Facing the biggest recession since the early 1990s, specified commercial flooring sales took a big hit in 2009 as volume declined between 20% and 30%  over 2008, according to industry estimates. Unlike previous economic downturns, no category was spared as a plethora of new and interior decorating projects were either placed on hold or saw their budgets slashed in the five major end-use sectors.

over 2008, according to industry estimates. Unlike previous economic downturns, no category was spared as a plethora of new and interior decorating projects were either placed on hold or saw their budgets slashed in the five major end-use sectors.

Statistics are hard to pin down, but suppliers estimate the specified commercial flooring business (excluding Main Street business) generated roughly $3.74 billion in sales last year. The economic crisis also saw the average sale dip as well, experts say, as specifiers sought to stretch clients’ budgets with less expensive flooring choices. “People are looking for value, but not just for a lower price point. Every buy has to make sense,” said Jack Ganley, president, Mannington Commercial, reporting higher demand for high performance flooring options with a lower total cost of ownership. “And it has to make sense not only in terms of immediate costs, but also environmental costs.”

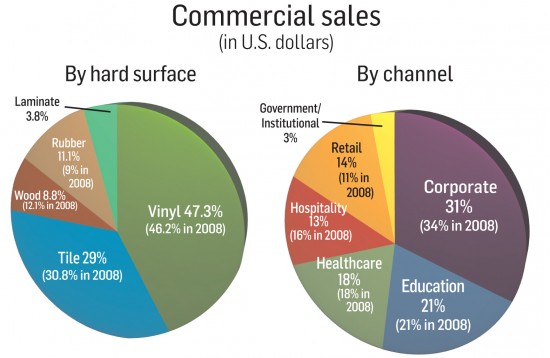

Compared to the prior year, the percentage of commercial flooring sold into the primary distribution channels remained consistent, according to suppliers. While the leading end-use segment remains corporate, accounting for about 31% of commercial sales, this figure declined by about 3% over 2008. The market share for hospitality (13%) took a huge hit with estimates of a 35% decline. Education (21%) and healthcare (18%) maintained their market shares while retail (14%) actually picked up share with a lesser decline than other segments. The area that is picking up share is government-institutional or GSA work, which may now be about 3% of the market.

In terms of specified commercial flooring sales by category, FCNews estimates carpet remains the runaway market share leader at about 63.7%. But sales nosedived to between $2.1 and $2.2 billion in 2009 (Main Street sales accounted for an additional $650 to $750 million). Corporate applications represent the bulk of commercial carpet sales (45%) followed by education (15%) and hospitality and healthcare (10% each). Observers say education and healthcare are considered the two fastest growing sectors, driven largely by higher school enrollment nationwide and an aging U.S. population, respectively.

“There is a continued push for value, with business conditions being as they are,” Mannington Commercial’s Ganley noted. “We also continue to see a response to customers being offered different options; the customer especially wants choices that work together.” For example, Mannington Commercial is seeing carpet tiles and luxury vinyl tile being used in combination with each other for various projects.

Indeed, carpet tile continued to gain traction in the commercial arena last year, experts say, as styling, ease of installation and multiple price points caught the attention of the A&D community. The subcategory now represents nearly half of carpet’s specified commercial sales. “Carpet tile is displacing broadloom in the middle price points of the market,” observed Tim Baucom, vice president of commercial sales and marketing, Shaw Industries.

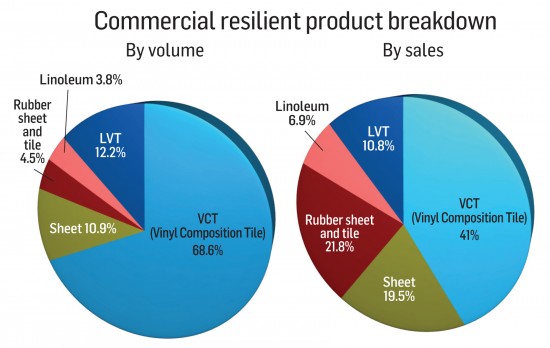

The remaining 36.3% of specified commercial sales (an estimated $1.55 billion) is represented by hard surfaces. Vinyl sheet and floor tile combined to represent roughly 42% of the market (approximately $680 million), with more than two-thirds of product sales coming from tile products. The irony is while commercial resilient sales dropped between 16% and 20% last year, it is considered to have the best growth prospects of any commercial flooring.

“Commercial resilient flooring is doing better than soft surface and even ceramic for a couple of reasons,” said Dominic Rice, vice president and general manager, Armstrong Floor Products Commercial. “Resilient flooring will not have to be replaced in five years like many soft surfaces. And, when compared to a product like ceramic, there is a cost benefit to resilient.”

Education, healthcare and retail are the three leading segments for resilient, suppliers say, accounting for over 75% of sales. Some resilient subcategories, such as linoleum and LVT, continue to outperform other resilient floors. “Linoleum has a wide range of applications, but most often is used in healthcare, corporate and increasingly in education,” Rice said.

Rubber flooring accounts for about 9% (an estimated $9 million) of specified hard surfaces sales, with more than 80% generated from the bedrock healthcare and education segments. Rubber is reportedly valued for its excellent slip resistance, safety and acoustical properties. “In the past, you were looking at solid and marble colors only. But now you have new color innovations such as tone-on-tone, metallics and non-repeating patterns,” said  Jeremy Whipple, marketing manager, Roppe. “The positive life cycle impact, ability to recycle, the use of renewable resources when manufacturing and the fact it is PVC-free all make rubber flooring very attractive for healthcare and education projects.”

Jeremy Whipple, marketing manager, Roppe. “The positive life cycle impact, ability to recycle, the use of renewable resources when manufacturing and the fact it is PVC-free all make rubber flooring very attractive for healthcare and education projects.”

Although the initial cost of rubber is higher than most competitive floors, the product’s annual life cycle cost is actually less. “A value orientation is measured in savings and return, not price,” said Jeff Krejsa, Johnsonite’s director of marketing. “Couple this with a sustainability component and rubber has become a serious alternative to other resilient materials.”

One category which is seeking to convince the A&D community that it is a viable commercial flooring material is laminate. Vendors are reportedly stepping up their efforts to educate specifiers about the virtues of the category while continuing to develop products suitable for certain types of end uses. The major selling points—high durability and striking wood and ceramic faux visuals—make it ideal for many commercial applications, including retail, hospitality and healthcare uses.

Laminate represents only about 2% of the specified commercial hard surface flooring business (valued at approximately $24.5 million in sales), according to industry estimates.

Educating specifiers about the types of laminates that can be used in certain commercial applications is paramount to future sales growth, experts say. “Our HPL (high pressure laminate) construction has been successfully installed in commercial applications for more than 14 years; we have a proven track record,” said Russ Rogg, director of sales, Wilsonart Flooring.

By comparison, the ceramic tile industry has a long-standing track record selling to a number of commercial sectors. Nonetheless, sales to education and healthcare applications slowed down last year and demand from the hospitality, retail and corporate sectors were weak. Observers say these were major factors impacting tile sales.

On a positive note, federal construction projects contributed to fuel tile sales growth in the public sector, experts say. Porcelain-body tile represents nearly 50% of tile shipments, observers say, a number which has been increasing for several years, as both domestic production and imports from Asia are largely geared toward porcelain. The product continues to grow in popularity in the U.S. due to its low porosity and durability.

Another natural flooring material, hardwood, sustained a similar sales decline with specified commercial sales accounting for an estimated 4.9% of hard surface sales. More than 70% of these sales were from engineered products. In addition to the stability factor of engineered floors, these products offer many differentiated visuals, including the look of solid wood achieved by using thick sawn-face veneers.

The primary commercial end-use markets for hardwood are corporate, hospitality and retail. Designers for these key channels are reportedly selecting wood flooring for its natural good looks and long-term durability. “At a broader level, many commercial designers are trying to capture a more residential feel, and wood flooring allows them to select products that create a particular look or image,” Armstrong’s Rice said. “Of course, there is opportunity in corporate in public areas such as reception and conference rooms.”

While the supply chain cannot control economic conditions, it is in a position to manage customer expectations, one of the biggest factors impacting commercial flooring sales. Industry members say knowing which products to recommend for specific applications is critical to ensuring customer satisfaction.