There is no doubt 2009 was a tough year for the broadloom segment. The reasons for this are many, with most agreeing the category’s biggest challenges  involved the continued decline of the single-family builder business, or new home starts; the significant slowdown of the commercial market; high unemployment, and low consumer confidence. From a retail perspective, these factors represent “the big three” of things that affected 2009 in a negative way.

involved the continued decline of the single-family builder business, or new home starts; the significant slowdown of the commercial market; high unemployment, and low consumer confidence. From a retail perspective, these factors represent “the big three” of things that affected 2009 in a negative way.

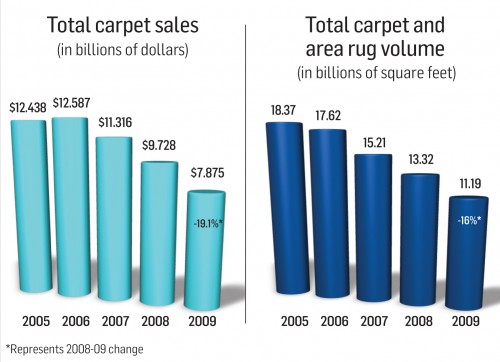

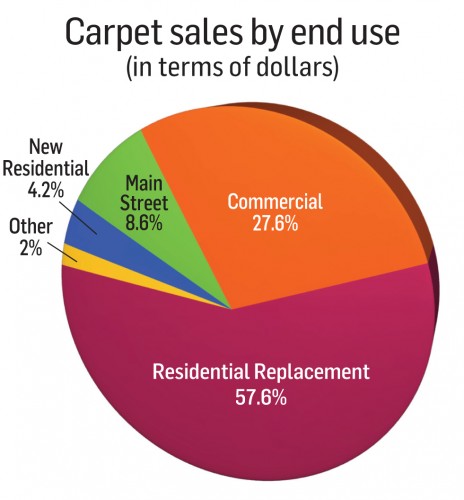

According to industry sources, when it comes to total carpet for residential and commercial in 2009, the industry did approximately $7.875 billion in manufacturer dollars, or mill price as some refer to it. That equates to 48.6% of the total flooring market. Meanwhile, in 2008 the number was roughly $9.73 billion, resulting in a 19.1% drop for the category. Commercial (specified and Main Street) in 2009 was said to be responsible for between 34% and 37% of that total, depending on the source.

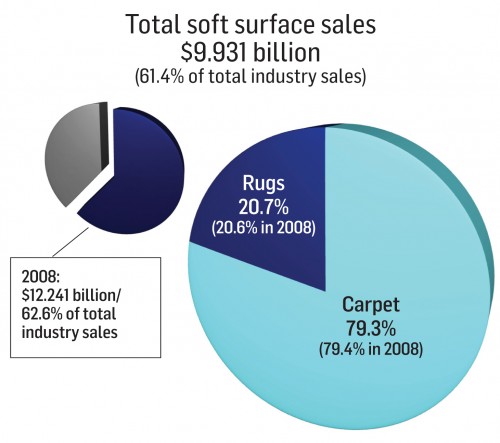

Soft surface (carpet and rugs) still represents the lion’s share of floor covering sales, accounting for about 61.4% of floor covering dollars vs. 62.6% in 2008. In terms of square footage, that number is slightly higher at 66.6%, down slightly from 66.9% in 2008. Square footage commands a greater percentage because of carpet’s value proposition, coupled with the fact that popular, low-priced bath and scatter rugs are included in the mix.

The big news on the commercial side was the continued changing of mix between broadloom and tile. As tile gains market share at the expense of broadloom, sales dollars decrease because tile is a less expensive product. “We’re seeing demand and product offering remaining robust in modular,” one executive told FCNews.

Another factor negatively impacting the commercial market was the decline in hospitality, estimated by some to be in the 35% to 40% range. “A lot of large- scale projects were tied to the debt crisis, and hospitality was overleveraged more than other segments, like government/ institutional,” another executive said.

Another factor negatively impacting the commercial market was the decline in hospitality, estimated by some to be in the 35% to 40% range. “A lot of large- scale projects were tied to the debt crisis, and hospitality was overleveraged more than other segments, like government/ institutional,” another executive said.

Unlike past recessions, the high end of commercial got hit harder than the low end, one supplier said. That was echoed by another mill, which noted the high end was pushed into the middle.

Due to the struggling economy, a major buzzword for 2009 was “value.” In terms of products, carpet mill executives agreed that consumers were more discriminatory toward their purchases as value became a bigger issue. End users were not overspending but would open their wallets if they saw value.

Accordingly, at the retail level in broadloom, the retail price points of $19 to $25 a yard were much more prevalent in 2009, enabling polyester filament to pick up market share because, as officials noted, compared to a nylon, it is much more value priced for the same weight. In fact, it is estimated that 90% of sales in 2009 were priced below

$30 a yard. It some ways, what was bad news for some, served as good news for others. The soaring number of foreclosures meant people were on the move, needing to find a new place to live. This only served to benefit the multi-family segment or apartment business, which tends to refurbish a space before a new tenant signs a lease. That means paint and carpet in most cases.

Another way in which the economy affected the carpet business in 2009 involved a marked upturn for cleaning businesses or carpet retailers who incorporate cleaning as part of their operation. Because people were not replacing their carpeting and there was not a lot of new construction going on as well as sales of existing homes, people were looking at their homes and wondering how to make them more livable until they could afford replacement carpeting. As a result, industry executives noted, there was a lot more interest and business in the area of carpet cleaning.

Several positive developments in broadloom in 2009 came from the area of state-of-the-art, high-tech products, which continue to proliferate the marketplace no matter what the state of the economy may be. Whether it be the growth of polyester BCF, the ever- expanding offerings of soft fibers as well as the environmentally friendly green products featuring use of post-consumer recycled content, the carpet mills have not sat on their hands waiting for the recovery to sweep them off their feet.

In these tough times, broadloom mills have continued to move forward, supplying retailers with the greatest selection of product the industry has ever seen, and, according to many industry experts, the carpet segment has gained market share against its hard surface counterparts.

Rugs

Things fared no better for area rugs in 2009. The segment did approximately $2.056 billion in total sales, down just over 18%. This number includes  everything from high quality area rugs 4 x 6 and larger to scatter rugs and bath mats. Much of the decline could be attributed to the decrease in hard surface sales in 2009, notably hardwood, ceramic tile and laminate. A bright spot, however, continued to be the advancement of machine-made products, generally priced lower than their handmade variety. As mills continue to employ more technology, offerings have been increased to provide retailers and consumers with more looks and innovative products than ever.

everything from high quality area rugs 4 x 6 and larger to scatter rugs and bath mats. Much of the decline could be attributed to the decrease in hard surface sales in 2009, notably hardwood, ceramic tile and laminate. A bright spot, however, continued to be the advancement of machine-made products, generally priced lower than their handmade variety. As mills continue to employ more technology, offerings have been increased to provide retailers and consumers with more looks and innovative products than ever.

While some businesses felt the affects of the economy early in the year, some were fortunate to not begin to feel the full effects of the recession until the fall. Companies that were well diversified with their price points seemed to fare better.

One aspect of the business that really seemed to suffer was the high end. Several executives who have been dealing high-end handknotted rugs for years expressed surprise at the degree to which this segment was hit. They believe the consumer was frightened to spend and it was reflected in their purchases. Price points drifted lower and consumers seemed to be trading down until they felt more secure.

Much of the business in the segment seemed to be at $499 retail and below. For those that produced at this level, business remained somewhat consistent, but high-end knotted fell and has yet to recover. Custom tufted offerings, for those dealing in that segment, remained a growing category. Nepalese custom and low-end knotted production from India remain strong as well as accessories such as pillows. China has also become a major importer to the U.S. In fact, it is estimated that India and China represent more than 50% of all soft surface imports.