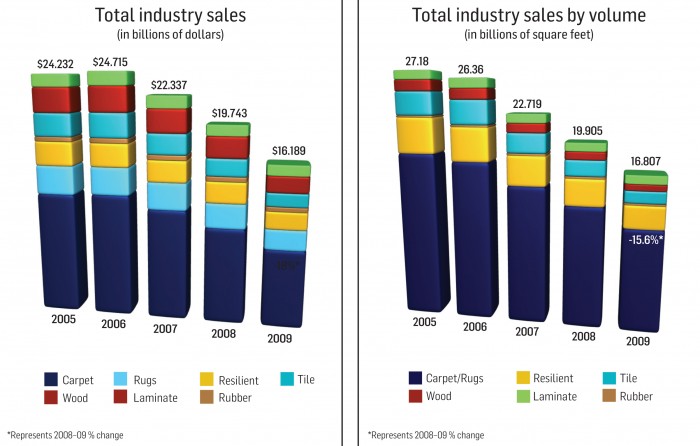

The year that was 2009 was one the United States flooring industry would just as soon forget. Besieged by a challenging economy, sagging consumer confidence, high unemployment, stagnant new construction and a credit crunch, industry sales topped out at $16.189 billion, down 18% from $19.743 billion in 2008. The number represents the industry’s lowest sales volume since 1997. Things were slightly better in terms of volume with 16.807 billion square feet of flooring sold into the U.S. market, a decrease of 15.6% from 2008’s 19.905 billion. The more significant drop in dollars reveals consumers were purchasing less expensive goods; prices of more expensive goods came down; Chinese imports continued to proliferate the market, and consumers were increasingly purchasing their flooring in channels like big boxes and, in the case of laminate, price clubs.

The year that was 2009 was one the United States flooring industry would just as soon forget. Besieged by a challenging economy, sagging consumer confidence, high unemployment, stagnant new construction and a credit crunch, industry sales topped out at $16.189 billion, down 18% from $19.743 billion in 2008. The number represents the industry’s lowest sales volume since 1997. Things were slightly better in terms of volume with 16.807 billion square feet of flooring sold into the U.S. market, a decrease of 15.6% from 2008’s 19.905 billion. The more significant drop in dollars reveals consumers were purchasing less expensive goods; prices of more expensive goods came down; Chinese imports continued to proliferate the market, and consumers were increasingly purchasing their flooring in channels like big boxes and, in the case of laminate, price clubs.

One of the biggest issues that plagued flooring sales last year was consumer spending habits. In many instances, they have chosen to use their disposable income to reduce debt as opposed to making discretionary purchases. Not only is flooring discretionary, it is also postponable. And when consumers did spend in 2009, they were seeking more value than ever before. Carpet remains king with consumers and the A&D community, accounting for 48.6% of industry sales dollars and, along with area rugs, 66.6% of total square footage. In terms of dollars, it lost some share after checking in at 49.3% in 2009. However, when combined with area rugs, soft surface is certainly maintaining its share of square footage, its share dropping just 0.3%. According to some carpet mill executives, the industry witnessed a shift in product mix. Commercially, it was the continued move from broadloom to carpet tile. On the residential side, it was the never-ending quest for value. Polyester continued to gain share at the expense of nylon, and the $2-to- $3-a-foot price point was more significant than in years past.

Area rugs suffered in conjunction with the decline in hardwood and ceramic tile. In terms of soft surface dollars, it is generally believed to represent about  20% of the total, which FCNews estimates at $2.056 billion for 2009. It should be noted that this number includes rugs of all types: from high quality area rugs 4 x 6 and larger all the way down to bath and scatter rugs. It is difficult to break down the percentage of area rugs vs. bath and scatter, but it is safe to say area rugs command a much larger percentage of dollars and the inexpensive bath and scatter own the lion’s share of volume.

20% of the total, which FCNews estimates at $2.056 billion for 2009. It should be noted that this number includes rugs of all types: from high quality area rugs 4 x 6 and larger all the way down to bath and scatter rugs. It is difficult to break down the percentage of area rugs vs. bath and scatter, but it is safe to say area rugs command a much larger percentage of dollars and the inexpensive bath and scatter own the lion’s share of volume.

Resilient flooring (excluding rubber) remains the industry’s second largest category with sales of $1.751 billion and 2.52 billion square feet, representing 10.8% and 14.9% of total industry numbers, respectively. While the category dipped 17.8% in dollars and 14.2% in volume, more important is that it was one of the few segments to maintain its market share in dollars and actually picked up 0.2% share in volume. It all has to do with vinyl’s value proposition, which was the hot button for consumers. Vinyl offers just about everything anyone would want in a floor: aesthetics, performance, ease of maintenance, comfort underfoot and low installation cost, all for a very economical price. In fact, luxury vinyl tile and modular carpet were the two subcategories to actually pick up share in 2009.

The rubber segment, which accounted for $470 million in 2009 sales dollars, has to be looked at from two angles. First, there is rubber sheet and tile. Then there is cove base and things like stair treads. They are completely different animals. Rubber sheet and tile, which FCNews estimates to be about $190 million, was flat to down single digits in 2009. Sheet accounts for about 40% of that number and is dominated by Nora. The average-square-foot price varies from $3.25 to $3.75. Rubber tile, which comes with an average-square-foot price of $4.25, offers a number of players with Johnsonite and Roppe-Flexco considered market leaders. The other component of rubber is cove base, which is between a $225 million and $250 million business. Its decline paralleled that of the entire commercial market. The average price for cove base is $.50 a lineal foot. And when you look at cove base, there is pure rubber and rubber/vinyl blends. Some factions only consider pure rubber when sizing up the category.

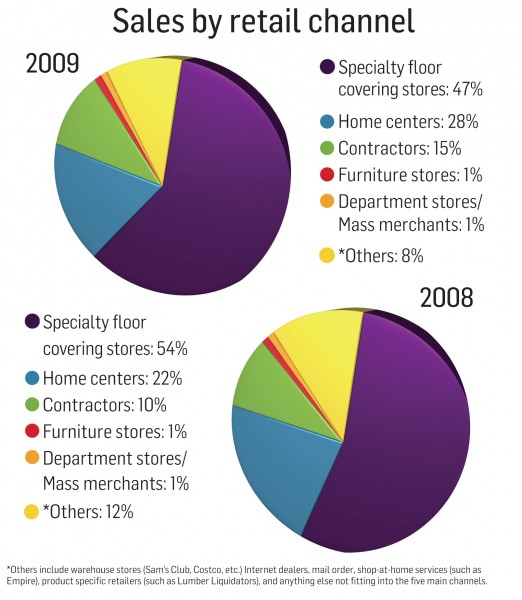

Laminate flooring, which many in the industry believe to have suffered mightily, may be the one category many have a hard time quantifying. That’s because less and less product is moving through the specialty retail channel and more through the home centers and alternate channels. For example, few realize the significance the price clubs play in the category. Last year U.S. mills sold approximately $135 million of laminate through this channel. Then there is Lumber Liquidators, which sold nearly $100 million of laminate last year, meaning it had to import at least $50 million. Add that to direct imports to distributors and larger retailers, and the newfound impact of companies like Clarion, and it is FCNews’ belief that the category lost very little in dollars and actually gained in volume. When the dust cleared, FCNews is reporting that laminate represented 6.6% of total industry dollars at $1.073 billion and 5.5% of volume at 932 million square feet. The one thing everyone can agree on: The category lost about a dime in average selling price as the channels shifted.

Laminate flooring, which many in the industry believe to have suffered mightily, may be the one category many have a hard time quantifying. That’s because less and less product is moving through the specialty retail channel and more through the home centers and alternate channels. For example, few realize the significance the price clubs play in the category. Last year U.S. mills sold approximately $135 million of laminate through this channel. Then there is Lumber Liquidators, which sold nearly $100 million of laminate last year, meaning it had to import at least $50 million. Add that to direct imports to distributors and larger retailers, and the newfound impact of companies like Clarion, and it is FCNews’ belief that the category lost very little in dollars and actually gained in volume. When the dust cleared, FCNews is reporting that laminate represented 6.6% of total industry dollars at $1.073 billion and 5.5% of volume at 932 million square feet. The one thing everyone can agree on: The category lost about a dime in average selling price as the channels shifted.

As for hardwood and ceramic tile, the less said the better. Both categories suffered more than 20%-plus declines in dollars and volume after posting huge gains throughout the prior decade. Simply put, these are the two segments most closely tied to new home construction. As well, they represent two of the higher-end categories, especially when installation is factored in, so as consumers were gravitating toward value-oriented products like carpet and resilient, hardwood and ceramic were feeling the effects of this new world order.

Specifically, hardwood posted sales of $1.617 billion and 683 million square feet, drops of 23% and 20%, respectively. Ceramic now stands at $1.347 billion and 1.28 billion square feet. Both categories continue to lose market share. Hardwood went from 10.6% of flooring dollars in 2008 to 10% in 2009. Ceramic, which owned 8.8% of the dollars in 2008, dropped to 8.3% in ‘09.

One thing to note about ceramic: FCNews’ numbers will be lower than other industry estimates and reports because we do not include wall tile. It is believed floor tile accounts for between 78% and 79% of the total number.

Check the category features for each individual breakdown.