November 26/December 3, 2018: Volume 34, Issue 12

By K.J. Quinn

The ceramic tile industry can best be described as a two-sided coin: one side shows a business thriving from a healthy economy and consumer preferences trending toward floors resembling or made from natural materials; but on the flip side, a projected decline in new housing starts and unfavorable macroeconomic issues threaten to stymie growth.

The ceramic tile industry can best be described as a two-sided coin: one side shows a business thriving from a healthy economy and consumer preferences trending toward floors resembling or made from natural materials; but on the flip side, a projected decline in new housing starts and unfavorable macroeconomic issues threaten to stymie growth.

“I predict that by the end of the year, the overall consumption of ceramic tile [floor and wall] will be flat with the previous year,” said Gianni Mattioli, executive vice president, product and marketing, Dal-Tile. “New residential applications should be positive thanks to new home construction, while residential remodeling could be slightly negative.”

When you look at the numbers, ceramic is a steady performer, posting eight consecutive years of sales growth through 2017. Sales rose 5.8% and nearly topped $3 billion for the first time while volume rose 5.5%, according to FCNews research. The U.S. remains fertile ground for tile makers, as the amount of ceramic sold is significantly less than other parts of the world.

“Products continue to get to market through tile distribution and dealers’ showrooms, though e-commerce continues to grow, as well,” noted Lindsey Waldrep, vice president of marketing for Crossville.

In 2018, the category benefitted from numerous factors ranging from a strong economy and new housing market to high consumer confidence and low unemployment rates. The remodeling market remained busy, observers report, as more people chose to remain in their homes and update them to accommodate evolving needs.

“Many homeowners are compelled to upgrade materials in their homes,” Waldrep said. “We always aim to guide homeowners and the remodeling professionals they are working with to choose the right tile products for the applications at hand.”

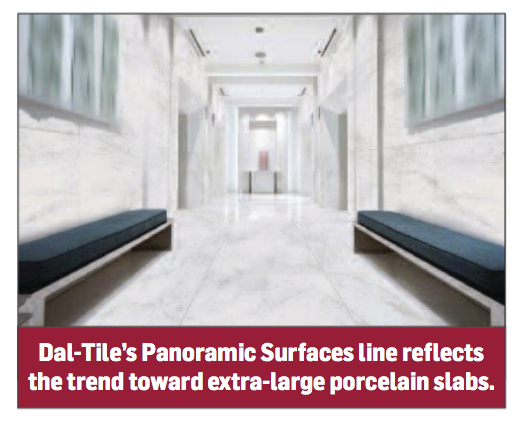

Meanwhile, the category expanded usage into key commercial sectors— namely hospitality, healthcare, education and corporate offices—and new high-end homes saw greater quantities of tile specified. “Consumers are still extending the use of tile in applications outside of traditional kitchen and bathroom floors,” said Bob Baldocchi, chief marketing officer and vice president of business development, Emser Tile. “Wall, decorative accents, indoor/outdoor, external landscaping and cladding are all growth areas.”

But the eight-year winning streak for tile is expected to end soon. Rising prime lending rates, tighter mortgage qualification criteria and rising real estate costs are among the factors expected to impact demand in 2019. For example, Dodge Data & Analytics projects single-family housing starts will slide 3% to 815,000 units in 2019 while multi-family starts drop 8% to 465,000 units.

“Total housing starts will decline 5% to 1.28 million units,” stated Kim Kennedy, manager of forecasting at Dodge Data & Analytics. “In dollars, single-family housing starts will remain flat in 2019 at $232 billion, and multi-family housing starts will fall 6% to $87 billion.”

New housing is one of the biggest markets for tile consumption. Residential construction data, however, can be skewed by peaks and valleys in key regions. For example, the South region, the largest in terms of building activity, saw housing starts decline by almost 14% through September. Unforeseen situations—such as the recent fires in Northern California and Hurricanes Florence and Michael in the South—impacted flooring choices in home improvement projects as well as new residential construction, according to published reports.

Emerging issues

A major issue affecting the builder business is affordability, as declines in home ownership persisted well into the market recovery and recent gains have been restrained, Dodge Data reported.

Limited increases in income, large spikes in house prices and rising mortgage rates are combining to hamper affordability, particularly for first-time homebuyers. “Home affordability issues within key markets are driving a push towards lower square footage,” Emser Tile’s Baldocchi said.

Limited increases in income, large spikes in house prices and rising mortgage rates are combining to hamper affordability, particularly for first-time homebuyers. “Home affordability issues within key markets are driving a push towards lower square footage,” Emser Tile’s Baldocchi said.

From a product perspective, LVT is reportedly expanding into commercial and residential spaces previously occupied by ceramic. What some industry members find worrisome about this trend is that tile is a superior product on paper, as it is a natural product offering an inert and impermeable surface with zero VOCs, is more durable and offers arguably better looks. “So it must be cost to the consumer that is a primary deciding factors, which includes everything up to and including installation,” said Ryan Fasan, Tile of Spain consultant and tile specialist.

Tile costs are slowly climbing with the average per-square-foot price increasing from $0.95 to $1.20 in the last decade, according to FCNews research. Rising tariffs and transportation/freight expenses contributed to higher sticker prices for a product among the priciest of floor coverings. Suppliers are cognizant of this, and adjusting to decrease landing costs (such as shaving a millimeter or two from the product thickness). This minor adjustment can have major ramifications throughout the supply chain.

“The lighter material is easier to carry, cut and work with on site, potentially cutting project timelines and cost when it comes time for installation,” Fasan explained. “The goal is to engineer product that does its job without overkill to allow for a broader range of projects to afford the premium characteristics and style that tile provides.”

Tile is among the most difficult floorings to install, as there are many product types, sizes and applications indoors and outdoors, plus potential floor preparation issues on job sites. Further complicating matters is the shortage of qualified installers, as retailers and contractors are challenged to find good help. “Labor continues to be a topic of conversation as it relates to both the availability and quality,” Emser Tile’s Baldocchi said. “However, recently we have seen and heard reports of markets where this is easing, and efforts are being made to do more training and attract new installers.”

Industry associations and suppliers are doing their part to boost installation quality and recruit more mechanics. For example, the National Tile Contractors Association (NTCA) offers an online apprentice program for tile installers. The University of Ceramic Tile and Stone (UofCTS) provides an online Tile Installer ITS Verification course, which features an extensive section on how to install gauged porcelain tiles on floors and walls. “It only takes about five hours to complete,” said Donato Pompo, UofCTS founder.

Crossville, for its part, prioritizes installer training and education. Its industry partnerships and in-house workshops are non-stop efforts to help more members of the installation community be equipped with the know-how to answer demand. “When installers are armed with the knowledge to land projects and achieve successful installations, they are in positions of strength to grow their businesses in terms of staffing, further training and resources.”

Eye on innovations

Tile is reportedly becoming mass marketable due to improvements in technology that have led to usage beyond floors and walls. For example, the advent of slabs for countertops and 16mm-30mm thick paver options is providing an entry for ceramics into areas of specification dominated by natural stones and other manufactured goods.

“By creating product in these progressive formats—with all of the inherent benefits of ceramics coupled with the ever-growing capabilities for staggering decoration methods—ceramics are making big waves in these areas of specifications,” Tile of Spain’s Fasan pointed out.

Emerging formats, such as large tiles and porcelain panels, are expected to continue expanding into multiple end uses in 2019. “The market is accustomed to larger proportions in field tiles, making dimensions upwards of 36-inches viable in the residential market,” Crossville’s Waldrep explained. “Even larger, porcelain tile panels are starting to be embraced residentially as options for shower stall walls, fireplace surrounds and backsplashes.”

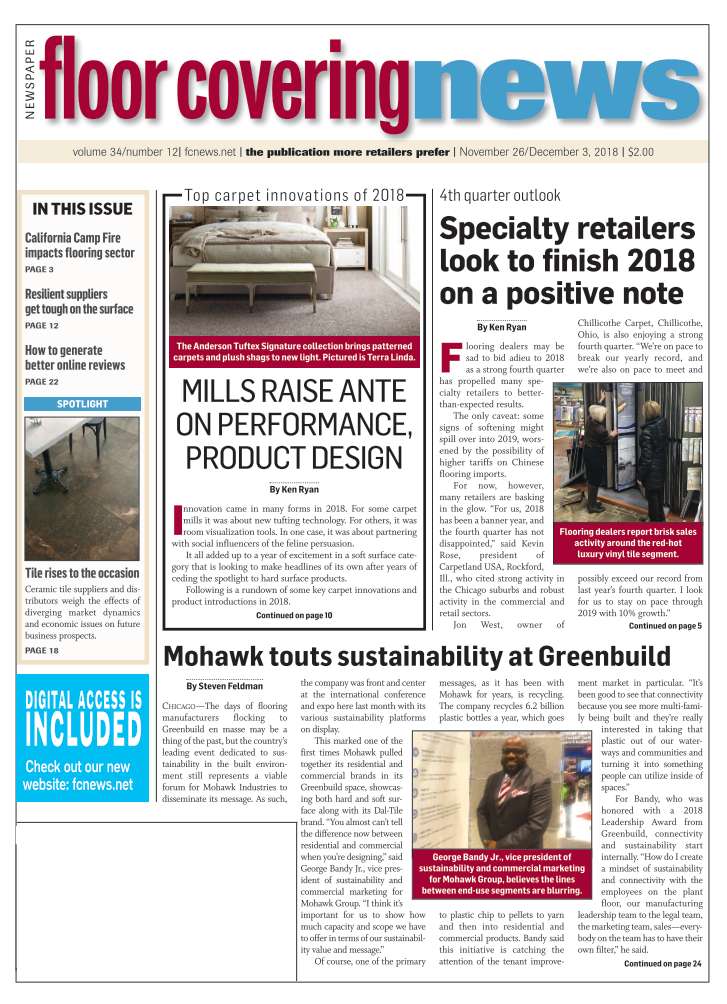

Size does matter as vendors continue churning out larger formats and myriad shapes to accommodate pent-up demand. For instance, rectangle sizes are popular both in small subway wall tiles and large floor tiles. “We see strengths in larger rectangular sizes, like marbles and limestones, in general,” Dal-Tile’s Mattioli explained. “Polish material is getting more popular, and wall tile is strong in all categories and sizes.”

Wood grain, stone and concrete tile looks are top sellers in hard surfaces, and ceramic is no exception. Mosaic tiles are also trending as consumer confidence holds strong, making homeowners open to more bold and customized styles. “Wood-look tile collections are now staples,” Waldrep said. “These products are perpetually popular as durable alternatives for bringing the look of wood to spaces where the real thing wouldn’t be an option.”

Suppliers continue to invest across their manufacturing footprints to bolster production efficiency and speed to market. Digital printing is becoming so sophisticated that it has completely transformed the category, allowing production of high-quality tiles that mimic natural materials and vary in design.

Case in point: The colors in Crossville’s new Astral Plane collection offer nuanced details captured through the latest tile manufacturing technology and are somewhat warmer in tone. “We also offer mosaic options that not only add to the aesthetics of the line, but provide functional slip resistance when installed as flooring in wet areas such a shower stalls,” Waldrep said. “The size options are varied and align with popular preferences as well.”

In addition to improved aesthetics, R&D efforts center on developing larger sized floor tile and polished materials. “We also have a new product focus on wall tile that is 3D, providing an artisan look, or features structure,” Dal-Tile’s Mattioli said. “Our extra-large Panoramic porcelain slabs are hitting the market with a competitive program.”