September 17/24, 2018: Volume 34, Issue 7

By Reginald Tucker

When it comes to hardwood sales in the U.S. today, all signs point to increased consumption of engineered products. Proponents of the format cite—among other benefits—more efficient use of raw materials, improved performance in demand climates and the increased design and application flexibility that engineered products offer.

“There’s never been more changes taking place in the wood flooring segment than what we’re seeing before our eyes right now,” Tom Lape, president, Mohawk Residential, told FCNews. In particular, he’s seeing many consumers moving away from solid at a rapid pace. “We see the engineered category evolving right in front of our eyes from what was historically a 5-ply construction format to an HDF solution.”

As Mohawk seeks to leverage its position as an integrated, vertical HDF engineered wood producer, it continues to benefit from the shift to engineered. “Making all our own HDF internally gives us an advantage in terms of consistency and uniformity of the product,” Lape explained. “In addition, we produce all those products here in North America, which gives us an advantage in terms of supply chain and reliability.”

Other industry observers attest to the trend. Mannington, which moved to an all-engineered format several years ago, saw the proverbial writing on the wall. “While the overall wood category grew by low single digits last year, the growth rates were different between solid and engineered, with solids declining in overall volume and engineered growing by mid-single digits,” said Dan Natkin, vice president, wood and laminate.

But for suppliers that play in both the engineered and solid segments of the market, there’s still room for both formats. As Michael Bell, vice president, hardwood, Armstrong Flooring, explained: “In engineered, we see much of the growth occurring on the bookends of the market with significant increases in the opening price point/value engineered products and the best/premium sliced- and sawn-face engineered products. Solid is similarly seeing increased activity on the best/premium side of the market.”

While it is generally accepted that consumer tastes differ by region and/or climate, some point to inherent limitations of solid products as an impediment to acceptance beyond the core solid markets. “With the demand and overall trend moving toward longer and wider, there are limitations you have with solids that are not there with engineered,” said Clark Hodgkins, director of hardwood and laminate, Shaw Floors.

Longer, wider trend

Longer, wider trend

Suppliers agree that having the ability to go longer and wider has ushered more consumers in the direction of engineered products. It’s simple physics, actually—the wider the board, the more it will flex under stress and temperature changes. This plays directly to the strengths of engineered products, which—by sheer virtue of their multi-ply construction—can better resist this movement.

“We’re giving consumers more of what they want—wider and longer,” Mohawk’s Lape said. “We’re selling planks up to 80 inches long and 9 inches wide, and we’re making better-performing products for contractors, retailers as well as consumers.”

It’s no surprise then that suppliers continue to fortify—and diversify—their product mix. Over the past 18 months, for example, Quebec-based Wickham Hardwood introduced several new engineered offerings designed to complement its solid collections. “What we are seeing is the demand in the U.S. market for a thicker platform appears to be on the rise,” said Paul Rezuke, vice president residential sales, U.S. “With this demand, we are projecting a significant demand for ¾-inch platform engineered products in our U.S. footprint.”

In that same vein, Boa-Franc, maker of the Mirage brand, has bolstered its offering of wider/longer engineered planks. The company now offers new board lengths up to 82 inches. “The new lengths make any room in the house look bigger,” said Brad Williams, vice president of marketing. “Since fewer boards are needed to cover a given area, fewer joints are visible.”

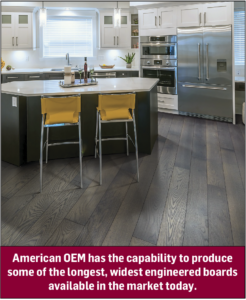

Other major manufacturers are utilizing technology to produce engineered products that are much wider and longer than their predecessors. Case in point is Tennessee-based American OEM, founded by Don Finkell, whose family legacy of producing engineered hardwood floors dates back to 1938.

According to Allie Finkell, executive vice president, the company’s plant has the capability to produce board lengths up to 8 feet in wide widths across a variety of species and platforms. “It is flexible in the constructions it can produce, ranging from veneer core to HDF core, topped with sawn-, sliced- or rotary face veneers,” she said. “Limitless design capabilities are achieved through a talented, hands-on workforce and industry-leading staining techniques for every color of the spectrum. The American OEM/Hearthwood facility is efficient and has capacity to accommodate increases in the demand for domestically produced engineered wood flooring.”

With the continued growth of engineered—and as a means to provide differentiation in the market—suppliers are continuing to push the envelope and expand the possibilities. An example of this is Arte Mundi, the Jurupa, Calif.-based supplier of innovative engineered collections such as Bauhaus, Renaissance and Nouveau. But perhaps the most intriguing offering is the company’s Crystal Elements collection—an engineered hardwood flooring line that incorporates actual crystals in the wood’s surface. Developed in conjunction with world-renowned brand Swarovski, the new line was designed to provide retailers and distributors with a step-up product. “Our product lines embody the most natural elements without chemicals, resulting in a process that is completely organic,” said John Lee, president/CEO, citing Arte Mundi’s approach to high-quality wood flooring production.

The company’s product development teams start each new collection by searching for the most aesthetically pleasing, highest-grade lumber for the top layer. This is supported by top quality, multi-layered plywood. Additional visual enhancements are achieved through 100% hand scraping as well as other proprietary techniques.