June 26/July 2, 2018: Volume 34, Issue 1

By Ken Ryan

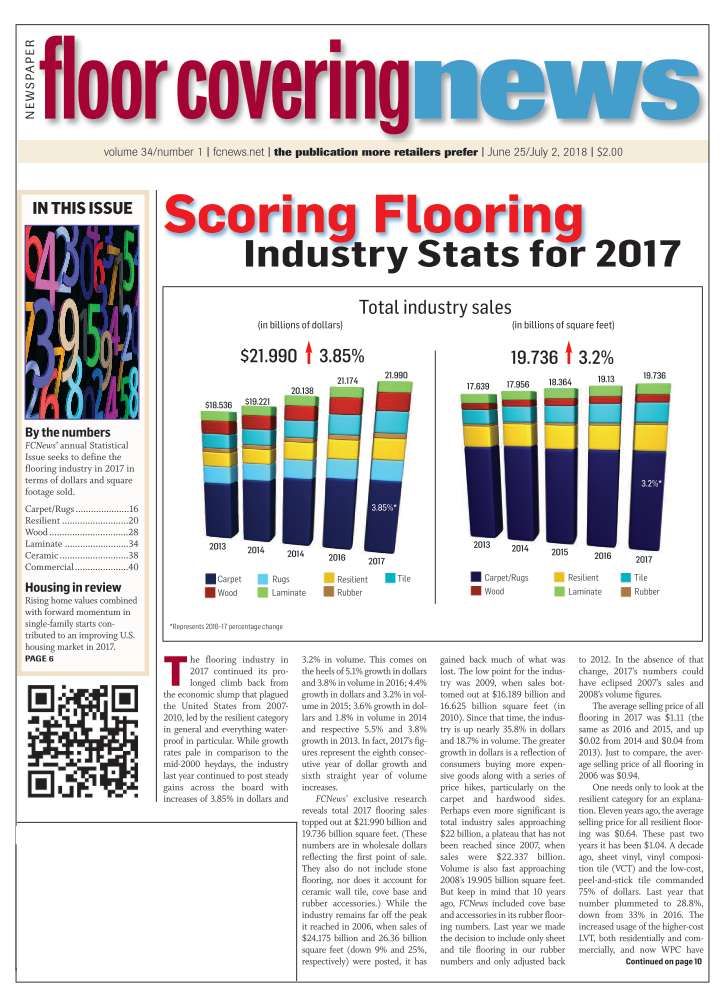

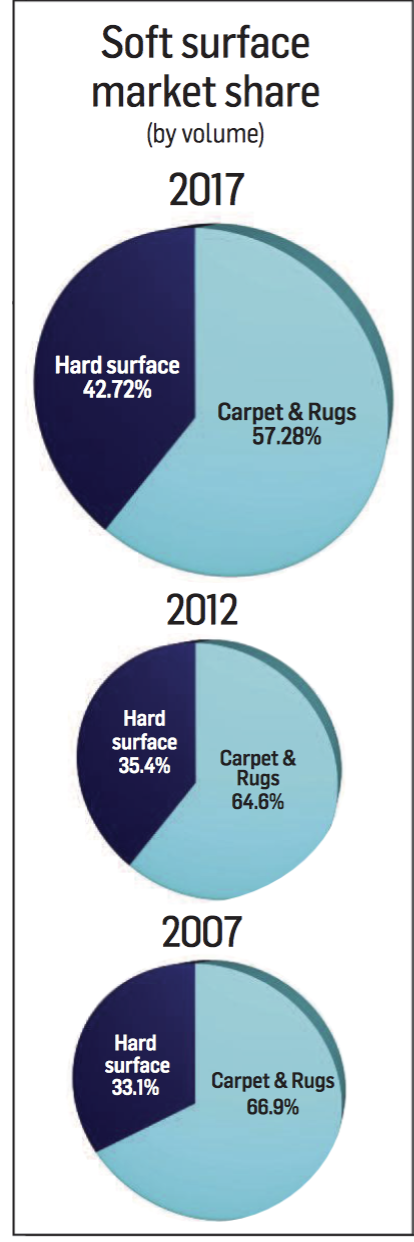

The uphill battle against unrelenting growth in hard surfaces across multiple segments kept the U.S. carpet market in check in 2017, with overall sales and volume essentially flat for the year. FCNews research shows sales inched ahead 0.6% to $8.83 billion while volume (which includes area rugs) was up a scant 0.4% to 11.25 billion units. Rug sales grew about 3% in 2017, the fourth year in a row the segment has grown, thanks primarily to the growth in hard surfaces.

The uphill battle against unrelenting growth in hard surfaces across multiple segments kept the U.S. carpet market in check in 2017, with overall sales and volume essentially flat for the year. FCNews research shows sales inched ahead 0.6% to $8.83 billion while volume (which includes area rugs) was up a scant 0.4% to 11.25 billion units. Rug sales grew about 3% in 2017, the fourth year in a row the segment has grown, thanks primarily to the growth in hard surfaces.

Dissecting the category, residential carpet sales rose 2.5% in 2017, a reversal from 2016 when it fell 1.5%. Meanwhile, units were down an estimated 0.5%, also a departure from the previous year when volume was ahead 1.5%. A movement toward higher-end carpet and frequent price increases, allowed carpet sales dollars to increase even though units declined.

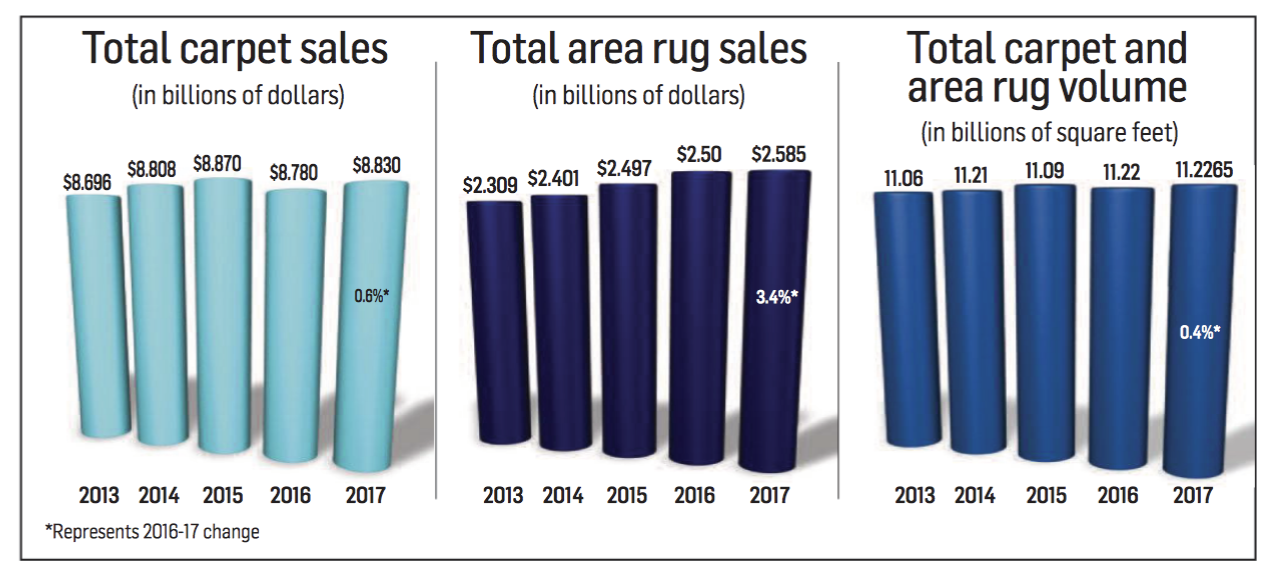

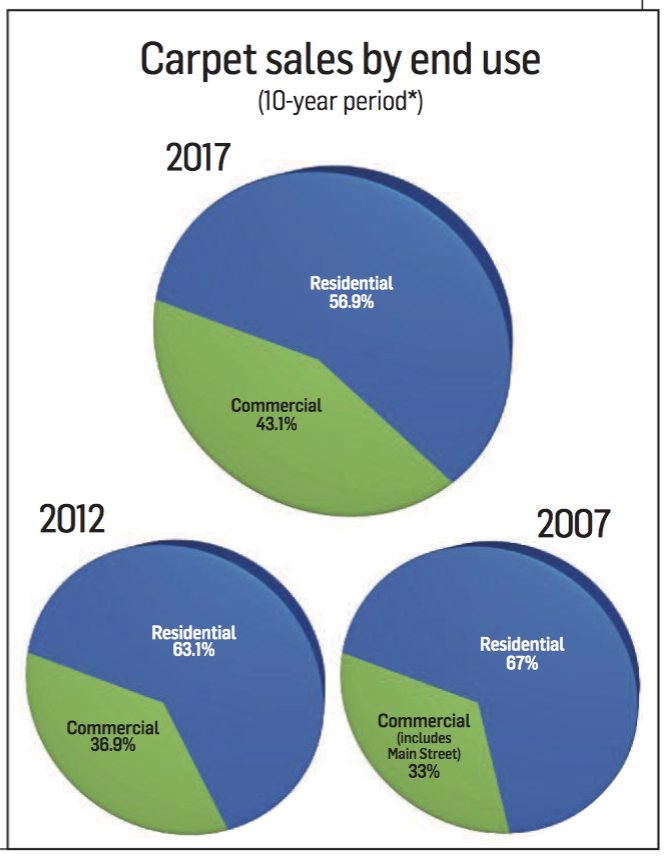

Overall, carpet and rugs make up 57.3% of the overall flooring market in volume, still the largest percentage of any flooring surface, yet waning from its dominant days of a decade ago when soft surface commanded 66.9% of the market. That year, carpet sales were down 10.1% and volume fell another 13.7% as the flooring industry was mired in a terrible housing crisis.

By 2012, carpet’s dominant market position was down to 64.6% (volume), a loss of 3.3 percentage points since 2007. Between 2012 and 2017, however, car- pet’s share as a percent- age of the overall industry has receded even more, down 7.3 percent- age points.

How much longer carpet’s steady decline will continue is not known, although there are industry executives who believe the rate of decline will start to slow and may stop entirely for a while. That line of thinking is credited to enhanced technology that can produce better goods that consumers demand, as well as an aging population, which—studies show—prefer softer surfaces, especially in their bed- rooms, which is still a solidly carpet segment within residential.

Carpet continues to play well in certain regions, in particular the upper Midwest, the Northeast and Canada, and is faring well at both the higher (above $15 retail) and lower end.

Mill executives who are looking for any signs of a carpet resurgence see indications that hard surfaces may get overstretched to the point where carpet rebounds. They point out that today’s newer homes tend to have higher ceilings than in the past; the argument goes that if the home is dominated by hard surfaces, there will be issues with noise. To abate this, soft surface is needed, and observers suggest broadloom would be a better solution than rugs. On the commercial side, the biggest complaint with restaurants isn’t the food or the service—it’s the noise, thanks to all hard surfaces.

Age is another factor in carpet’s long-term favor. The nation’s population has a distinctly older age profile than it did 16 years ago, according to the U.S. Census Bureau. Its estimates show the nation’s median age rose from 35.3 years on April 1, 2000, to 37.9 years on July 1, 2016. Residents ages 65 and over grew from 35.0 million in 2000 to 49.2 million in 2016, accounting for 12.4% and 15.2% of the total population, respectively. Statistics like these give carpet executives a reason to be optimistic. “We still believe in the category,” said Chet Graham, president of Marquis Industries. “We know trends come and go and carpet is still more than half the industry. I think the numbers will get closer—with hard surfaces gaining more market share, but then we think carpet will inch up. As people get older, they don’t want to walk on cold floors.”

Age is another factor in carpet’s long-term favor. The nation’s population has a distinctly older age profile than it did 16 years ago, according to the U.S. Census Bureau. Its estimates show the nation’s median age rose from 35.3 years on April 1, 2000, to 37.9 years on July 1, 2016. Residents ages 65 and over grew from 35.0 million in 2000 to 49.2 million in 2016, accounting for 12.4% and 15.2% of the total population, respectively. Statistics like these give carpet executives a reason to be optimistic. “We still believe in the category,” said Chet Graham, president of Marquis Industries. “We know trends come and go and carpet is still more than half the industry. I think the numbers will get closer—with hard surfaces gaining more market share, but then we think carpet will inch up. As people get older, they don’t want to walk on cold floors.”

The improving economy has provided many consumers with the confidence to spend more on their homes, and that goes for all surfaces. “The increased popularity in hard surfaces has led to carpet being used more in the bedroom and retreat areas of the home,” said Mark Clayton, president, Phenix Flooring. “This has led to increased demand for better designs and improved styling in the carpet category and has led to the continued upward movement in the category in terms of face weights and retail price points.”

T.M. Nuckols, president, Dixie Residential, also endorsed the growth in hard surfaces as helping to create demand for better goods in carpet. “Consumers are looking for differentiated styles (patterns, loops, etc.) to complement the beautiful hard surfaces being installed,” he said. “And there is movement toward cut/bound rugs from broadloom styles. These can be area rugs, hallway runners, stair carpet or other niche applications in the home.”

If nothing else, 2017 was a year of volatility in the carpet world. Continued increases in raw material costs, led by polyester chip pricing, forced carpet companies to raise prices, in some cases multiple times during the course of 2017. The year also saw the departure of Beaulieu, which was acquired by Engineered Floors out of Chapter 11; and the abrupt shuttering of Royalty Carpet Mills, a long-time West Coast mill known for better goods. Some of Royalty’s business was picked up by Tuftex, which in 2017 was merged with Shaw’s Anderson hardwood brand to create Anderson Tuftex. AT launched at the beginning of 2018.

Category leaders Shaw and Mohawk, as well as the Dixie Group, benefited by the upheaval as well. In its 2017 financial statement, Dixie reported its residential sales benefited from its response to the market space vacated by Royalty on the West Coast. “We responded to the Royalty shut down by introducing our Pacific Living collection as well as adding numerous new dealers on the West Coast,” said Dan Frierson, chairman and CEO. “The impact of these efforts was an over 20% increase in sales for our West Coast regions for the second half of 2017 as compared to the same period the prior year.”

The loss of Beaulieu, once the No. 3 carpet mill, was a boon to Engineered Floors, which since its inception in 2009 has now become a $1 billion-plus company with a stronghold in the commodity segment of car- pet.

Commercial

Commercial carpet, which makes up 43.1% of the overall carpet market, was estimated at $3.805 billion in sales for 2017, with specified contract sales coming in at $3.104 billion and Main Street business at $701 million.

[Note: For years, a large percentage of mills considered level loop polypropylene a Main Street product, mostly installed in rental space/tenant improvement and low-end apartments and basements. Today, much of this business has been lost to low-end polyester cut piles. These cut-pile sales are reported as residential, not Main Street. As well, some mills break out Main Street from their specified business; others do not.]

For the second year in a row, commercial lagged residential. In fact, estimates had commercial volume down 6% while sales declined 3%. The drop off speaks to the sweeping dominance of LVT, which has captured share in virtually every segment of the commercial market. If not for the continued success of modular carpet, the numbers would have been far worse. “Resilient is definitely taking share from carpet overall and some stained concrete is taking share from commercial,” said Michel Vermette, president, Mohawk Commercial. “You are definitely seeing [stained concrete] in retail and some corporate spaces, especially tech companies. At Google, Amazon and Nikon you see concrete. The floor is a bit louder; to compensate, they try to put some soft surfaces around it.”

For the second year in a row, commercial lagged residential. In fact, estimates had commercial volume down 6% while sales declined 3%. The drop off speaks to the sweeping dominance of LVT, which has captured share in virtually every segment of the commercial market. If not for the continued success of modular carpet, the numbers would have been far worse. “Resilient is definitely taking share from carpet overall and some stained concrete is taking share from commercial,” said Michel Vermette, president, Mohawk Commercial. “You are definitely seeing [stained concrete] in retail and some corporate spaces, especially tech companies. At Google, Amazon and Nikon you see concrete. The floor is a bit louder; to compensate, they try to put some soft surfaces around it.”

Carpet tile now represents 60% of the commercial carpet market, and executives do not see that trend reversing anytime soon, as modular is easier to install and is the floor of choice for most commercial environments vs. broadloom. However, there is long-term hope for broadloom in office settings, executives said. That’s because new, open office spaces—table settings vs. cubes—are emerging where it is easy to move furniture pieces around, which in turn changes the whole installation thought process. As Vermette explained, “You could see—and I’m not saying it is going to happen—but where broadloom makes inroads in this space as it becomes an easier, simpler install because you don’t have all the lift in this space; maybe over time I may not have to spend as much; carpet tile is more expensive than broadloom. So, if you want a clean aesthetic, broad- loom could be a trend.”

Corporate and government sectors are also changing their environments, opting for less traditional spaces in favor of open and collaborative spaces. “Flooring solutions that help define separate spaces—such as carpet tile, which allows for different designs, color accents and patterns—help achieve that desired workspace,” said Bob Chandler, executive vice president, commercial division, Shaw Floors.

Among commercial segments, education saw a late surge in 2017 as bond money began flowing through the system. The full effect of that trend will be seen in 2018 and beyond. Broadloom also remains a viable alternative in segments of hospitality even though hard surfaces are making significant inroads, especially in renovations and boutique hotels.

While carpet tile continues to grow in the commercial space, it has never found a pathway to the residential segment. Some executives say carpet tile’s window of opportunity in the home—if it ever had one—is closed for good.

Fibers

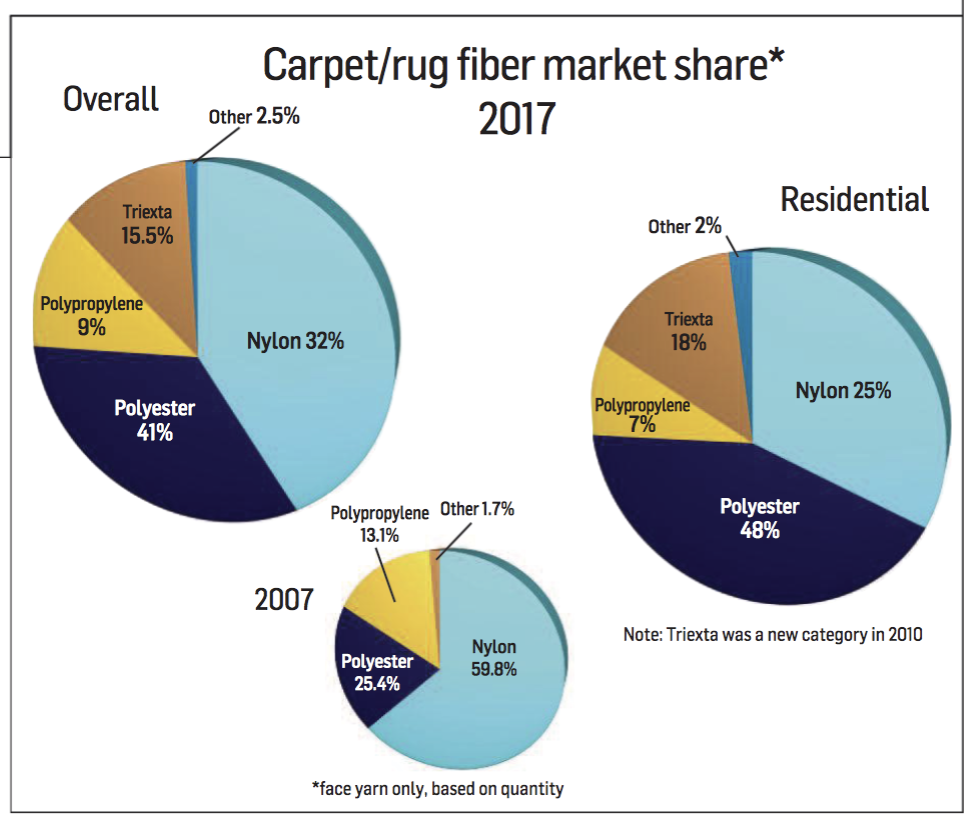

In 2017, nylon continued to lose share to PET/polyester and has virtually been wiped out of the builder market. There is also  consistent “deselection” in multi-family, observers say, in favor of polyester. On the retail side, soft nylon is favored at the upper end of a differentiated market; however, nylon is under immense pressure in the middle markets of residential. Despite the fact consumers have high expectations for soft nylon, it has not done well as a soft-performing product, according to industry observers.

consistent “deselection” in multi-family, observers say, in favor of polyester. On the retail side, soft nylon is favored at the upper end of a differentiated market; however, nylon is under immense pressure in the middle markets of residential. Despite the fact consumers have high expectations for soft nylon, it has not done well as a soft-performing product, according to industry observers.

Meanwhile, the rug business continues to be a bright spot in soft surfaces, with 2017 marking the third year in a row in which it has had a higher sales increase than carpet. Rugs continue to track through what some call a “remarkable” channel shift, largely away from the independent flooring dealer. These days you’re just as likely to see rugs in a Bed Bath & Beyond or on Wayfair than you will in an independent dealer’s showroom. In fact, by some estimates, rugs are only represented in 8% of specialty flooring dealers’ showrooms.