June 24/July 1, 2019: Volume 35, Issue 1

By Ken Ryan

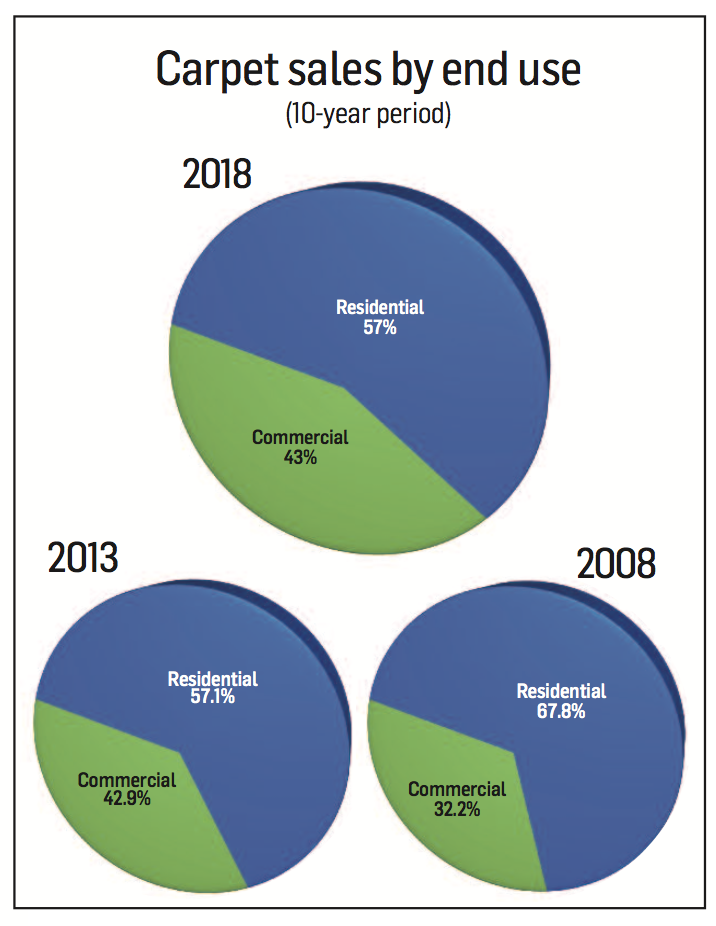

Constrained by multiple interest rate hikes, carpet price increases and the continued onslaught of the LVT segment, the carpet industry experienced deficits across residential sales/volume and commercial sales/volume in 2018, marking the first time since 2010 that the segment finished in the red in sales and volume.

Constrained by multiple interest rate hikes, carpet price increases and the continued onslaught of the LVT segment, the carpet industry experienced deficits across residential sales/volume and commercial sales/volume in 2018, marking the first time since 2010 that the segment finished in the red in sales and volume.

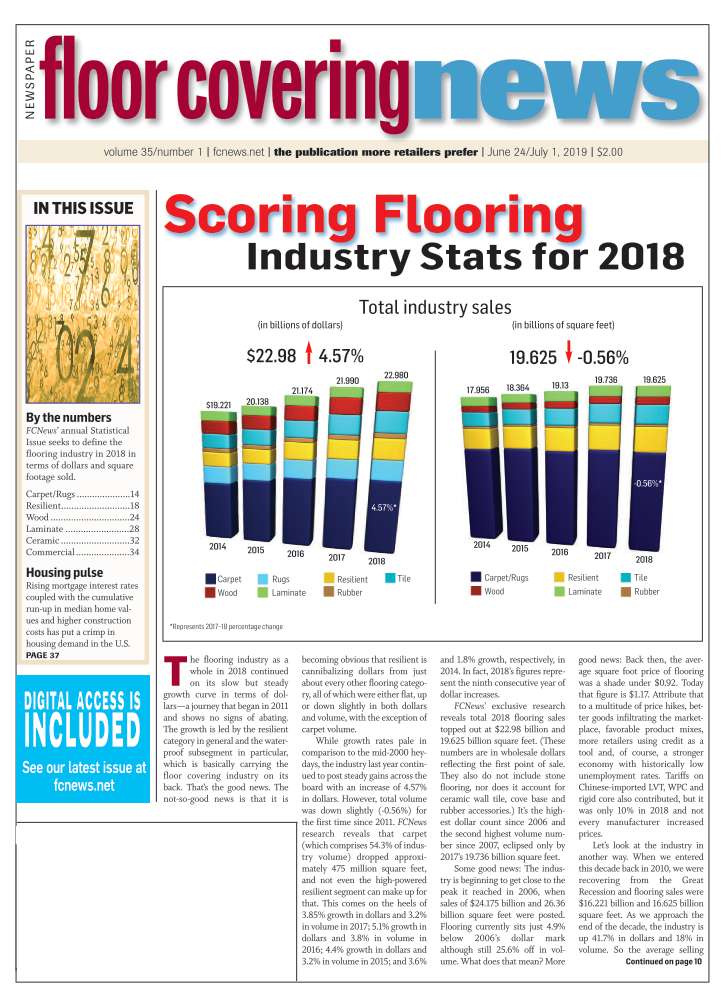

FCNews research showed overall carpet sales fell 0.5% in 2018 to $8.785 billion, while volume (including rugs) fell 4.2% to 10.75 billion units. Residential was down 0.2% in sales and 4.1% in volume. Rug sales, which has been the fair-headed child in the soft surface category in recent years, increased 2.3% to $2.591 billion, buoyed by the growth of hard surfaces and online sales. It was the sixth consecutive year of increases for rugs.

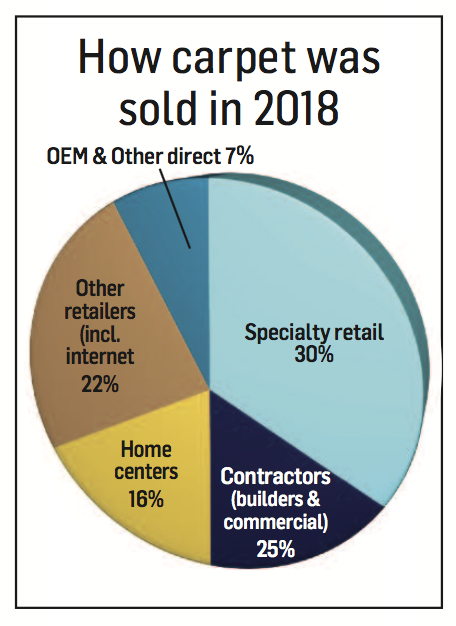

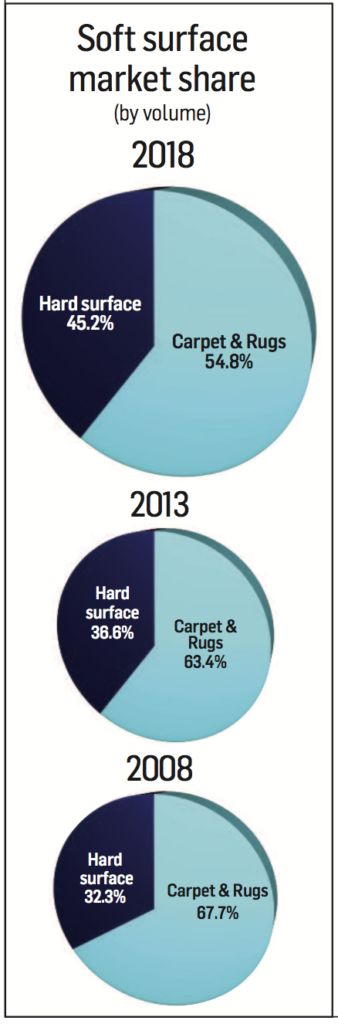

While carpet and rugs comprise 54.8% of the overall flooring market—still the highest percentage of any flooring surface—it is 2.5% lower than the previous year and continues the category’s steady decline since 2006, just prior to the start of the Great Recession. In 2006, for example, overall carpet sales were $12.87 billion. In the 12 years since, sales have dropped 30.2%. Meanwhile, volume is down a whopping 38.9% over that span (17.62 billion units in 2006 to 10.75 billion in 2018). To view it another way, carpet/rugs has lost more than 13 market share points since 2008, when the category accounted for 67.7% of the industry sales; 2008 was the one year in the last 10 in which soft surfaces gained a market share point, and that occurred during the heart of the recession when virtually all flooring categories were taking it on the chin.

Following the downturn, which ended in mid-2009, hard surfaces categories have mostly grown while carpet has only managed to skim along the bottom, with small gains or losses along the way.

Following the downturn, which ended in mid-2009, hard surfaces categories have mostly grown while carpet has only managed to skim along the bottom, with small gains or losses along the way.

In this market, observers say any sign of instability can impact carpet sales by effectively keeping consumers on the sideline. In 2018, for example, there were many reasons to sit it out despite a relatively healthy economy. For starters, 2018 saw the Federal Reserve raise interest rates four times. Meanwhile, existing home sales slowed, and the year ended with the government in a shutdown. What’s more, carpet mills, facing inflationary pressure primarily from raw materials, passed along price increases on four to five occasions during 2018. That helped elevate the average selling price to $6.97 per yard compared with $6.70 in 2017.

Michel Vermette, president, residential carpet for Mohawk, called 2018 a tale of two halves: a strong beginning and a lackluster second half. “The year was looking to be OK, but then with all the increases in prices it came to a standstill,” he explained. “There was a lot of disruption in the marketplace. New housing came to a halt. When interest rates were announced in October, consumers went into a shell for the most part.”

The October rate increase from 2% to 2.25%, which drew the ire of the White House, was carried out to preserve a steady economy, according to the Fed. The fourth increase of 2018 took place in December as the central bank hiked its fund rate to 2.5%—the highest it has been since 2008. The funds rate is tied to most consumer debt, particularly credit cards and adjustable-rate loans. That move, coupled with rising raw material costs (up to 20% in some cases) for some components used in soft surfaces, impacted flooring sales in general and carpet in particular. “The carpet numbers did not keep up,” Vermette said. “We were playing catch up all year long [in 2018] and we’re still playing catch up. You also can’t ignore LVT/LVP and how it is  eating at the rest of the market.”

eating at the rest of the market.”

Bifurcated market

A widening gulf between low- and high-end goods has defined the carpet segment in recent years. At the commodity end, solution-dyed polyester is driving the market and helping companies like Engineered Floors and its Dream Weaver residential brand take significant market share. Engineered Floors, already a top three carpet mill in just its 10th year of existence, enjoyed growth rates of between 20% and 30% in 2018 and is doubling down on solution-dyed polyester as its go-to fiber. “That’s where the growth of the industry is,” said Joe Young, soft surface category manager. “These days, if it is not soft multicolor polyester, it is hard to sell.”

At the upper end of the market, priced at $15 or more per square yard, companies are also finding success. “The last two years were solid for residential high-end carpet and rugs,” said Jonathan Cohen, CEO of Stanton Carpet. “Although residential continues to lose share vs. hard surface overall, there are pockets of growth in high-end decorative carpet and rugs.”

Continuing that same theme, Mark Clayton, CEO of Phenix Flooring, noted carpet’s average sales price continued to improve in 2018 as consumers opted for mid- to higher-end goods and products that exhibited more pattern and overall sophistication. “Since consumers have ‘broken up’ the overall floor of the home, in lieu of wall to wall, consumers have been willing to move toward better design/color options,” he explained.

Where carpet mills—and their retail partners—do not want to end up is in the dreaded middle of the market, which most define as the $8 to $14 per-square-foot price range, a veritable black hole for the carpet industry these days.

Commercial

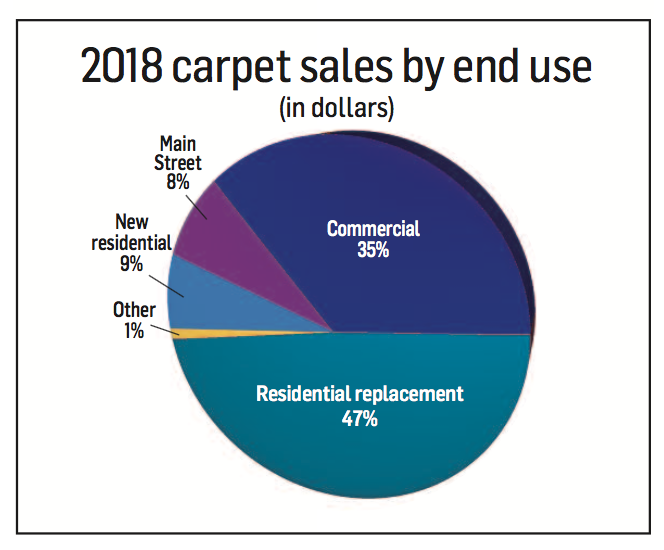

Commercial carpet, which makes up 42.9% of the total carpet market, was down 0.8% in sales and 5% in volume in 2018, marking the third year in a row that both sales and volume have fallen. FCNews estimates the commercial market at $3.774 billion in sales for 2018, with specified contract sales coming in at $3.07 billion and Main Street business at $704 million.

[Note: For years a large percentage of mills considered level-loop polypropylene a Main Street product, mostly installed in rental space/tenant improvement and low-end apartments and basements. Today, much of this business has been lost to low-end polyester cut piles. These cut pile sales are reported as residential, not Main Street. As well, some mills break out Main Street from their specified business; others do not.]

The down figures for commercial in 2018 continue a disturbing trend. The last time commercial sales were in positive territory was 2015, when it increased 2%. However, volume was down that year as well. The last year commercial carpet units grew was in 2014, when it rose 4%.

The struggles of the commercial business can be tied directly to the overwhelming strength of the LVT/SPC market that continues to expand its footprint in all applications, in the process pushing carpet to the margins. As Mike Gallman, president of Mohawk Group, explained, “You can’t talk about carpet without talking about hard surfaces.”

The struggles of the commercial business can be tied directly to the overwhelming strength of the LVT/SPC market that continues to expand its footprint in all applications, in the process pushing carpet to the margins. As Mike Gallman, president of Mohawk Group, explained, “You can’t talk about carpet without talking about hard surfaces.”

While broadloom is still an ideal solution in key targeted commercial segments, there continues to be a shift to carpet tile in overall demand due to its ease of installation, maintenance and design versatility. That’s according to Tim Baucom, president of Shaw Industries, who points out that the proper seam matching, row cutting, roll sequencing and seam diagrams required with broadloom can be difficult and result in a loss of profit if not properly executed. “Labor challenges—especially the need for and lack of qualified installers for broadloom—also have led to the increased use of carpet tile,” he explained.

As corporate and government sectors are changing their environments—utilizing less traditional office spaces and moving to more open and collaborative spaces—Baucom said flooring solutions like carpet tile can help define separate spaces to creatively achieve that desired workspace.

Education and healthcare combined make up almost one-third of the commercial carpet market. Baucom said carpet tile is rapidly taking share in K-12 education and is solidly in place in higher education. “We estimate that carpet tile now makes up about 80% of K-12 carpet installations. In many schools, broadloom is limited to stairs. In higher education, the  move to carpet tile took place much earlier and now represents almost 90% of carpet installations.” Carpet as a whole continues to shrink in the healthcare segment. Carpet tile has about 90% of the carpet market in health- care and continues to grow in share while broadloom has decreased in the past year in acute care facilities and medical office buildings.

move to carpet tile took place much earlier and now represents almost 90% of carpet installations.” Carpet as a whole continues to shrink in the healthcare segment. Carpet tile has about 90% of the carpet market in health- care and continues to grow in share while broadloom has decreased in the past year in acute care facilities and medical office buildings.

A path for success?

It is projected that hard surfaces, in particular LVT/rigid core, will continue to take market share from other flooring categories including carpet. How much longer carpet’s decline will continue is not known, although there are some optimistic voices who believe the rate of decline will start to slow especially if the 25% tariffs on Chinese imports—which impacts hard surfaces—continues beyond 2019. Some executives point to advantages in soft surfaces that are not always mentioned. “Carpeting, for a majority, is still produced in the U.S., and manufacturers need to educate consumers of the importance of supporting local production to help maintain domestic growth,” said Chet Graham, CEO of Marquis Industries. “If tariffs continue to put pressure on pricing levels, we should see some gain on soft goods even though I don’t believe it will come back to the high point from years ago.”

While more favorable economic triggers may help carpet down the line, mill executives say the industry must do a better job of exciting consumers on the look and merits of the product. More recently, mills have taken a page from hard surface trends by developing carpet that replicates distressed looks or even stone visuals—all meant as a complementary piece to hard surface in the home. “We as an industry are going to have to innovate a little more—be fashionable,” Vermette said. “[Mohawk is] putting money into carpet. We’ve made nice investments in tufting and fiber. We have the resources to reinvent ourselves compared to some others. Companies that have not made the investment, or took too long, are not here anymore.”

Stanton’s Cohen said there are still plenty of opportunities to promote soft surfaces as a complementary home décor to hard surfaces—whether it is used for area rugs, runners or wall-to-wall for bedrooms. “The older generation is already aware of this, but the younger generations need to be reminded of [the benefits of carpet] in new and unique ways. There is a huge replacement cycle opportunity as [these products] become a real fashion statement that can be replaced more frequently than previously to keep the aesthetics of the home updated. Specialty retail needs to have a regular cycle of updating the look of their showroom while staying appropriately active on social media.”

Phenix’s Clayton believes that in the coming years the share of carpet should stabilize and maintain a prominence in the home thanks to the category’s aesthetics and functional benefits such as softness underfoot, noise abatement and overall design capabilities.

Phenix’s Clayton believes that in the coming years the share of carpet should stabilize and maintain a prominence in the home thanks to the category’s aesthetics and functional benefits such as softness underfoot, noise abatement and overall design capabilities.

Fiber

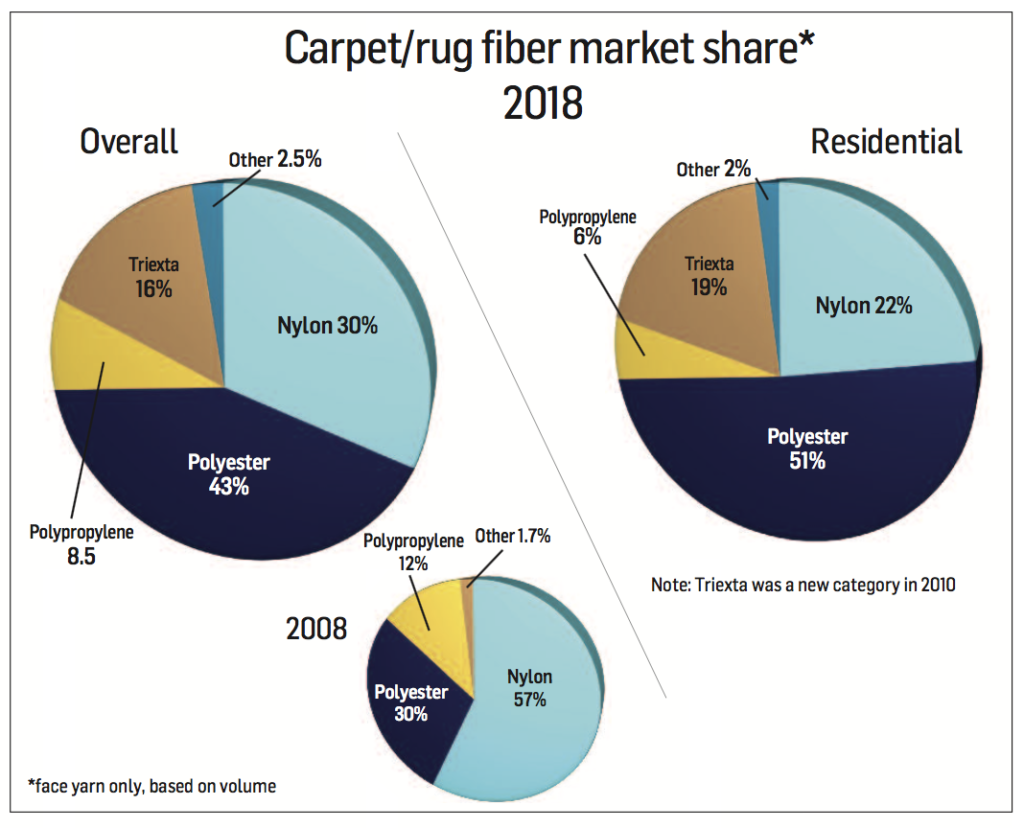

With few notable exceptions in commercial, the carpet market has turned decidedly toward solution-dyed polyester. In 2018, PET captured virtually all of the growth, grabbing share from olefin and nylon. “Some of the competition will have to reset,” Mohawk’s Vermette said. “If you are highly leveraged in nylon you will have your hands full.”

T.M. Nuckols, president of the residential division of The Dixie Group, concurred, noting “From a trend standpoint, where we had been seeing nylon make a bit of a comeback over the past few years, we are now seeing PET and triexta resurging and taking more share of the residential market. This is being driven by the large mills due to the increases in nylon prices over the past 12-18 months.”