While the new home construction standstill has affected every flooring category, hardwood flooring has inarguably been the most negatively impacted along with ceramic tile. While these two segments enjoyed meteoric rises throughout the last decade, the recession has played havoc with sales in terms of both dollars and volume. Housing has hovered at 50-year lows with new home building, commercial demand and consumer spending on home improvements all in decline.

While the new home construction standstill has affected every flooring category, hardwood flooring has inarguably been the most negatively impacted along with ceramic tile. While these two segments enjoyed meteoric rises throughout the last decade, the recession has played havoc with sales in terms of both dollars and volume. Housing has hovered at 50-year lows with new home building, commercial demand and consumer spending on home improvements all in decline.

According to FCNews’ research, hardwood flooring sales in 2009 clocked in at $1.617 billion, down 23% from $2.101 billion in 2008. Sales in terms of volume were not quite as bad, relatively speaking, with a drop of 20% to 683 million square feet from 2008’s 854 million square feet. That suggests either the mix of product may have shifted to less expensive goods or manufacturers were selling the same goods for lower prices. One thing that cannot be debated is the impact Chinese imports are having on the market.

As it stands today, hardwood flooring represents about 10% of the total flooring market in terms of dollars and slightly more than 4% of volume. This is down from 4.3% of industry volume in 2008. The product still represents the highest square-foot price of any flooring product, save rubber sheet and tile.

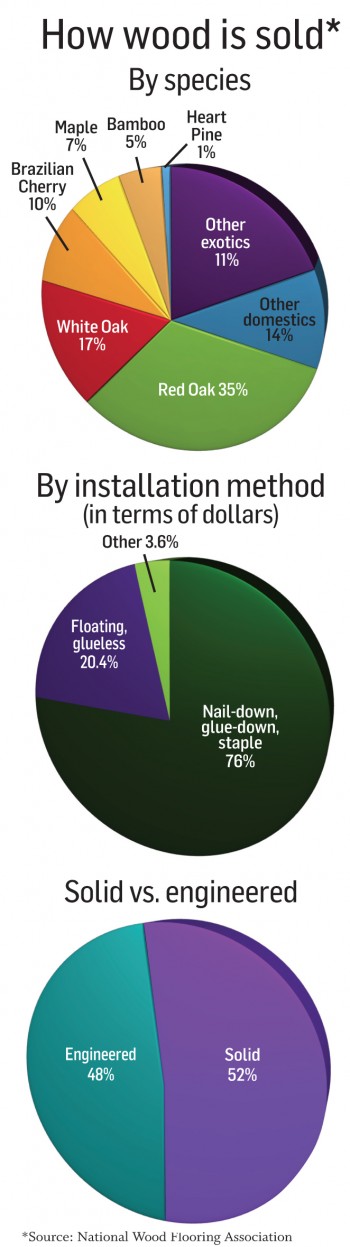

Sales of hardwood varied by species, with oak still dominating the mix. The breakdown shows oak commanding more than 50% of the market with  estimates putting red oak at 35% and white oak at 17%. In fact, continuing a trend that began a few years ago, consumers are favoring domestic species over exotics, due in part to the rising social and environmental consciousness of product procurement. While exotic species sales made up a substantial 21% of the hardwood market—10% of which was Brazilian cherry—domestic varieties dominated: 52% oak, 14% other domestics, 7% maple and 1% heart pine.

estimates putting red oak at 35% and white oak at 17%. In fact, continuing a trend that began a few years ago, consumers are favoring domestic species over exotics, due in part to the rising social and environmental consciousness of product procurement. While exotic species sales made up a substantial 21% of the hardwood market—10% of which was Brazilian cherry—domestic varieties dominated: 52% oak, 14% other domestics, 7% maple and 1% heart pine.

Wood faced several challenges last year, many of which do not have the same impact on other categories. For one, wood can have a longer lifespan than most other flooring products. “The discretionary spending of the end user made wood flooring an unnecessary replacement because it doesn’t ugly out or wear out,” said Ed Korzcak, executive director and CEO of the National Wood Flooring Association (NWFA). Sanding and refinishing hardwood floors can make them look like new, not a viable option for the other flooring categories. For this reason, Korzcak also cited the replacement segment as slow, due to the high cost of hardwood: replacement floors tend to be less expensive.

Within the category, solid and engineered hardwood suffered its own demons though both struggled with the overcapacity of lumber. Last year, 48% of wood sales were in engineered and 52% were in solid, maintaining the trend that has seen engineered continue to pick up share. Engineered finds favor in areas where climatic change is an issue, and with consumers who are environmentally conscious and prefer less real wood in the product.

“In solid you had a lot of capacity,” said Roger Farabee, vice president of Mohawk Hard Surfaces. He added, when the builder market crashed many saw mills were at capacity in both unfinished and product-fed finishing, so the pinch there was delayed. “Before companies started closing plants they reduced prices to hold onto the volume and you saw significant price erosion, more than we ever saw on the solids.”

“In solid you had a lot of capacity,” said Roger Farabee, vice president of Mohawk Hard Surfaces. He added, when the builder market crashed many saw mills were at capacity in both unfinished and product-fed finishing, so the pinch there was delayed. “Before companies started closing plants they reduced prices to hold onto the volume and you saw significant price erosion, more than we ever saw on the solids.”

Kim Holm, president, Mannington Residential, also credited overcapacity to plummeting sales. “Demand continued to erode with the demise in new home construction and wood being so tied to that market.”

Hardwood floors in new residential construction accounted for only 26.2% of sales, or $423.7 million. The majority of business was in the replacement sector at 56.6% or $915.2 million. Commercial is still a small portion of the industry, accounting for just 8.1% of the hardwood flooring market. Of that number, $79.2 million was specified and $51.8 came courtesy of Main Street business. Miscellaneous sales accounted for the category’s remaining $147 million.

The homebuilder market was also responsible for the derivation in hardwood’s numbers by region. Areas like the mid-Atlantic fared better with $372 million in business as opposed to the East South Central region with $209 million, according to the NWFA. Similarly, the West North Central region tanked at $175 million but the East North Central rang in at $472 million. “The Southwest and Southeast were hit much harder than the Midwest, but homebuilding stopped completely in California, Las Vegas and Florida,” Korzcak said. “It still hasn’t bounced back.”

On the upside, new housing starts are expected to increase to 800,000 by the end of this year, up from 595,000 from the end of last year, according to research conducted by Fannie Mae economics and mortgage market analysis group.

The NWFA also found manufacturers, distributors and retailers redefining business to run profitably, becoming more lean and efficient. “As revenue increases, we’ll increase the bottom line,” Korzcak said. “Before, 20 cents of every dollar went to the profit line but now, 30 cents of every dollar is a profit gain.”