higher initial cost and potential for longer cleaning times, he added.

Carpet is not expected to be phased out completely, as there will always be people who prefer the plush feel underfoot after waking up in their guest room. “A trend in the healthcare market is to use carpet tile to create an accent rug inset into a hard surface product,” noted Brenda Knowles, vice president of commercial marketing and product development, Shaw Industries.

Performance, style and sustainability needs are impacting flooring selections and driving demand for new hard surface options. For instance, large-format porcelain tile is reportedly viewed by hospitality designers as a cost-effective alternative to ceramic or marble floors and coveted for aesthetic qualities and resistance to staining and chipping. Polished concrete is gaining popularity in commercial spaces, offering a different twist to products specified in contemporary design.

“Hotel lobbies, guest rooms, schools, grocery stores, etc., have all used concrete,” explained Curt Thompson, president and CEO, Aggretex Systems. “The trend now is to start to blend seamlessly the exterior concrete, which is becoming more and more decorative, with the interior concrete.”

RetailSimilar to hospitality, the retail business is undergoing a makeover to attract more foot traffic and distinguish locations from competitors. Online shopping continues to reduce the number of brick-and-mortar stores. What’s more, it contributed to the decline in retail store sales last year, according to recent studies. “While the retail segment has been a little softer than expected, we are seeing positive signs in key areas,” Dal-Tile’s Mattioli said. “Car dealerships and fitness centers, as well as quick-service restaurants, are areas of growth that are positively impacting the tile market.”

Retailers are redesigning their stores to create inviting and comfortable shopping environments that appeal to all customers. Flooring selections run the gamut, often depending on the end use. Ceramic, wood and carpet tile are often specified in high-end retail spaces while resilient, VCT and rubber flooring are found in other public areas.

“We have an opportunity to continue to take share from broadloom in retail and hospitality as designers recognize the performance, maintenance and flexibility benefits of carpet tile in other segments—coupled with technology advancements in carpet tile design,” Interface’s Miller said.

No surprise that LVT is a popular choice among commercial specifiers in a segment renown for staying on top of interior design trends. “Retail has dramatically shifted to hard surfaces, with the advent of LVT and more younger shoppers,” Mohawk’s Gallman observed. Hard surfaces accounts for nearly 25% of commercial flooring sold to the sector, FCNews research shows.

HealthcareRenovation and new construction are reshaping healthcare to accommodate the needs of an aging U.S. population. Designers are paying close attention to specific criteria for meeting safety and sanitary requirements. According to FCNews research, the segment saw a slight uptick in flooring sales in 2018 with much of the growth coming from hard surfaces.

“In 2018 we saw growth in the healthcare segment, specifically clinics, assisted-living communities and urgent care centers,” Dal-Tile’s Mattioli said. “This segment is anticipated to continue to soar, particularly due to the shortage of spaces available to care for the currently aging population and the high usage of tile in healthcare buildings.” The channel accounts for roughly 12% of the commercial hard surface market.

Natural materials such as ceramic tile, hardwood, rubber and linoleum are considered sustainable options. Rubber sheet, vinyl and linoleum are the mainstay in areas that require high sanitary levels. Carpet, rubber, luxury vinyl and vinyl composition tiles have found their way into non-critical areas such as corridors,  medical, patient and waiting rooms.

medical, patient and waiting rooms.

Infection control is a major area of emphasis and concern as hospital-acquired infections can be both deadly and costly. Homogenous resilient floors are preferred in surgical suites, where infection control and quick turnaround of the room is paramount while other spaces. “[Healthcare] continues to be a strong market for vinyl sheet due to the ability to heat weld and flash cove the flooring for a seam-free surface that is easier to keep clean and hygienic,” Armstrong’s Lechner said.

EducationSimilar to healthcare, there is a good amount of remodeling taking place in education, according to published reports. The amount of flooring sold is aided, in part, by increases in state and local government tax revenues and private schools investing in remodeling to attract high school and graduate students. “College and university endowment investment returns grew in 2018, which also helps to support construction spending,” Lechner observed.

K-12 represents the lion’s share of the education sector, accounting for approximately 75% of flooring sales, with the remainder generated from colleges/universities, according to FCNews research. The driving force impacting interior design within K-12 schools is the notion of the active learning classroom, experts say.

Performance, health and safety requirements are also important selection criteria, as flooring needs are changing to support new learning environments. For example, schools are looking for ways to optimize their learning environments to have the right sounds and acoustics, avoiding vibration issues. Materials such as flooring must meet stringent criteria for issues such as indoor air quality, sustainability and maintenance.

“University systems as well as high schools are looking at having a better teaching and educational space,” said Rives Taylor, director of design resilience, Gensler.

An estimated 50% to 60% of the business is hard surfaces, as its versatility enables it to be found in virtually all learning environments. LVT is the leading resilient product utilized across the board, FCNews research found. The latest WPC products offer color and design flexibility which enable designers to apply numerous looks into learning environments.

As awareness around the maintenance and lifetime cost of owning floors grows, school officials are seeing the budget-friendly benefits of investing in quality products, according to industry executives. Premium materials such as ceramic and porcelain tile, terrazzo, rubber and linoleum are often utilized in high-traffic areas on campus such as corridors, lobbies, retail stores and restaurants.

Education is the second-largest commercial segment for carpet, representing approximately 30% of sales. However, broadloom is limited to small areas, such as stairs. “Education has the second highest penetration rate of carpet tile,” Interface’s Miller explained.

OutlookLeading indicators such as ABC’s Construction Backlog Indicator and Construction Confidence Index strongly suggest that 2019 will be another year of nonresidential construction spending growth in the United States. “There are many variables to watch, including interest rates, worsening skilled worker shortages, rapidly rising construction compensation costs and the U.S. economy’s broader trajectory in the context of a slowing global economy,” Basu stated. “Rapid job growth should boost demand for office and commercial space. Healthier state and local government finances should help fuel additional spending across multiple categories.”